[ad_1]

Bloomberg Information

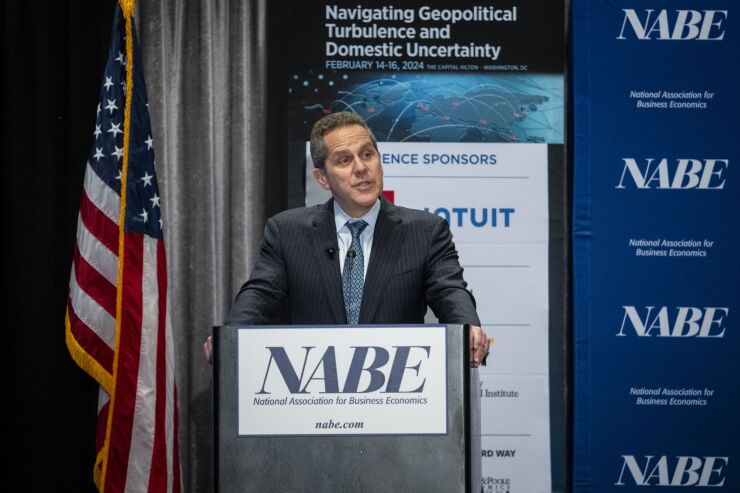

WASHINGTON — Federal Reserve Vice Chair for Supervision Michael Barr mentioned Wednesday that contemporary turmoil within the regional banking sector isn’t indicative of issues within the broader banking machine, however famous that banks must high themselves to faucet the Fed’s bargain window and that the central financial institution is operating to strengthen its operations on the last-resort lending facility.

In a speech prior to the Nationwide Affiliation of Trade Economists annual convention, Barr mentioned the hot declines in inventory valuations at various regional banks that kicked off after a Jan. 31 income name from New York Group Financial institution — by which the financial institution reported a quarterly loss because of larger regulatory compliance prices and further mortgage loss reserves — isn’t purpose for fear. With out naming New York Group Financial institution explicitly, Barr mentioned a unmarried unhealthy end result at a unmarried financial institution must no longer be interpreted as a number one indicator of long run turmoil.

“A unmarried financial institution lacking its earnings expectancies and extending its provisioning does no longer trade the truth that the total banking machine is robust,” he mentioned. “We see no indicators of liquidity issues around the machine.”

However Barr reiterated his name for banks to preposition collateral with the Fed’s bargain window to present it extra liquidity choices in instances of pressure, and mentioned the Fed could also be operating on its finish to make the method smoother and extra regimen.

“Banks must do a little preparation to be totally able to faucet the window [and] that comes with pre-positioning collateral, and trying out bargain window utilization,” he mentioned. “Whilst banks do their phase to get operationally able, we on the Federal Reserve additionally want to proceed to strengthen bargain window operations.”

Barr has

Barr additionally famous that regardless of what he characterised because the banking machine’s persisted resilience and restoration from final spring’s turmoil, regulators stay vigilant in tracking sure wallet of dangers. He additionally mentioned the emerging dangers associated with industrial actual property lending, which he mentioned continues to pose demanding situations for banks because of diminished revenues and valuation of homes after the pandemic brought on the upward push of far flung paintings and place of business area discounts.

Federal regulators like Treasury Secretary Janet Yellen have

Barr in a similar fashion mentioned Wednesday that the banking machine is in “a lot better form than it used to be final spring,” even regardless of “a couple of wallet of chance that we proceed to look at, together with the pandemic’s continual have an effect on on place of business industrial actual property in sure central trade districts.

Reflecting on final yr’s screw ups of Silicon Valley Financial institution, Signature Financial institution, and First Republic, Barr mentioned the runs at those companies had been in particular serious because of their unsafe reliance on uninsured deposits from concentrated and extremely interconnected buyer bases.

As a result of deposits at those 3 companies had been extra risky than up to now expected, Barr famous the corporations confronted demanding situations in assembly outflows with to be had belongings, in particular with securities designated as held-to-maturity. That is as a result of, in line with Barr, as rates of interest building up and the worth of HTM securities decreases, companies that account for HTM securities at amortized price wouldn’t have to mirror this decline in price on their steadiness sheets.

“However promoting even a portion of an HTM portfolio ends up in a company desiring to acknowledge losses on all the portfolio — a success to capital,” he famous. “The facility to show HTM belongings into money, in particular when gross sales aren’t possible, is proscribed via a company’s talent to ramp up get right of entry to to secured investment resources, which proved problematic in massive measurement final March.”

Barr expressed pride that banks were tackling those dangers via reducing reliance on held-to-maturity belongings for liquidity, adjusting portfolio compositions, bettering get right of entry to to various liquidity resources, and revising contingency investment plans.

“Those stepped forward practices are essential for each making sure particular person company resilience and combination monetary balance,” mentioned Barr.

Barr famous that final yr’s banking disaster turns out to have led banks to want retaining extra reserves on the central financial institution than that they had previous to the Covid pandemic, and that this choice may sooner or later be at odds with the Fed’s ongoing coverage of steadiness sheet relief. However the Fed’s status quo of a status repo facility after

“It can be tough to decide what stage of reserves is in step with ‘plentiful,'” Barr mentioned. “The marketplace dynamics from September 2019 illustrate this. This episode used to be an element resulting in the status quo of the status repo facility, which, in conjunction with the bargain window, will assist hose down pressures that might emerge in momentary cash markets.”

[ad_2]