[ad_1]

The previous 3 years within the loan business had been cutthroat, with origination quantity shrinking, and whilst issues are having a look higher for 2024, lenders are nonetheless able the place they will have to make daring strikes to stem losses at the manufacturing aspect of the trade, consistent with a document from Stratmor Staff, a loan advisory company.

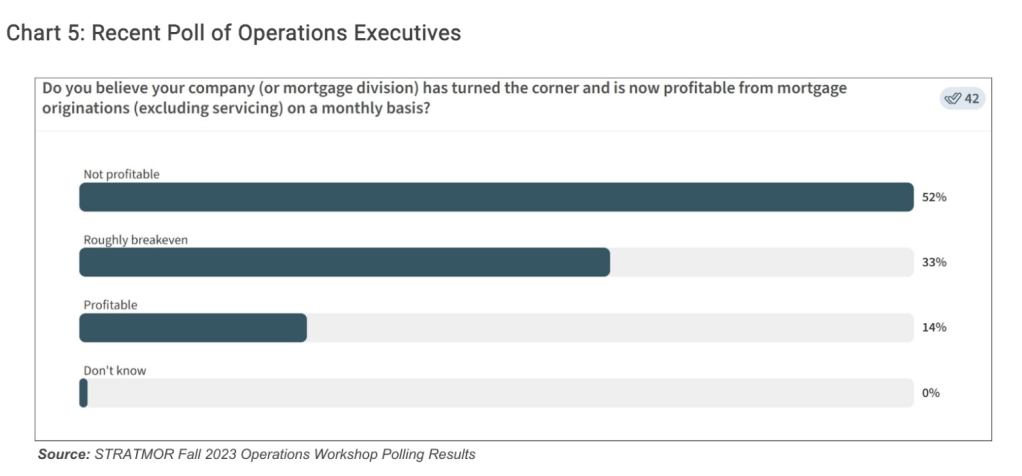

Greater than part of loan executives who participated in Stratmor’s fresh survey indicated that they don’t consider their corporations have became the nook to develop into successful in terms of originations — except for servicing.

About 85% of surveyed executives believed that their corporate was once both no longer successful or was once more or less breaking even in manufacturing.

If lenders’ losses are available as anticipated all over fourth-quarter 2023 and first-quarter 2024, it is going to constitute 8 consecutive quarters of losses for greater than 350 impartial loan bankers, mentioned Jim Cameron, senior spouse at Stratmor.

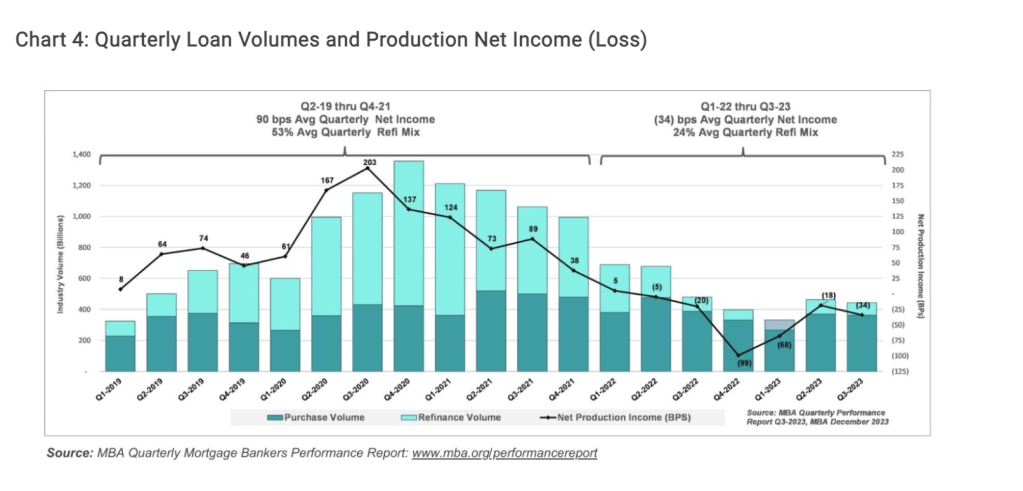

Unbiased loan banks (IMBs) and loan subsidiaries of chartered banks have jointly been within the pink for 6 consecutive quarters. Maximum just lately, they reported a mean web lack of $1,015 on each and every mortgage they originated in third-quarter 2023 — doubling the reported lack of $534 in step with mortgage in Q2, consistent with knowledge from the Loan Bankers Affiliation (MBA).

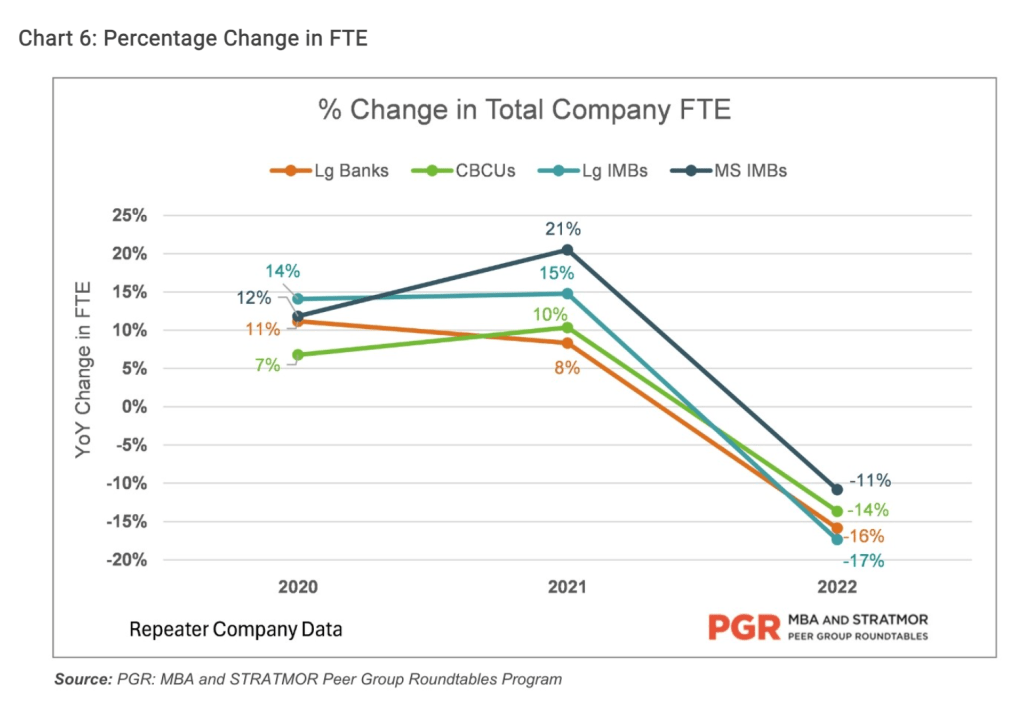

Whilst lenders were aggressively reducing exertions prices — their greatest form of expense — it has no longer been sufficient to scale back per-loan manufacturing expense.

Even with large cuts to gross manufacturing bills (from $44 million in step with corporate in Q3 2020 to $18 million in Q1 2023), the associated fee in step with mortgage has larger to extra $13,000 as mortgage manufacturing devices dropped off dramatically all over that length.

As of Q3 2023, overall mortgage manufacturing bills had been $11,441 in step with mortgage, up quite from $11,044 within the prior quarter.

“As we head into 2024, it’s transparent we nonetheless have extra capability and lenders will have to proceed to be disciplined and competitive in managing staffing ranges,” Cameron mentioned.

Whilst exertions is the concern in terms of decreasing prices, reducing down rent prices and applying the hybrid paintings style; reviewing seller contracts; and removing plug-ins with prime prices and coffee adoption charges are wanted, consistent with the document.

The silver lining for IMBs, basically, are their sturdy money balances, the document famous.

After bouncing between the $6 million to $8 million vary in 2018 and 2019, moderate money balances now stand at about $11.5 million as of Q3 2023. Lenders offered off a lot in their servicing portfolios in 2022 and 2023, and balances would were a lot decrease with out those strikes, in accordance Cameron.

“After an overly difficult 2023 and no longer a lot reduction anticipated in 2024, lenders will have to have a renewed focal point on money float forecasting,” Cameron mentioned.

“As a foundational want, loan bankers will have to be certain that they have got a powerful mechanism in position to forecast temporary, intermediate, and long-term money flows. And coming in an in depth 2nd is the wish to get razor sharp with monetary and operational reporting and tracking of key efficiency signs (KPIs). Loan bankers will have to be extremely professional at inspecting each prices and function throughout a number of dimensions, together with mounted as opposed to variable and break-even-point analyses,” he added.

Comparable

[ad_2]