[ad_1]

E-file.com is a tax submitting instrument program that provides intuitive steerage and a clutter-free interface designed to lend a hand customers dossier their taxes briefly.

On the other hand, it is not simple to record your investment-related process, and whilst they provide loose, restricted federal submitting, E-file.com turns out overpriced at each degree.

For the ones causes, we suggest staying clear of E-file.com in 2024. If you are taking into account the use of E-file.com to dossier your taxes, learn the next assessment earlier than you do. Or, take a look at how they examine to different main on-line tax prep corporations right here: The Absolute best Tax Tool.

E-file.com – Is It Loose?

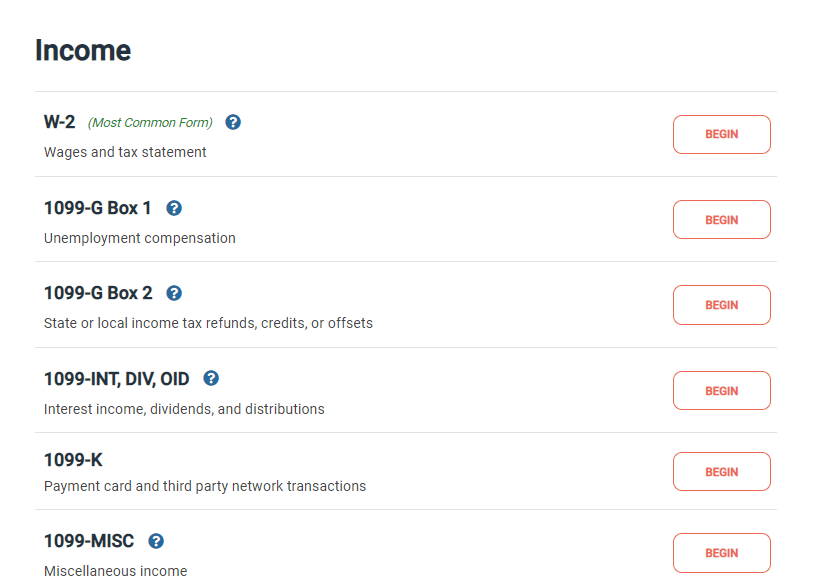

E-Record.com has a restrictive loose federal submitting possibility, however all customers must pay for state submitting. The “Loose” possibility best contains W-2 source of revenue and the Rebate Restoration Credit score. If you happen to reside in a state that doesn’t require a tax go back and feature very simple taxes, you’ll be able to dossier free of charge. However that’s very uncommon.

All different credit and deductions (together with the Kid Tax Credit score and HSA contributions) require you to improve to a paid product. As a result of an vast majority of folks gained’t qualify free of charge submitting with E-file.com, it is best to think about it as a paid product.

What’s New In 2024?

E-file.com has made the specified updates to take care of the brand new limits for tax credit and deductions for the 2023 tax 12 months (submitting in 2024). Differently, it is most commonly unchanged from prior years. Because of IRS changes, be expecting new usual deduction limits, brackets, and different adjustments all through your tax go back.

The left navigation menus and shape types have stepped forward through the years, making E-file.com a very simple tax app to navigate. Customers with easy tax returns will most likely be capable of get their taxes carried out briefly, although traders and somebody with extra complicated wishes must maintain some monotonous shape entries.

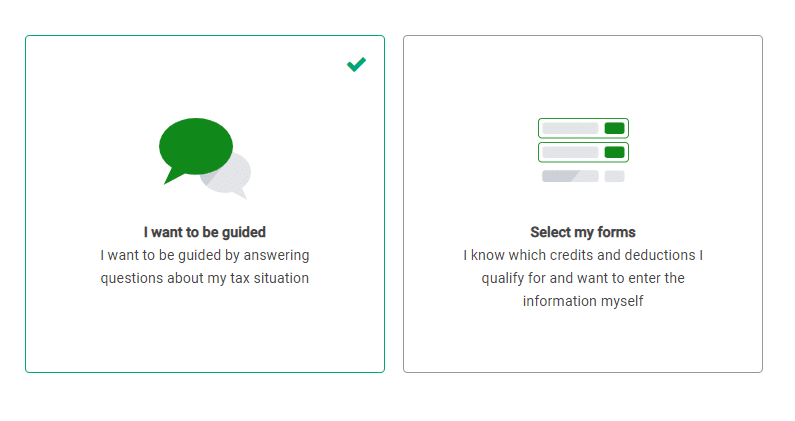

Choose from questions and menu variety

Does E-file.com Make Tax Submitting Simple In 2024?

E-file.com provides a very good consumer enjoy for filers with easy tax returns. Claiming deductions and credit is moderately easy. Many customers can to find related sections and input knowledge briefly. The clutter-free monitors make submitting intuitive.

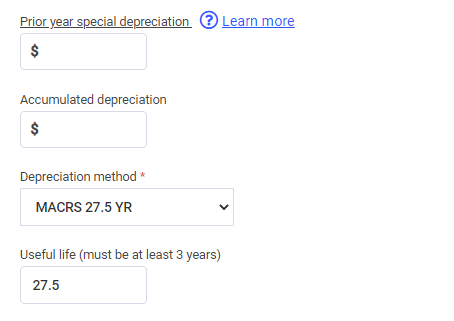

On the other hand, filers with investments or self-employment source of revenue are more likely to to find that e-file.com is much less user-friendly. Our workforce of testers questioned whether or not they have been coming into knowledge in the right kind containers. The depreciation “wizards” for genuine property and trade have been fairly complicated since they by no means confirmed the volume of depreciation claimed.

Inventory or crypto investors would even be required to manually input their trades via lengthy monitors as an alternative of importing spreadsheets or uploading 1099 bureaucracy.

Instance of sudden complexity- Accrued Depreciation is one thing that are supposed to be calculated.

E-file.com Notable Options

Those are one of the most options that set e-file.com except mid-priced choices.

Guided And Self-Guided Navigation Choices

Customers can go for guided or self-guided navigation when the use of E-file.com. Filers who really feel comfy in a single segment (say Source of revenue) can go for self-guided navigation in that segment. Then they may be able to resume a guided possibility (together with questions and solutions) for the deductions or credit sections.

Helps Multi-State Submitting

Filers who earned source of revenue in more than one states can dossier in more than one states. E-file.com fees customers on a per-state foundation, so this isn’t a specifically nice deal.

e-file.com Notable Drawbacks

E-file.com’s notable drawbacks make it lower than the perfect product for many filers. Those are one of the most drawbacks that attainable customers must perceive.

Loose Tier Calls for Paying For State Submitting

E-file.com’s loose tier is amazingly restrictive. Filers with kids, investments, HSA contributions, unemployment source of revenue, scholar mortgage passion deductions, and every other main tax scenario must improve. However even worse, the Loose tier isn’t in fact loose in follow. Filers must pay $22.49 to dossier their state go back.

No Phase Summaries

Many tax methods display segment summaries to lend a hand filers see their numbers. Those lend a hand filers work out whether or not they are going to have neglected a supply of source of revenue or crucial deduction. E-file.com does now not have those summaries, making submitting tougher, particularly for filers with investments.

Complicated “Wizards”

E-file.com has a couple of calculators it calls “wizards”. Those wizards, which can be utilized to calculate depletion, mileage deductions, or depreciation, have been somewhat complicated. They didn’t give an explanation for the place a filer may just to find sure knowledge, and a couple of contained unclear tax jargon.

Tech Strengthen Calls for Fee

Customers who need to obtain tech give a boost to must improve to E-file.com’s Deluxe tier. That is tech give a boost to best and doesn’t come with lend a hand submitting taxes.

E-file.com Plans And Pricing

E-file.com pushes a shocking collection of folks to the “Top rate” plan. The Loose version is very restrictive, as was once prior to now mentioned.

The Deluxe tier best helps W-2 source of revenue, unemployment source of revenue, and a couple of deductions (together with loan passion). It additionally helps the Kid Tax Credit score however is restricted to families with lower than $100,000 in source of revenue. Filers with the next source of revenue, different sorts of source of revenue, or different deductions or credit to assert must improve to top class.

|

W-2 Source of revenue, No dependents, source of revenue lower than $100,000 |

Kids (no dependent care credit), unemployment source of revenue, source of revenue lower than $100,000 |

Everybody else (HSA, trade source of revenue, all different deductions, and many others.) |

|

How Does E-file.com Evaluate?

E-file.com has mid-market pricing, so we’ve when put next it to cheap competition. Money App Taxes provides the most efficient general consumer enjoy, however customers would possibly need to use FreeTaxUSA as it helps multi-state submitting. We do not watch for filers ever discovering a selected explanation why to make use of E-file.com over any such more economical choices.

|

Header |

|

|

|

|---|---|---|---|

|

Unemployment Source of revenue (1099-G) |

|||

|

Dependent Care Deductions |

|||

|

Retirement Source of revenue (SS, Pension, and many others.) |

|||

|

Small Industry Proprietor (Over $5k in Bills) |

|||

|

Loose Version $0 Fed & |

Loose Version $0 Fed & |

||

|

Deluxe $20.99 Fed & |

Deluxe $7.99 Fed & |

||

|

Top rate $37.49 Fed & |

Professional Strengthen $39.99 Fed & |

||

|

Cellular |

Is It Secure And Safe?

E-file.com makes use of knowledge encryption and multi-factor authentication to stay consumer knowledge protected. This guarantees that the web site meets the IRS requirements.

E-file.com hasn’t ever reported main knowledge breaches, so it sort of feels most likely that the corporate upholds prime requirements for knowledge safety. On the other hand, no corporate can ensure 100% knowledge safety. Customers must moderately evaluation any tax instrument supplier earlier than opting to make use of the instrument.

How Do I Touch The E-file.com Strengthen Group?

That is a space the place E-file.com falls brief. As discussed prior to now, until you improve to a minimum of the “Deluxe” version, you will not even get get admission to to elementary telephone and on-line give a boost to. Irrespective of your plan, you will not find a way to succeed in out to tax execs for recommendation.

In spite of the loss of give a boost to, maximum consumers on Trustpilot record sure reviews, and the corporate maintans an A+ ranking with the Higher Industry Bureau (BBB). That is most likely as a result of e-file.com has a tendency to draw filers who’re comfy dealing with their tax returns on their very own. However in case you are in search of some hand-holding alongside the best way, e-file.com may not be the proper tax instrument for you.

Why Must You Accept as true with Us?

The Faculty Investor workforce spent years reviewing the entire best tax submitting choices, and our workforce has non-public enjoy with the vast majority of tax instrument equipment. I in my opinion were the lead tax instrument reviewer since 2022, and feature when put next many of the main corporations at the market.

Our editor-in-chief Robert Farrington has been attempting and trying out tax instrument equipment since 2011, and has examined and attempted virtually each tax submitting product. Moreover, our workforce has created reviews and video walk-throughs of the entire main tax preparation corporations which you’ll be able to to find on our YouTube channel.

We’re tax DIYers and need a excellent deal, similar to you. We paintings exhausting to supply knowledgeable and fair reviews on each product we take a look at.

How Was once This Product Examined?

In our unique checks, we went via e-Record.com and finished a real-life tax go back that integrated W2 source of revenue, self-employment source of revenue, condominium belongings source of revenue, and funding source of revenue. We attempted to go into each piece of information and use each characteristic to be had. We then when put next the end result to all of the different merchandise now we have examined, in addition to a tax go back ready via a tax skilled.

This 12 months, we went again via and re-checked all of the options we in the beginning examined, in addition to any new options. We additionally validated the pricing choices.

Who Is This For And Is It Value It?

Whilst E-file.com has a good consumer interface, the product best works neatly for filers with moderately easy returns. The ones with easy returns can to find lower-cost choices that paintings similarly neatly.

However in case you have a reasonably complicated go back, you’ll be able to almost definitely need to go for a extra tough selection. For 2024, we suggest that the majority filers skip e-file.com. As a substitute, make a choice the absolute best tax instrument to your scenario.

E-file.com FAQs

Listed below are the solutions to a number of the maximum not unusual questions that filers ask about E-file.com:

Can E-file.com lend a hand me dossier my crypto investments?

E-file.com has give a boost to for crypto trades, however it calls for filling out an in depth shape for every industry all through the 12 months. Maximum investors gained’t need to spend the time wanted to do that. This 12 months, a greater selection is TurboTax Premier.

Can E-file.com lend a hand me with state submitting in more than one states?

Sure, E-file.com helps multi-state submitting. Customers will have to pay $22.49 in step with state.

Does E-file.com be offering refund advance loans?

No, E-file.com does now not be offering refund advance loans in 2024.

E-file.com Options

|

Sure, (further price applies) |

|

|

Sure, Top rate plan required |

|

|

Import Tax Go back From Different Suppliers |

|

|

Import Prior-12 months Go back For Returning Shoppers |

|

|

Import W-2 With A Image |

|

|

Inventory Brokerage Integrations |

|

|

Crypto Change Integrations |

|

|

Sure, Top rate plan required |

|

|

Sure, Top rate plan required |

|

|

Deduct Charitable Donations |

Sure, Top rate plan required |

|

Refund Anticipation Loans |

|

|

Telephone and chat (Deluxe or Top rate plan required) |

|

|

Buyer Carrier Telephone Quantity |

|

[ad_2]