[ad_1]

This acceleration, alternatively, is a residual impact of remaining spring and summer season’s robust run of expansion, with more moderen information suggesting that the expansion fee will start to cool within the coming months, the record famous.

The seasonally adjusted per 30 days expansion fee of house costs picked up from 0.09% in November to 0.13% in December. However value appreciation stays cool, falling 0.42% within the month on a non-adjusted foundation, smartly beneath the 25-year December reasonable of -0.08%.

Refinance Incentive

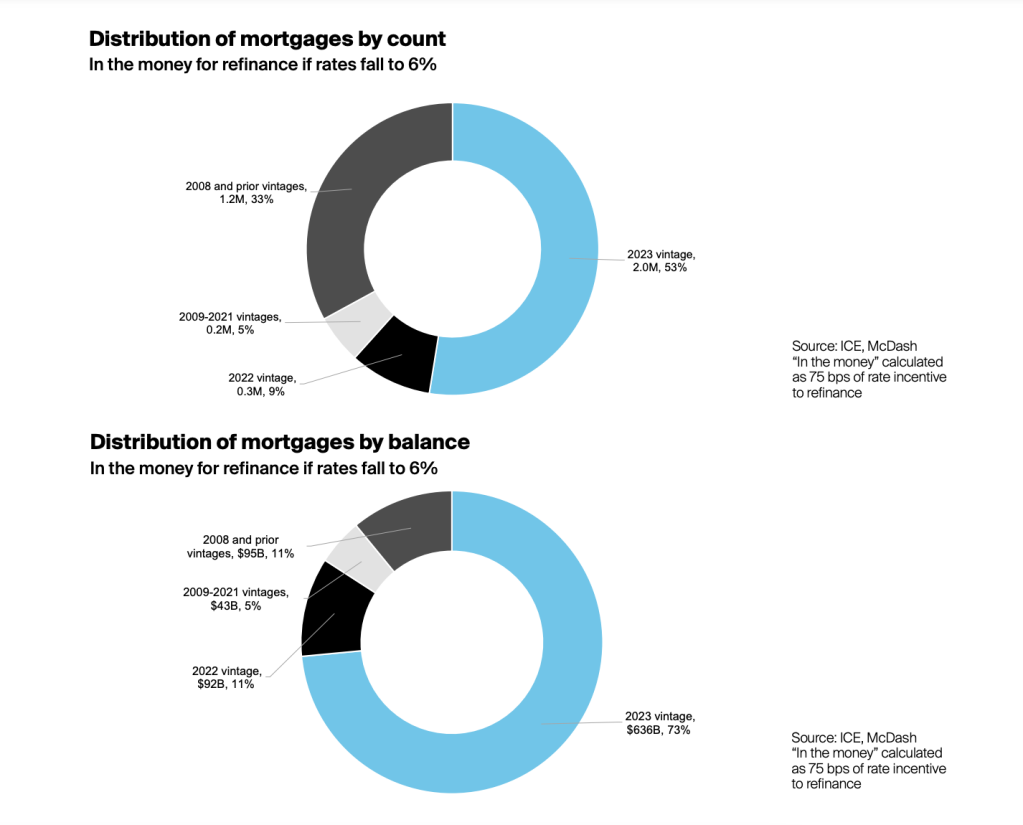

Decrease rates of interest have additionally begun to slowly building up refinance incentives for present householders, specifically a number of the 4.3 million mortgages originated in 2023.

Of the 2023 classic, 2 million of those debtors (or 26%) would have the ability to minimize their first-lien fee by means of 75 bps if 30-year charges fall to a projected 6% by means of the tip of 2024, with 33% in a position to avoid wasting a complete proportion level or extra.

“Beneath that state of affairs — a possible needle mover for the refinance marketplace — some 46% of 2023-vintage debtors can be ‘within the cash,’ with just about a 3rd in a position to chop a complete proportion level off their present charges,” mentioned Andy Walden, ICE vice chairman of endeavor analysis technique.

If 30-year charges fall to six% by means of the fourth quarter, because the Loan Bankers Affiliation (MBA) and Fannie Mae are these days predicting, the full inhabitants of loans with a 75-bps refi incentive would greater than double from 1.7 million to three.8 million. Just about 60% of that expansion would come from loans originated in 2023, ICE projected.

Beneath this kind of state of affairs, greater than part can be householders who financed in 2023, with not up to 10% coming from 2022-vintage loans.

Every other one-third can be debtors who took out loans greater than 15 years in the past and didn’t refinance when charges dipped beneath 3%, making them not likely to refi at 6%.

House affordability

ICE famous that house affordability has progressed in contemporary months regardless of a modest upward tick in loan charges over the last few weeks.

Householders are required to make a per 30 days cost of $2,257 to buy the median-priced house, assuming the usage of 30-year fixed-rate mortgage and a 20% down cost. That determine is down $243, or just about 10%, from a report in October, however up $831 (58%) from the beginning of 2022.

At 33.4% of the median family revenue, the common cost is down from a 38-year top of greater than 38% in October.

However that quantity remains to be 9 proportion issues above the 30-year reasonable debt-to-income ratio of 24.2% and reasonably not up to the 33.8% top previous to the housing marketplace downturn in 2006.

“If present business fee forecasts come to fruition, affordability will steadily enhance as we transfer via 2024 however proceed to run smartly over long-run averages right through the 12 months,” the record mentioned.

Fairness ranges

Loan holders ended 2023 with $16 trillion in fairness, the best possible year-end overall on report, and up $1.6 trillion, or 11%, in comparison to the tip of 2022.

About $10.3 trillion of this overall is thought of as “tappable,” which means it may be withdrawn whilst keeping up an 80% or decrease mixed loan-to price (CLTV) ratio. This quantity rose by means of 12%, or $1.14 trillion, in 2023.

The typical loan holder now has $299,000 in fairness, up from $274,000 on the finish of 2022. This equates to a median of $193,000 in fairness that may be withdrawn whilst nonetheless keeping up a 20% fairness stake of their house.

“Traditionally top ranges of fairness proceed to lend a hand insulate loan buyers from doable losses and create the prerequisites for an upswing in fairness lending when rates of interest ease sufficient to make withdrawals extra horny to householders,” in step with the record.

[ad_2]