[ad_1]

StellarFi

Strengths

- Might fortify your credits rating throughout the first few months

- Studies to the foremost credits bureaus

- No hidden charges, deposits, or hobby fees

- Get right of entry to to unfastened monetary and credits training

Weaknesses

- No unfastened plan

- Restricted customer support availability

- Doesn’t file previous bills sooner than enrollment

- Nonetheless a tender corporate

StellarFi is a credits builder platform that doesn’t require you to borrow cash, pay hobby, or make any safety deposits. As a substitute, it converts your common per thirty days expenses into an impressive credit-building instrument.

However how does StellarFi examine to the various credit-building merchandise to be had available on the market, and does it truly paintings? On this StellarFi evaluation, we’ll provide an explanation for how the platform works, how a lot it prices, and the way it mean you can construct credits.

Desk of Contents

What Is StellarFi?

StellarFi is a credit-building carrier that opened to the general public in July 2022. In keeping with the monetary generation (fintech) platform, over 130 million American citizens don’t have get entry to to a homeownership trail or a monetary protection internet to have the funds for emergencies.

One among StellarFi’s key promoting issues is that it lets you construct credits with out a bank card by way of reporting your per thirty days bills to 2 of the foremost credits bureaus (Equifax and Experian). Moreover, you gained’t go through a difficult credits test which will affect credits selections for the following two years.

How StellarFi Works

Getting began with StellarFi is straightforward. You merely join your per thirty days expenses to a StellarFi Invoice Pay Card, which acts like a line of credits. This credits line can pay your expenses and in an instant attracts the price range from a related checking account, so that you by no means raise a stability or pay bank card hobby.

StellarFi has been including further perks as its buyer base expands. This comprises invoice cost rewards and different perks on its upper-tier plans.

Let’s take a more in-depth take a look at how you’ll be able to bolster your credits rating.

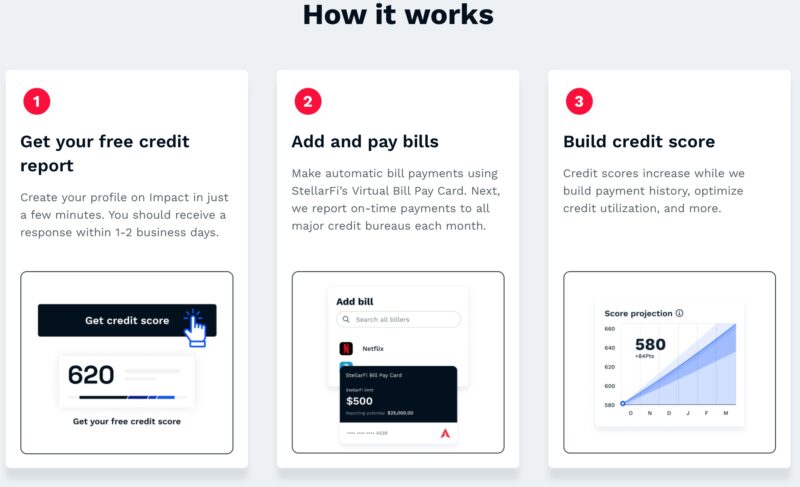

Loose Credit score Document

You’ll test your credits rating at no cost after developing your StellarFi profile (there’s no affect to your credits.) This gives a baseline from which to trace your growth with each and every invoice cost.

Your StellarFi credits rating is a Vantage 3.0 scoring fashion from the 3 bureaus. Maximum credits rating apps handiest track one or two ratings.

One minor frustration is that you just see a Vantage 3.0 credits rating as a substitute of a FICO Rating, which is the commonest credits rating. The FICO Rating is the only the lenders use after they carry out a credits test. So, the VantageScore isn’t as exact, however you’ve got a company thought of your present credits rating vary.

Upload and Pay Expenses

After finishing the preliminary account setup, you’ll be able to hyperlink your ordinary per thirty days expenses, corresponding to your cable TV, web, or telephone invoice. You obtain a digital StellarFi cost card that you’ll be able to give you the biller to pay the per thirty days tab.

StellarFI’s auto-connect function permits you to briefly replace your cost way with maximum nationwide manufacturers. You’ll additionally hyperlink expenses manually with traders that StellarFi doesn’t have a right away courting with.

Along with linking expenses, you join your bank account to StellarFi to pay expenses. There aren’t any further charges to make use of this carrier, corresponding to cost processing charges or financial institution switch charges. When a invoice is due, StellarFi will test your financial institution to make sure there are enough price range to pay the invoice to steer clear of inflicting an overdraft. If there aren’t enough price range, the invoice is probably not paid. If, for some reason why, an overdraft does happen, StellarFi gained’t price overdraft charges, however your number one financial institution might.

Fortify Your Credit score Rating

Through paying your expenses thru StellerFi, you identify a good cost historical past, as you can with a credits builder mortgage. Despite the fact that you’re now not borrowing cash or purchasing on credits, it seems that as a per thirty days mortgage reimbursement.

Your per thirty days bills file to 2 of the foremost credits bureaus:

This intensive reporting is very similar to the unfastened carrier introduced by way of Experian Spice up. On the other hand, Spice up handiest improves your Experian credits rating. It gained’t mean you can construct credits with Equifax or TransUnion.

You could understand a brief drop to your credits rating whilst you first sign up for StellarFi, as the road of credits seems as a brand new account to your credits reviews. A brand-new credits account negatively affects your moderate period of credits historical past (15% of your overall credits rating) and new credits elements (10% of your overall rating).

You’ll get equivalent effects to StellarFi by way of paying your expenses with a secured or unsecured bank card. On the other hand, a bank card isn’t ideally suited if it encourages you to overspend or you find yourself paying prime bank card rates of interest. It additionally is not going to in an instant take the cash from your bank account whilst you pay a invoice.

It can be tough to qualify for a bank card when you’ve got dangerous or truthful credits.

Different StellarFi credit-building gear come with:

- Developing custom designed credits objectives

- Credit score rating simulator

- Debt-to-income (DTI) calculator

- Dynamic rating projections

✨ Comparable: Tips on how to Build up Your Credit score Rating

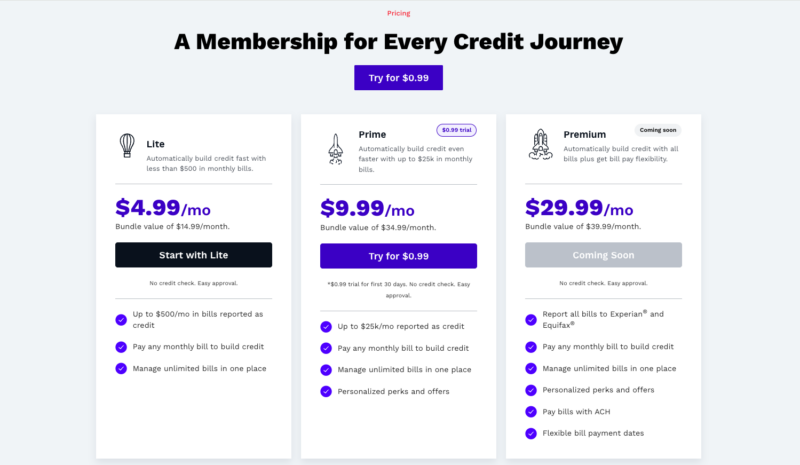

StellarFi Pricing

StellarFi provides 3 paid plans (there’s no unfastened model.) You’ll improve to a better plan to get entry to a better credits prohibit, which might mean you can decrease your credits usage ratio and can help you pay extra expenses. Right here’s a more in-depth take a look at what each and every plan has to provide.

Lite

The entry-level Lite plan prices $4.99 per thirty days and lets you file as much as $500 of expenses as credits. Your preliminary line is smaller till you entire your first invoice cost sooner than it expands to $500.

With Lite, you additionally get get entry to to different crucial StellarFI options, together with invoice pay auto-withdrawal, invoice cost notifications, credits rating tracking and signals, 1-on-1 are living credits training, and extra.

High

StellarFi’s mid-tier plan is known as High, and it prices $9.99 per thirty days after a $0.99 trial for the primary 30 days.

You’ll have as much as $25,000 in expenses reported as credits, an important build up over the Lite plan.

Top class

StellarFi Top class is the highest-tier plan and prices $29.99 per thirty days. As of January 30, 2024, it’s but to move are living – there’s a ‘Coming Quickly’ understand at the StellarFI website online.

In keeping with StellarFi, the Top class plan will come with the next unique advantages:

Is StellarFi Protected?

StellarFi makes use of bank-level 256 AES safety to encrypt your individual knowledge. The platform additionally makes use of randomized virtual tokens and not retail outlets your monetary data.

With that mentioned, tech system defects do happen, and there are occasions when invoice bills is probably not finished as scheduled. If that occurs, StellarFi will make it proper by way of reimbursing any overdue charges and protective your privateness.

Remember the fact that StellarFi is a tender corporate, so that you should be at ease coping with a startup.

Does StellarFi In fact Paintings?

You’ll get advantages probably the most from StellarFi when you’ve got a credits rating within the low 600s or underneath. Listed here are some reported effects from StellarFi customers on Trustpilot:

- Adrian N. reported a mean 40-point build up after the primary month

- Angel M. reported a mean 45-point build up over 4-6 months.

- Caitlynn D. reported a 20+ issues spice up all over the primary 30 months.

- Destany B. reported a 28-point build up after the primary month and 0 issues after the second one month sooner than leaving their evaluation.

Remember that those are on-line reviewers, and their effects can’t be substantiated.

Additionally, from Trustpilot, the commonest StellarFi lawsuits generally tend to enclose a loss of customer support choices. A number of opinions point out that chatbots care for the preliminary inquiry procedure, and it may be tough to achieve a human.

In the end, you’ll be able to’t depend on StellarFi on my own to reinforce your credits historical past. You should additionally center of attention on paying your present loans and bank cards on time, averting opening new bank cards or loans, and holding present bank card accounts open so long as conceivable to have the utmost advantages.

Professionals & Cons

We’ve known the next strengths and weaknesses of StellarFi’s carrier providing:

Professionals

- You’ll fortify your credits rating throughout the first few months

- Studies to all 3 credits bureaus

- No hidden charges or hobby fees

- Can earn money rewards on invoice bills (Plus and Top class plans)

Cons

- No unfastened plan

- Restricted customer support availability

- Doesn’t file previous bills sooner than enrollment

- Nonetheless a tender corporate

Possible choices to StellarFi

Sooner than signing up with StellarFi, it’s a good suggestion to discover different credits builder platforms. With that during thoughts, listed here are a couple of StellarFi choices value taking into consideration.

Kikoff

Kikoff is a credit-building platform that gives a credits account in addition to a secured bank card. The Kickoff Credit score Account is a $750 credits line. As a substitute of paying expenses, you’ll be able to purchase monetary training merchandise, and your cost task reviews to the 3 bureaus.

Two further gear come with a secured bank card and a credits builder mortgage. There’s a flat, $5 per thirty days rate for Kickoff’s Credit score Provider, however not like some competition, it doesn’t price any charges for its secured card or credits builder mortgage product.

Kikoff evaluation for extra.

CreditStrong

You’ll fortify your individual or industry credits thru CreditStrong. A number of credits builder mortgage tiers are to be had relying on how aggressively you wish to have to extend your rating and your per thirty days funds.

Take a look at our CreditStrong evaluation to match credit-building plans.

Self

Self permits you to deposit per thirty days bills into an FDIC-insured certificates of deposit (CD). The credits builder mortgage’s reimbursement time period is so long as 24 months with a per thirty days dedication between $24 and $150. Each and every cost reviews to the 3 main bureaus, and you might be reimbursed the contribution quantity on the adulthood date, aside from charges.

Further merchandise come with a secured bank card and unfastened hire reporting.

Learn our Self Credit score Builder evaluation to determine extra.

FAQs

No laborious credits test is important to use as you handiest want a Social Safety quantity or particular person taxpayer id quantity (ITIN) to file bills in your credits bureaus.

Your StellarFi account seems as a revolving line of credits very similar to a bank card. Each and every month, the platform reviews your per thirty days invoice cost quantity and compares it towards your overall prohibit to calculate a credits usage ratio.

You’ll pause or cancel your account by way of gaining access to the “set up account” button within the private data menu. Pausing your account helps to keep your line open to stop an account closure from showing to your credits file, nevertheless it now not reviews per thirty days bills as you’re now not paying a club rate anymore.

Chat and electronic mail beef up is to be had from 8 a.m. to six p.m. Central from Monday to Friday. Reside telephone beef up is unavailable until the platform contacts you to agenda a decision.

Is StellarFi Price It?

StellarFi is value taking into consideration if you happen to’re on the lookout for a method to construct or restore your credits with out a secured bank card or different credits product. One of the vital greatest benefits of the use of StellarFi is that it is helping you automate your budget and file your invoice bills to 2 main credits bureaus, Experian and Equifax.

Simply have in mind of the costs – sadly, StellarFi does now not be offering a unfastened tier – and be real looking about how a lot StellarFi can spice up your credits rating. Take note that you’re going to need to keep on with sound credit-building practices, corresponding to well timed credits bills and common budgeting, to stick not off course for monetary luck.

[ad_2]