[ad_1]

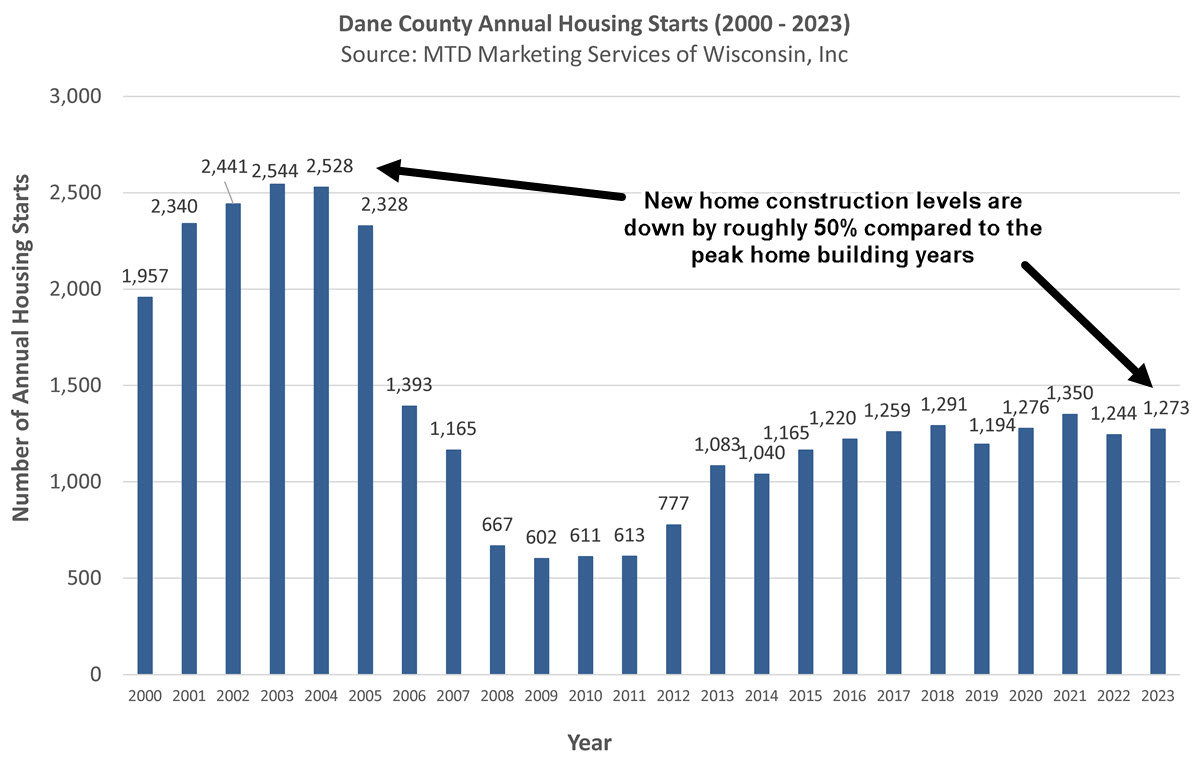

Let’s have a handy guide a rough take a look at the numbers: Closing 12 months, Dane County’s inhabitants grew by way of nearly 8,000 other people, and but we constructed just below 1,300 properties. This is an overly acquainted trend in Dane County. Because the chart beneath displays, new house development has been subdued for the final 18 years, despite the fact that our county has persistently ranked as some of the fastest-growing areas within the state.

What does the longer term hang for Dane County?

Whilst many counties in Wisconsin are experiencing inhabitants declines, you need to be aware that Dane County’s inhabitants is projected to develop by way of some other 200,000 other people over the following 30 years. For this and a number of different causes, we absolutely be expecting native house values will proceed to comprehend for the foreseeable long run.

All of this data is particularly necessary for first-time house consumers to grasp and internalize.

So, if certainly one of your lifestyles objectives is to turn out to be a home-owner, we extremely suggest you embody the mindset of “getting your foot within the door”. In different phrases, the house you purchase this 12 months will not be your highest house, for your highest location, and at your highest worth. However it may be the house that is helping you “get your foot within the door” for developing a greater lifestyles — and development a more potent monetary basis.

Just by paying your loan every month, and by way of making the fitting enhancements, you’ll get started development fairness at the moment to help you transfer as much as your subsequent house a couple of years down the road. That is the mindset that a lot of our purchasers are embracing in our new customary marketplace. And that is the viewpoint that is serving to them enjoy their dream of homeownership, as they construct wealth for the long-term, too.

[ad_2]