[ad_1]

The U.S. housing marketplace has reached its least reasonably priced level in a long time and housing companies have an increasing number of rolled out homebuyer help methods to take on this factor.

A complete of 135 new homebuyer help methods have been offered in 2023, a 6% build up over the former 12 months. This introduced the national tally as much as 2,294, in step with Down Fee Useful resource’s fourth-quarter Homeownership Program Index (HPI) document.

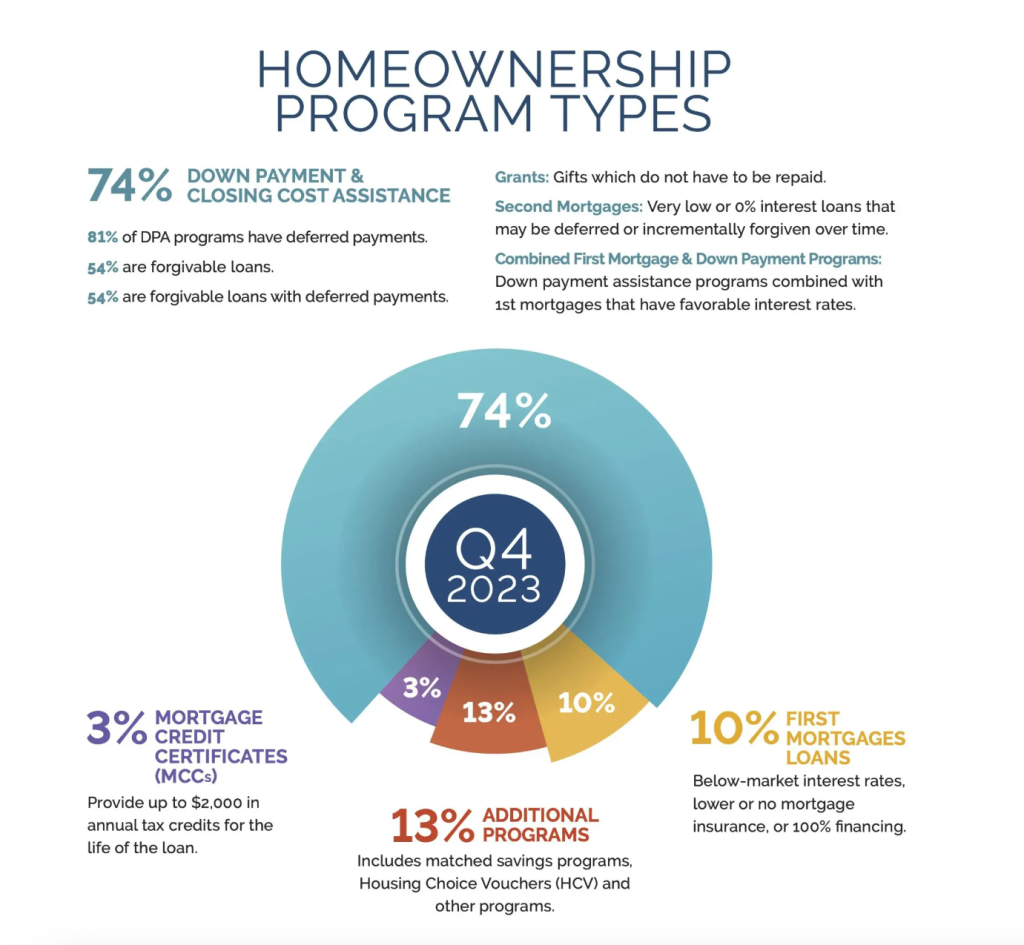

Of the homeownership program sorts, 74% consisted of down cost and shutting price help methods; 13% have been further methods together with matched financial savings methods and Housing Selection Vouchers (HCVs); 10% have been first-lien mortgages with below-market rates of interest, decrease or no loan insurance coverage; and three% got here from loan credit score certificate (MCCs) that offer as much as $2,000 in annual tax credit for the lifetime of the mortgage.

A rising selection of nonbank loan lenders have just lately rolled out down cost help (DPA) methods to extend their origination proportion in a difficult loan setting.

Maximum just lately, loanDepot rolled out a brand new DPA program for Federal Housing Management debtors that permits them to position no cash down in advance.

Different lenders that experience offered DPA methods or DPA-oriented methods of past due come with Rocket Loan, United Wholesale Loan, Guild Loan and Assured Price.

Some of the just about 2,300 homebuyer help methods to be had ultimate 12 months, 804 have been designed to lend a hand with the acquisition of a manufactured house — up 20% from the former 12 months, in step with the document.

“With an important build up in methods for manufactured houses, multifamily houses, and explicit purchaser demographics like carrier participants and Local American citizens, this 12 months’s document underscores a rising dedication to diversify housing answers and empower a broader spectrum of aspiring householders,” stated Rob Chrane, founder and CEO of Down Fee Useful resource.

Manufactured housing has a decrease access level than different varieties of houses and helps many consumers to get their foot within the door, the document famous. Going ahead, Down Fee Useful resource expects to peer the selection of methods that permit for manufactured housing to keep growing.

Housing companies are increasing program eligibility pointers to incorporate extra belongings sorts. For instance, some 686 methods at the moment are to be had for the acquisition of a multifamily belongings (outlined as the ones with two to 4 devices) — up 8% from the former 12 months.

The usage of DPA to buy a multifamily belongings has turn into an increasing number of well-liked. This permits other people to turn into homebuyers in addition to buyers, a extra not unusual technique lately this is referred to as “space hacking,” the document mentioned.

Along with finishing a homebuyer training elegance, debtors buying a multifamily house with homebuyer help generally have to head thru categories on being a landlord to verify long-term sustainability.

Comparable

[ad_2]