[ad_1]

Making an investment apps are making it more uncomplicated than ever to take a position commission-free. However there are numerous apps available in the market? Which can be the most productive unfastened making an investment apps?

However making an investment is dangerous. It comes with few promises. The one making an investment ensure I will be able to be offering is that this: the whole lot held equivalent, the fewer you pay in charges, the easier your returns.

Charges don’t have to forestall you from making sensible and profitable investments. Fortunately, we are living within the twenty first century, and there’s by no means been a greater time to be a small investor.

And now, in lately’s cellular global, making an investment is turning into more uncomplicated and less expensive than ever. Plus, with the making an investment price cutting war that is been occurring, it is inexpensive than ever to take a position!

Listed below are the most productive making an investment apps that help you make investments without spending a dime (sure, unfastened). You may also take a look at our listing on the most productive agents to take a position.

Notice: The making an investment gives that seem in this website are from firms from which The School Investor receives repayment. This repayment would possibly have an effect on how and the place merchandise seem in this website (together with, as an example, the order through which they seem). The School Investor does no longer come with all making an investment firms or all making an investment gives to be had on the market.

1. Constancy

Easiest For: Complete Provider Making an investment At $0 Industry Costs

Constancy is certainly one of our favourite apps that lets you make investments without spending a dime. This surprises most of the people, as a result of most of the people do not affiliate Constancy with “unfastened”. Alternatively, Constancy gives a spread of commission-free ETFs that might permit the vast majority of buyers to construct a balanced portfolio. Plus, they now be offering $0 fee inventory, possibility, and ETF trades!

The additionally be offering fractional proportion making an investment, that means that you’ll make investments dollar-based, no longer simply share-based. This can be a giant win for folks beginning with low greenback quantities.

Constancy IRAs additionally don’t have any minimal to open, and no account upkeep charges. That implies it’s worthwhile to deposit simply $5, and make investments it without spending a dime. That makes this a a lot better deal in comparison to firms like Stash Make investments.

Moreover, Constancy simply introduced that it now has two 0.00% expense ratio budget – sure unfastened. So, you’ll no longer best make investments fee unfastened, however those budget do not rate any control charges. Really unfastened making an investment.

However to make it a best app, it has to have a super app, and Constancy does. Their app is the cleanest and very best to make use of out of all the making an investment apps we’ve got examined. They have got a ton of options, but it surely all works smartly in combination.

Plus, you get the advantage of having a complete provider making an investment dealer will have to you wish to have extra than simply unfastened. Take a look at Constancy’s app and open an account right here.

|

$0 for shares, ETFs, choices |

|

|

Taxable, IRA, HSA, 401k, Agree with |

|

2. Robinhood

Easiest For: 100% Loose Inventory Trades & Restricted Crypto

Robinhood is an app allows you to purchase and promote shares without spending a dime. Customers can purchase or promote shares at marketplace value. The app means that you can make prohibit orders and prevent loss orders too. Until you’re an energetic dealer, that is various capability. Plus, the app comes with a blank consumer interface and elementary analysis gear.

Maximum critical buyers will have to pair Robinhood with a number of unfastened analysis gear. This may increasingly assist them expand a extra systematic solution to making an investment. That mentioned, you’ll’t beat Robinhood’s unfastened trades, however its shortcomings right here make it 3rd.

Additionally they permit choices, fractional stocks, and cryptocurrency making an investment, however those are restricted as smartly.

The drawbacks are actually restricted, however probably the most greatest is that the platform has transform unreliable in contemporary months with huge outages impacting buyers.

In the event you’re curious how Robinhood makes cash, it’s via Robinhood Gold. Robinhood Gold is a margin account that lets you purchase and promote after hours. Purchasing on margin approach you double your anticipated returns. It additionally approach you double your anticipated losses. The outcome (in response to the magic of compounding) implies that buying and selling on margin has a tendency to devour into your most important.

Take a look at the opposite choices for buying and selling shares without spending a dime.

Open a Robinhood account right here and get a unfastened proportion of inventory >>

|

$0 for shares, ETFs, choices, crypto |

|

Get a unfastened proportion of inventory!

3. E*TRADE via Morgan Stanley

E*TRADE additionally gives a big number of fee unfastened ETFs. We’re in truth giant enthusiasts of E*TRADE for our solo 401k account, however they do not make the highest 5 with regards to making an investment apps and unfastened making an investment.

They simply just lately introduced $0 inventory, ETF, and choices trades, however we will see how they compete with others in this listing.

Whilst they do be offering IRAs and not using a minimums, and rate no transaction charges, we did not in finding their app as consumer pleasant as the remainder. Very similar to their site, it is just a little tougher to make use of. Alternatively, we nonetheless actually like E*TRADE and they’re for sure a runner up.

At this time, you’ll rise up to $600 while you open and fund an account with E*TRADE.

|

$0 for Inventory, Choices, ETF trades |

|

|

Conventional, Roth, Solo 401k, and Extra |

|

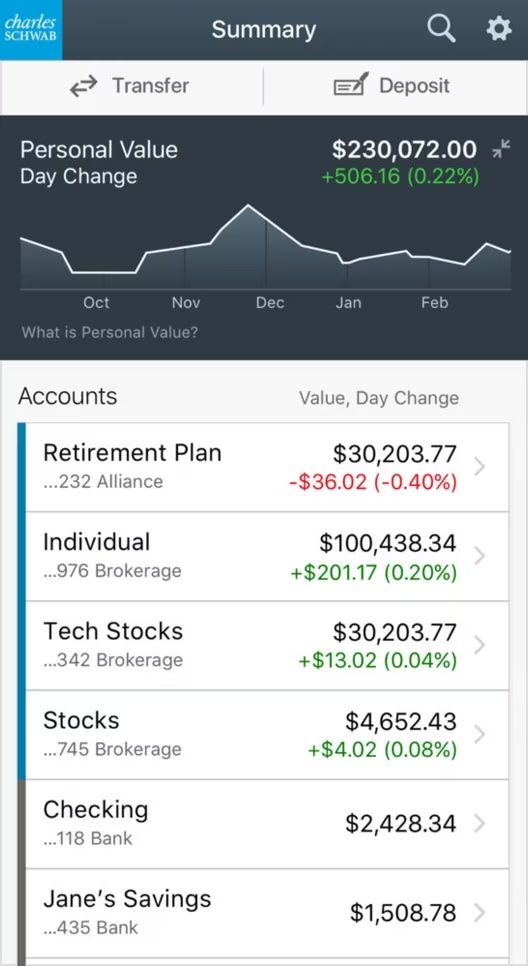

4. Schwab

Easiest For: Making an investment and Banking Mixed

Schwab is among the absolute best agents, and it’s been gaining flooring considerably over the previous few years, particularly with the purchase of TD Ameritrade. Plus, it is buying and selling platform thinkorswim is among the easiest rated for buyers.

The place Schwab actually shines is it is talent to have each commission-free making an investment, in conjunction with a super banking product. The Schwab checking is continually named a favourite, and you’ll see within the app how they make making an investment and banking blended very seamless.

Schwab additionally has each and every account kind possible, and they’ve a community of workplaces national for those who ever do want in-person give a boost to. However once more, their making an investment app is extremely rated.

|

$0 for shares, ETFs, choices |

|

|

Taxable, IRA, HSA, 401k, Agree with |

|

5. Public

Public is some other unfastened making an investment platform that has put an enormous center of attention at the social side of making an investment and schooling. On account of the use of influencers and schooling, Public has been considerably rising their consciousness.

Public has a cast making an investment app – you’ll put money into any asset: from shares, ETFs, crypto, effective artwork, collectibles, and extra – multi functional position, together with fractional stocks and choices. Additionally they be offering desktop give a boost to, which is amazingly helpful for such things as having a look at brokerage statements or tax bureaucracy.

Additionally they market it themselves as being probably the most few funding brokerage corporations that does not do Cost for Order Glide.

Learn out complete Public evaluation right here.

|

$0 for shares, ETFs, choices |

|

There are numerous apps and gear that come just about being within the Best 5. When the contest is so excellent, it is exhausting to make the reduce.

Forefront

Vanguard is continually referred to as the low value funding provider supplier. They have been probably the most authentic mutual fund and ETF firms to decrease charges, they usually regularly recommend a low-fee index fund solution to making an investment.

At Forefront, you do not pay any commissions while you purchase and promote Forefront ETFs. You additionally pay no account provider charges for those who signal as much as obtain your account paperwork electronically, or in case you are a Voyager, Voyager Choose, Flagship, or Flagship Choose Products and services consumer.

Moreover, Forefront just lately introduced that they would possibly not rate a fee on an enormous quantity of competitor’s budget and ETFs as smartly!

Forefront additionally does not have an account minimal, and there is not any minimal acquire requirement for mutual budget, however shares and ETFs it is the price of 1 proportion.

What holds Forefront again is that their app is a bit more clunky that the opposite apps. It feels a bit “old-fashioned”, and it kind of feels to be constructed for the fundamentals best.

Alternatively, it’s unfastened, so perhaps best the fundamentals are wanted?

Forefront Non-public Consultant

In case you are searching for skilled assist together with your investments and fiscal making plans, Forefront gives Non-public Consultant that will help you construct, execute, and proceed to control your monetary plan. Those are fiduciary advisors and can mean you can create a plan in response to your targets (it is not a robotic). It prices 0.30% AUM, which is among the lowest you’ll be able to in finding.

M1 Finance

Easiest For: Construction A Loose Portfolio For The Lengthy Time period

M1 has transform our favourite making an investment app and platform over the past 12 months. With fee unfastened making an investment, the facility to put money into fractional stocks, automated deposits, and extra, M1 Finance is best notch.

In the event you’re searching for a technique to create and handle a unfastened, various portfolio of shares and ETFs, glance no additional than M1 Finance. They supply a beautiful progressive instrument/making an investment app that lets you setup a portfolio and make investments into it (accurately allotted) for unfastened.

What do I imply? Neatly, believe a portfolio of ETFs – perhaps you’ve got 5 ETFs at 20% each and every. Neatly, as an alternative of getting to do 5 transactions (and fee for each and every) while you purchase, you’ll now merely make investments and M1 Finance looks after the remainder – without spending a dime!

If you do not know precisely learn how to set it up, you are greater than welcome to make use of certainly one of their already setup portfolios as smartly.

Plus, M1 Finance has a super making an investment bonus be offering at this time! You’ll rise up to $500 for those who deposit new cash via December 31, 2024.

Or, you’ll merely get $10 for opening a brand new account and investment it inside of 30 days!

It does not get a lot better than M1 Finance with regards to making an investment without spending a dime. Check out M1 Finance >>

J.P. Morgan Self Directed Making an investment

J.P. Morgan Self-Directed Making an investment is the newest replace from Chase with regards to making an investment (up to now this used to be referred to as Chase You Make investments). The good factor is they made their platform in reality commission-free. That is what makes it a runner up on our listing of unfastened making an investment apps.

Learn our complete J.P. Morgan Self-Directed Making an investment evaluation.

The details about J.P. Morgan Self-Directed Making an investment has been accumulated independently via The School Investor. The product main points have no longer been reviewed or authorized via the corporate.

Best friend Make investments

Best friend Make investments is a cast selection without spending a dime making an investment. They have got a cast app that lets you make investments, and prefer others in this listing, you’ll put money into shares, choices, and ETFs commission-free.

Best friend additionally gives cast bonus gives for those who switch your account to them. At this time, you’ll rise up to $3,000 while you transfer your property over to them.

Learn our complete Best friend Make investments evaluation right here.

Moomoo

Moomoo is the newest unfastened making an investment app operating to make a touch with US buyers. This app has numerous reputation within the Asian market, and it just lately introduced in each america and Australia. Like maximum apps right here, it gives unfastened inventory, ETF, and choices buying and selling. It additionally has powerful charting and different knowledge. Whilst you open a brand new account, you’ll earn as much as 15 unfastened shares!

Learn out complete Moomoo evaluation right here.

Webull

Webull has been gaining numerous traction within the remaining a number of years as a competitor to Robinhood. It is an funding platform this is app-first, and it makes a speciality of buying and selling. Actually, this 12 months it made our Honorable Mentions listing of Easiest Inventory Agents.

Webull gives robust in-app funding analysis gear, with nice technical charting. This can be a step above what you’ll in finding on maximum different funding apps.

You’ll in finding inventory, choices, and restricted crypto buying and selling at the Webull platform. Additionally they be offering aggressive margin charges. The disadvantage right here is that they lately do not give a boost to mutual budget, bonds, OTC Bulletin Board or Purple Sheets shares. Shares which are underneath $1 and/or have a marketplace cap of $10 million or much less are limited as smartly.

Bonus: WeBull is providing a super bonus of two unfastened stocks of inventory!

Learn our complete Webull evaluation right here.

Get a unfastened proportion of inventory!

Different Making an investment Apps

There are different making an investment apps that we are together with in this, however they don’t seem to be unfastened. Alternatively, they’re common and could also be helpful to a couple buyers.

Acorns

Acorns is an very popular making an investment app, however it is not unfastened. Acorns fees any place from $1 to $3 monthly ($5 for a circle of relatives), but it surely does make automating your investments simple!

Acorns means that you can spherical up your spare exchange and make investments it simply in a portfolio that is sensible for you. Alternatively, for those who shouldn’t have some huge cash invested, that subscription value can devour up your returns.

Learn our complete Acorns evaluation right here.

Bonus Be offering: At this time Acorns is providing a $10 bonus while you open a brand new account. Get started making an investment with as low as $5 >>

Stash

Stash is some other making an investment app that is not unfastened, however makes making an investment actually simple. They have got grew to become the making an investment procedure into a very simple to know platform, and they do not rate any commissions to take a position. Alternatively, they do rate a per month commission that levels any place from $1 to $9 monthly.

Stash was once identified for $5 making an investment, however they’ve since long past to $0 minimums, they usually permit fractional proportion making an investment.

Learn our complete Stash evaluation right here.

Who Is This For?

Making an investment apps are a good way to begin making an investment with the benefit of having the ability to do the whole lot out of your cellular instrument. It was once the one technique to put money into the inventory marketplace used to be to name a inventory dealer and make a industry. This used to be gradual, expensive (massive commissions to industry), and also you needed to meet positive minimums.

Once I began making an investment, issues had moved on-line. But it surely used to be nonetheless no longer commission-free (I take into accout paying $9.99 in keeping with industry), and there wasn’t any talent to do it on cellular.

Rapid ahead to lately, and there are a number of mobile-first making an investment platforms (like Robinhood, Webull, and Public). Those firms are majority-run on apps, and in consequence, they spread out making an investment to numerous younger folks.

In case you are having a look to get began making an investment and wish to do it in your telephone, this listing is for you.

Why Will have to You Agree with Us?

This listing is in response to a survey of one,000 American citizens who recognized themselves as buyers or enthusiastic about making an investment. The survey used to be fielded on February 9, 2024.

Moreover, I’ve been writing about making an investment and evaluating other making an investment platforms since 2009. I’ve reviewed and examined nearly each and every main making an investment platform and app to be had, and the research is in response to that have.

We imagine that our listing as it should be displays the most productive unfastened making an investment apps on the market for customers.

Making an investment App FAQ

Listed below are some commonplace questions on making an investment apps.

What makes an making an investment app other than a brokerage?

Making an investment apps are cellular first making an investment platforms. They’re brokerages (similar to the names you can be used to), however they permit buyers to industry and put money into an app.

Are making an investment apps secure?

Sure, they’re simply as secure as protecting your cash at any main brokerage. Those apps all are insured via the SIPC and feature a number of investor protections.

Can I put money into the rest on an app?

Is determined by the app. Some apps considerably prohibit what you’ll put money into, whilst others be offering the overall levels of funding choices.

Are those apps actually unfastened?

Sure. The highest apps we listing do not rate a per month commission to make use of, and do not rate a fee to put money into shares, ETFs, and choices. In fact, those apps would possibly rate provider charges for added services and products, reminiscent of cord transfers, paper statements, and extra.

Have you ever ever heard of any of those making an investment apps? Which one is your favourite?

Disclaimer:

Forefront Recommendation services and products are supplied via Forefront Advisers, Inc., a registered funding consultant, or via Forefront Nationwide Agree with Corporate, a federally chartered, restricted‐goal consider corporate

[ad_2]