As soon as reckoned as a price generator, Kotak Mahindra Financial institution now appears to be suffering to stay that tag. Within the remaining 3 years, the financial institution’s inventory worth has eroded by means of 5.3 in keeping with cent, whilst its friends ICICI Financial institution, Axis Financial institution and IndusInd Financial institution have generated 70–90 in keeping with cent positive aspects all through this era.

Even HDFC Financial institution has delivered six in keeping with cent returns within the remaining 3 years. With the Reserve Financial institution of India’s harsh motion on Monday night time, by means of enforcing a ban on onboarding shoppers digitally and issuing contemporary bank cards, the query is whether or not Kotak Mahindra Financial institution can shed its underperformer tag any time quickly.

For the primary time in a couple of decade, Kotak Mahindra Financial institution inventory witnessed the sharpest unmarried day fall (down round 11 in keeping with cent).

There are two vital issues to delve—first, the language used within the RBI round and 2d, the timing of the ban.

Harsh ban

Kotak Mahindra Financial institution isn’t the primary example of a financial institution being pulled up for deficiencies within the virtual banking area. There’s priority with HDFC Financial institution and Financial institution of Baroda (bob International app). Alternatively, the language utilized in Kotak Mahindra Financial institution’s order can have wider ramifications. To make sure, that is the primary example of a ‘cease-and-desist’ order issued on any massive financial institution in recent years; such orders may just invoke critical motion from the regulator in case of non-compliance.

The order defined a lot of circumstances (in 2022 and 2023) the place the financial institution used to be requested to take remedial motion however they have been nonetheless insufficient. It touched upon deficiencies throughout nearly each unmarried side of virtual operations starting from consumer get admission to control, IT stock control, dealer possibility control and crisis restoration to IT possibility and knowledge methods governance.

To make sure, the order issued on bob International, additionally invoking phase 35A of the Banking Law Act, wasn’t as scathing and detailed as Kotak’s and restrictions put on HDFC Financial institution have been in response to extra lenient sections of the BR Act.

Trade implication

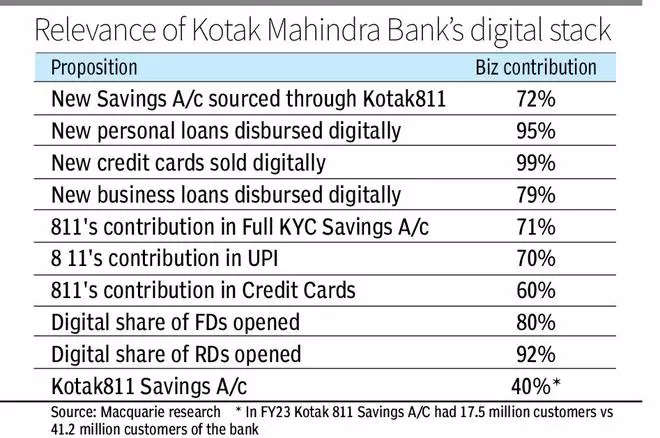

For Kotak Mahindra Financial institution, its virtual stack appears to be a meaty buyer sourcing road (see desk).

As for bank cards, whilst it can be contributing simplest 4 in keeping with cent to the financial institution’s mortgage e book, at 50 in keeping with cent expansion up to now in FY24, this in conjunction with unsecured loans (in large part digitally sourced) were the quickest rising engines for Kotak Mahindra Financial institution.

The financial institution aspires to take its unsecured mortgage e book to fifteen in keeping with cent over the years from the existing 11 in keeping with cent mark and the virtual means of doing industry could be extraordinarily related to make sure prices are in position and the yield from those loans is within the most sensible quartile. That benefit is also long past until RBI lifts the curb. Whilst it may well be argued that the financial institution may just shift to department banking, it will make for the expensive proposition.

Price to source of revenue ratio has already expanded by means of nearly 200 bps year-on-year and Kotak Mahindra Financial institution is on a good rope stroll with appreciate to profitability. From Q1 FY24 to Q3 FY24, internet pastime margin (NIM) shrank by means of 35 bps to five.22 in keeping with cent.

Timing of the ban

A brand new CEO is at all times identified to deliver alternate within the machine and therefore have a bearing at the financials. From Rajneesh Kumar to Sumant Kathpalia, we’ve observed many examples reiterating this.

Whilst the Boulevard used to be ready to look some asset quality-related ache and allied adjustments in Kotak Mahindra Financial institution with Ashok Vaswani taking on from January 1, 2024, as MD & and CEO, finishing the long-standing management of Uday Kotak, the financial institution’s promoter and previous CEO, Monday’s building got here as massive marvel.

Given how the inventory marketplace has reacted to the problem, wouldn’t it give Vaswani the distance to make structural adjustments with out additional hurting the Boulevard’s sentiments? RBI’s ban additionally raises questions about whether or not the tech stack used to be successfully constructed.

Kotak 811 app is showcased as Jay Kotak’s area. He’s the co-head of the app and in November 2023, he took further accountability as senior VP–conglomerate relationships.

Regularly speculated as Uday Kotak’s successor ultimately, it might be attention-grabbing to look if the RBI’s movements obstruct that adventure. To sum up, RBI’s ban at the financial institution’s virtual houses has come at a time when Kotak Mahindra Financial institution inventory has been a laggard at the Boulevard for over 3 years; but, it used to be a number of the ‘purchase’ record of maximum inventory agents, because of its previous legacy. That can now get challenged.

The saving grace is the cozy capital adequacy ratio of over 24 in keeping with cent. This may occasionally scale back the desire for having to faucet the capital marketplace any time quickly and thus maintain valuation erosion. However from over 4x worth to e book (P/B) in FY22 valuations are already down to two.5x FY25 estimated P/B. Can Kotak Mahindra Financial institution arrest an additional compression vis-à-vis friends?