[ad_1]

TokenTax is a crypto-first tax submitting corporate that specialize in crypto tax optimization. It has a stand-alone product that is in a position to calculate taxes due on crypto transactions.

Along with the stand-alone product, TokenTax provides full-service submitting, together with back-tax submitting for crypto investors who’ve misguided information, going again to 2014.

When you have a sophisticated crypto tax state of affairs, TokenTax could also be price bearing in mind. Right here’s what you wish to have to find out about it.

|

Cryptocurrency Tax Stories |

|

|

Limitless Thru CVS Report Import |

|

What Is TokenTax?

TokenTax is a tax-filing corporate that provides tax-filing products and services in many nations together with america. Based in 2017, TokenTax supplies a self-service tax utility that calculates taxes for crypto transactions in addition to full-service tax submitting.

As a tax-first corporate, TokenTax focuses on tax minimization methods, together with tax-loss harvesting. It additionally makes use of IRS-compliant common sense associated with margin buying and selling and different sides of crypto buying and selling.

TokenTax customers can generate Shape 8949 for cryptocurrency or have TokenTax report their whole go back for them.

For 2023 taxes filed right through the 2024 tax season, we picked TokenTax as our Easiest Complete Provider crypto tax instrument on our annual checklist of the most efficient crypto and NFT tax instrument. Whilst some TokenTax plans are dear, it is a forged providing general.

Some Crypto Tax Fundamentals

You need to know the way the IRS treats crypto and taxes. For probably the most phase, cryptocurrency and NFT are handled like shares. While you purchase or earn a token, that token has a value foundation which is the price of the token (in $USD) on the time of acquire. Like shares, crypto belongings result in capital beneficial properties and losses once they promote or industry the tokens.

The benefit or loss relies on the price of the token on the time you promote it.

Instance state of affairs

Let’s say a dealer bought 10 BTC (Bitcoin) on Jan. 1, 2021. Right now, BTC was once price $7,175.50.

- The dealer’s price foundation on this transaction is $71,755. (10 x $7,175.50 = $71,755)

- $71,755 will be the price foundation, although the dealer paid the usage of every other token.

Then, this dealer sells all 10 BTC on July 20, 2023, for $29,789.94 in step with token.

- The volume discovered is $297,899.40. (10 x $29,789.94 = $297,899.40)

- The IRS considers $297,899.40 the quantity to be taxed although the dealer receives fee within the type of every other crypto token.

On this transaction, the dealer incurs a long-term capital acquire of $226,144.40. The IRS will tax the dealer in this foundation.

Cryptocurrency could also be eligible for tax-loss harvesting. That implies you’ll use discovered capital losses (from promoting tokens that experience depreciated) to offset some or your whole discovered capital beneficial properties.

Maximum investors’ crypto transactions shall be taxed as investments within the tactics described above. Alternatively, there also are occasions when cryptocurrency will also be taxed as unusual source of revenue. Examples come with in case you won crypto for mining or staking or as hobby on a mortgage.

TokenTax – Is It Unfastened?

Sadly, TokenTax does no longer be offering a unfastened model of its instrument. Customers should pay for a selected tax 12 months prior to they are able to get started the usage of the provider. When you have greater than 5,000 trades in step with 12 months, you will get sticky label surprise from the pricing.

The bottom price plan will set you again $65 in step with tax 12 months. Upper-end plans price $199 to $3,499 in step with 12 months.

What’s New In 2024?

It’s been a quite gradual 12 months within the cryptocurrency markets, and no longer unusually, TokenTax hasn’t made many giant adjustments or updates to its instrument or pricing. However it nonetheless works smartly for the wishes of maximum cryptocurrency tax filers – if you’ll abdomen the fee for higher-end plans if wanted.

Does TokenTax Make Tax Submitting Simple In 2024?

TokenTax instrument eases tax submitting headaches for lively crypto investors. The instrument routinely calculates capital beneficial properties and losses and recommends tax-loss harvesting choices. This permits investors to get pleasure from tax minimization methods with out all of the effort.

DIY tax filers who use TurboTax shall be glad to be told that TokenTax integrates immediately with the tax submitting instrument. Not like the vast majority of its competition, TokenTax additionally has a CPA and a complete tax submitting group to be had for rent, despite the fact that the fee is excessive for this add-on.

TokenTax’s tax mavens can report your taxes in your behalf and supply white glove provider if you wish to have lend a hand piecing previous beneficial properties and losses in combination according to defunct exchanges. Whilst dear, this can be a provider that almost all accountants merely don’t be offering.

You’ll pay a beautiful penny for the best possible stage of provider, however that’s profitable for some rich investors with complicated portfolios or buying and selling methods.

TokenTax Options

TokenTax will report all of your go back or create experiences so that you can report by yourself. Those are probably the most crucial options.

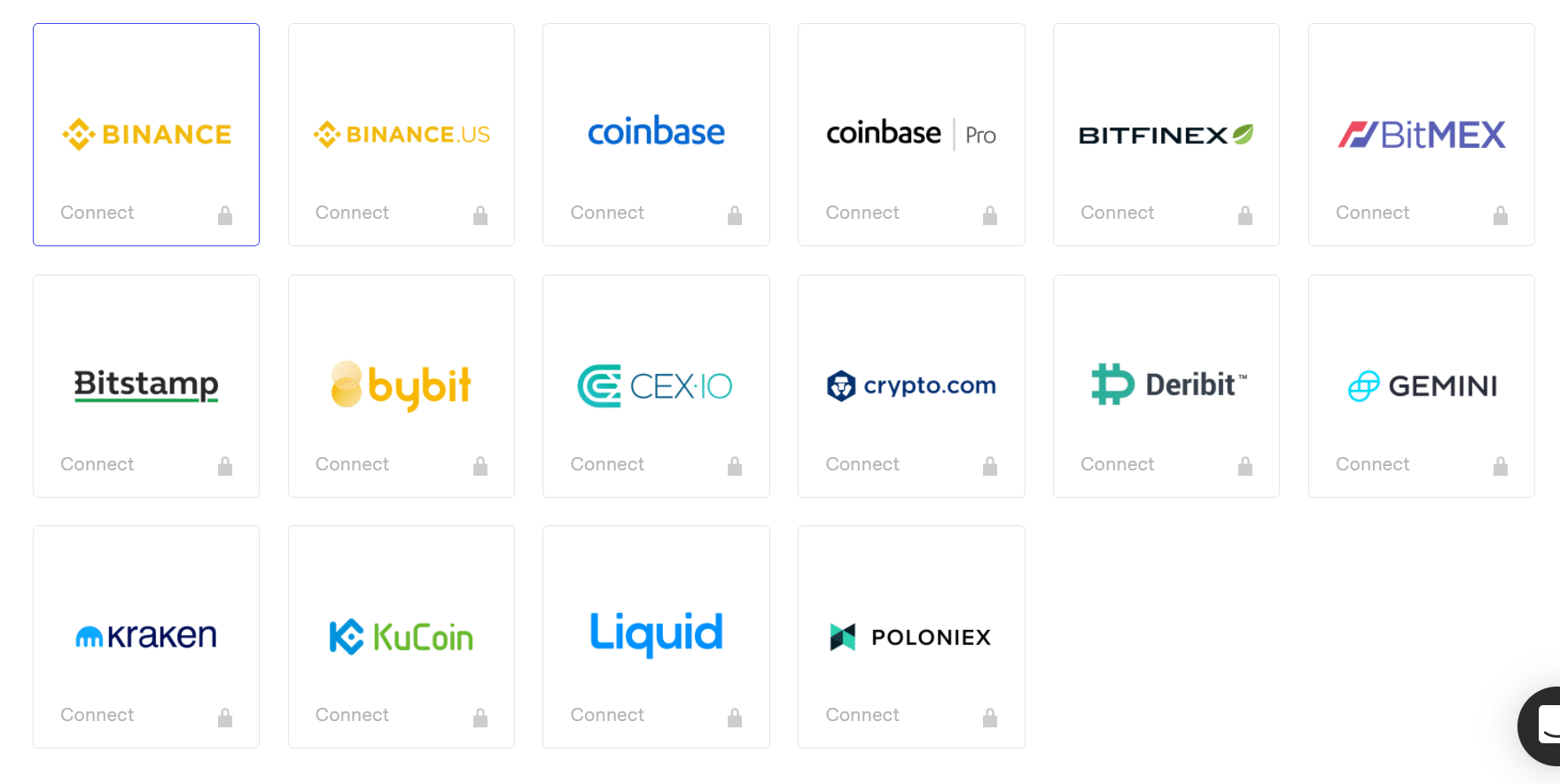

Imports From Each Alternate

TokenTax says it is the “solely cryptocurrency tax calculator that connects to each crypto trade.” Dozens of exchanges, together with those proven under, will also be attached immediately by means of API.

Even though an API integration is not to be had, TokenTax can nonetheless import your industry information. All it’s important to do is add a CSV report out of your trade. If TokenTax’s instrument cannot routinely procedure the file, its group participants will in my view handle including the trades in your account.

Tax-Loss Harvesting

TokenTax works to attenuate customers’ tax burden via growing alternatives for tax-loss harvesting (the place criminal). This center of attention permits investors to benefit from some occasions when buying and selling didn’t figure out.

Helps Margin Buying and selling

TokenTax helps margin buying and selling and gives API integrations to maximum exchanges that beef up margin buying and selling. Customers unencumber some margin buying and selling beef up on the Top class stage however might wish to improve to Professional, relying at the exchanges they use.

TokenTax Drawbacks

TokenTax provides a very good person revel in and answers for crypto investors the usage of subtle ways (like margin buying and selling). Alternatively, the instrument isn’t easiest. Those are a couple of drawbacks.

No Unfastened Trial

TokenTax doesn’t be offering a unfastened trial. To begin the usage of the instrument, you wish to have to pay. With super-high costs, it is a waste of cash if the instrument doesn’t do what a person wishes it to do.

API Integration Locked At Sure Ranges

TokenTax does no longer universally unencumber API integrations. The most typical exchanges are unlocked on the Top class stage, however others aren’t unlocked till the VIP tier.

Steep Will increase In Value

TokenTax has a aggressive $65 pricing tier (despite the fact that it solely helps Coinbase), however costs building up steeply after that. Customers who wish to get admission to all margin exchanges by means of API must pay for the Top class tier, which is $199 in step with tax 12 months.

You might want to temporarily to find your self within the $199 tier, relying on what number of transactions you may have performed. The best possible tier providing for extra sophisticated taxes begins at $3,499 in step with 12 months.

TokenTax On-line Pricing Plans

TokenTax fees charges according to a number of elements. Every tier unlocks extra trades, extra API connections to exchanges, and other tax minimization methods. The VIP stage contains consultations with crypto tax mavens who can lend a hand determine difficult problems associated with defunct exchanges.

|

Coinbase and Coinbase Professional solely |

|||

|

All conventional exchanges, however solely helps margin exchanges that supply API get admission to,which contains: BitMEX, Deribit, Bybit |

|||

|

All centralized exchanges |

|||

|

All exchanges (conventional and margin) Assist with reconciliation on defunct exchanges |

How Does TokenTax Examine?

TokenTax is among the solely crypto tax prep firms that may be offering complete provider if wanted. That mentioned, the VIP pricing tier (which contains hands-on beef up) may be very dear ($3,999+). Tax submitting itself calls for a customized quote. On account of the excessive costs, virtually all tax filers will go for TokenTax’s more economical choices.

General, TokenTax’s Fundamental tier is of deficient worth relative to the contest. On this tier, Coinbase customers who’ve fewer than 100 transactions can use TokenTax’s Fundamental package deal. Alternatively, customers can simply as simply pay TurboTax one time and connect with Coinbase.

At greater ranges, different firms beef up extra trades for decrease prices. TokenTax provides explicit beef up for margin buying and selling, however different firms, together with CoinLedger, additionally beef up margin trades.

From a worth standpoint, TokenTax in large part doesn’t make sense until you qualify for a decrease tier.

Alternatively, any individual with again taxes who wishes lend a hand reconciling outdated transactions must believe TokenTax’s VIP provider. Paying greater than $1,000 for hands-on lend a hand sounds too excessive, however few different firms supply this provider.

|

Header |

|

|

|

|---|---|---|---|

|

Add Any Alternate Historical past CSV Report |

|||

|

Tax Device Integrations |

|||

|

Mobile |

Is It Protected And Safe?

TokenTax makes use of encryption and read-only get admission to to stay data protected and protected. Customers must no longer fear that TokenTax will scouse borrow their tokens or their non-public data. The corporate additionally protects person data with a couple of varieties of safety.

When customers connect with APIs, they’ll be precipitated for a couple of varieties of authentication. Alternatively, TokenTax itself does no longer require multi-factor authentication for person accounts. A easy e mail and password mixture is used to begin with. This oversight might be the corporate’s greatest safety chance.

How Do I Touch TokenTax?

Until you are a VIP plan subscriber, the best choice to obtain beef up from TokenTax is almost certainly to make use of its Are living Chat provider. Alternatively, you’ll additionally take a look at achieving out via telephone at 845-663-1173 or e mail at beef up@tokentax.co.

When you do make a selection the VIP plan, you’ll be able to get get admission to to a wholly other stage of beef up. You can get two 30-minute periods with a tax professional and may have get admission to to customized accountant beef up that will help you clear up even probably the most complicated tax problems.

Buyer evaluations of TokenTax on Trustpilot had been normally certain, which is an encouraging signal. The corporate lately has a 4.7/5 (Superb) Trustpilot score with over 160 evaluations.

Is It Value It?

General, TokenTax provides a really perfect product however isn’t competitively priced. Even though TokenTax closely advertises that it helps margin buying and selling, it isn’t the one corporate that helps this. In 2024, maximum crypto investors must cross on TokenTax because of the fee. Investors can to find equivalent crypto tax submitting instrument at lower cost issues.

TokenTax FAQs

Listed here are some solutions to a number of the maximum not unusual questions that individuals ask about TokenTax:

Can TokenTax lend a hand me report my crypto investments?

Sure, TokenTax can lend a hand tax filers whole their taxes. The corporate can report all your go back in your behalf.

Can TokenTax scouse borrow my crypto?

No, TokenTax makes use of read-only APIs to get data out of your pockets or the exchanges you employ. It can’t scouse borrow your data.

Do I wish to file my crypto pockets switch information to the IRS?

It is dependent. Whilst transferring cryptocurrencies between wallets isn’t a taxable tournament, positive occasions that tax position within your pockets might be taxable, comparable to incomes hobby, receiving staking rewards, or receiving crypto as fee for products and services rendered.

Can world investors use TokenTax?

Sure, TokenTax says that its experiences can paintings for any nation and can give leads to no matter foreign money you select.

TokenTax Options

|

|

|

Limitless thru CVS report import |

|

|

Alternate API Integrations |

|

|

Tax Device Integrations |

|

|

Minimization (TokenTax’s customized HIFO set of rules) |

|

|

Tax-Loss Harvesting Dashboard |

At the Top class, Professional, and VIP Plans |

|

At the Top class, Professional, and VIP Plans |

|

|

Buyer Provider Telephone Quantity |

|

|

Buyer Provider E-mail Deal with |

|

|

Internet/Desktop Account Get right of entry to |

|

[ad_2]