[ad_1]

If you happen to spend money on cryptocurrency, you might be legally required to file capital good points and source of revenue when submitting your annual tax go back. When you’ve got a couple of cryptocurrency alternate accounts and wallets, finishing your crypto taxes manually is not sensible.

That is why maximum lively crypto buyers go for a crypto-specific tax app like Koinly to lend a hand with their tax prep wishes.

Koinly is cryptocurrency-specific tax and monitoring device that mechanically calculates your crypto taxes. It additionally generates any required tax bureaucracy and experiences, which you’ll be able to upload in your tax go back with an app like TurboTax or hand off to an accountant.

If you happen to’re searching for complete tax device that may streamline your crypto taxes, Koinly may well be a just right choice. On the other hand, sooner than you enroll and pay, get to grasp the options Koinly provides and the way it stacks up in opposition to different tax device.

This Koinly assessment covers the whole lot you wish to have to find out about this main tax device to lend a hand you make a decision if it’s best for you.

|

Cryptocurrency tax device |

|

|

Change & Pockets Integrations |

|

What Is Koinly?

Koinly is a cryptocurrency tax device that caters to the intense crypto buyers. Cryptocurrency buyers and accountants created Koinly with their very own wishes in thoughts, which most probably overlaps along with your wishes for those who’re additionally submitting cryptocurrency taxes.

Introduced in 2018, the corporate operates out of London. For 2023 taxes filed within the 2024 tax season, Koinly is our best select for the most efficient cryptocurrency and NFT tax legal responsibility calculator.

Take a look at our alternatives for the most efficient tax device platforms right here.

What Does It Be offering?

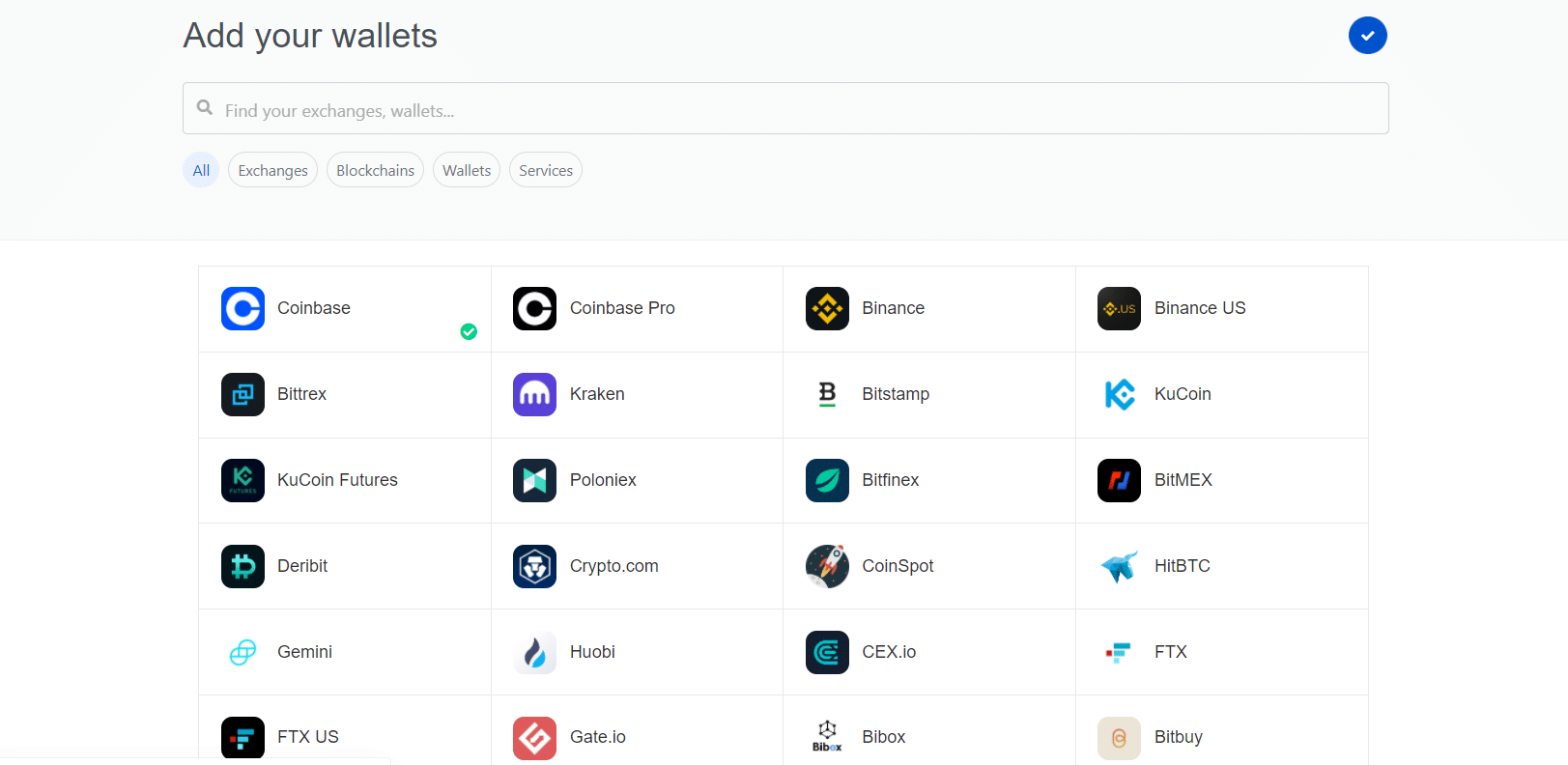

Intensive Pockets And Change Give a boost to

Koinly integrates with round 750 cryptocurrency exchanges and wallets and mechanically syncs your transactions in your Koinly dashboard. This selection is helping you consolidate all crypto making an investment job in Koinly to start making ready your tax bureaucracy. It’s additionally superb for monitoring your cryptocurrency holdings right through the 12 months.

Some well-liked exchanges Koinly helps come with:

Koinly helps 100+ wallets and a variety of crypto financial savings accounts as smartly, together with well-liked firms like:

- Ledger

- Nexo

- Trezor

- Consider Pockets

- Yoroi

Connecting an account to Koinly calls for read-only get admission to to import your transaction information. The place you employ an API to percentage cryptocurrency information, developing distinctive read-only keys for each and every monitoring app is very important so they are able to’t be used to execute trades or transfers.

Koinly can discover the kind of source of revenue you earned other transactions. For instance, it may differentiate margin and futures buying and selling from exchanges like BitMEX and Binance.

It could possibly additionally establish if transactions come with source of revenue from staking or quite a lot of lending platforms. With its error reconciliation characteristic, Koinly uncovers lacking transaction information and duplicates it to be sure you’re submitting correctly.

The secret is that Koinly makes uploading your entire crypto job simple. Whether or not you basically use API connections or add CSV experiences is as much as you.

One-Click on Crypto Tax Reviews

Koinly’s Tax Reviews tab supplies an summary of your cryptocurrency job for a given 12 months. Proper off the bat, you get a snapshot of:

- Capital good points and income or losses

- Different good points from assets like futures and derivatives

- Source of revenue from assets like airdrops, forks, and crypto financial savings accounts

- Value and bills now not incorporated in capital good points

- Presents, donations, and misplaced cash

You’ll be able to additionally regulate your account settings sooner than producing tax experiences. This lets you regulate your own home nation, foreign money, and source of revenue assets corresponding to airdrops or mining.

Koinly helps a number of other value foundation strategies, together with some which can be much less commonplace:

- Shared Pool

- Spec ID

- Reasonable Value Foundation (ACB)

- First In First Out (FIFO)

- Remaining In First Out (LIFO)

- Perfect In First Out (HIFO)

As soon as you select your value foundation way and import transactions, Koinly can create a number of tax experiences mechanically:

- Shape 8949 and Agenda D:

Shape 8949 is for the Gross sales and Tendencies of Capital Belongings and is significant for submitting crypto taxes. Then you definately come with web capital good points and losses on Shape Agenda D. - Source of revenue File: This comprises source of revenue from assets like airdrops, forks, mining, and staking.

- Capital Beneficial properties File: A breakdown of your short- and long-term capital good points, together with precisely whilst you bought particular property, the unique value, and your proceeds.

- Finish-Of-12 months Holdings: This file is useful if you happen to’re audited because it outlines your cryptocurrency holdings at 12 months’s finish.

- Presents, Donations, And Misplaced Belongings: Koinly outlines the crypto you’ve given as items or donations. Crypto that has been misplaced or stolen may be incorporated, as this might depend as a capital loss.

Koinly permits you to export those experiences to well-liked tax device like TurboTax and TaxAct so you’ll be able to end submitting.

Tax-Loss Harvesting

Tax-loss harvesting is a well-liked tactic you’ll be able to use to offset capital good points so as to scale back your tax burden. In a nutshell, it comes to promoting securities to appreciate a loss that you’ll be able to observe in opposition to a few of your capital good points. After promoting off property, you buy equivalent property to handle your portfolio composition.

You’ll be able to leverage tax-loss harvesting on crypto in addition to shares. As a result of Koinly tracks your whole capital good points and losses in line with crypto asset, it’s simple to inform which cash you’ll be able to promote and what kind of you’ll understand in losses.

A slight problem of Koinly is that it doesn’t have an impartial tax-loss harvesting calculator. Different crypto tax device like ZenLedger has a standalone software that breaks out tax-loss harvesting in a spreadsheet, so you’ll be able to undoubtedly pass to ZenLedger to make use of theirs.

By contrast, Koinly highlights your unrealized good points and losses on its dashboard. That is necessarily the similar data, however having a devoted calculator that spells the whole lot out in line with asset is most popular.

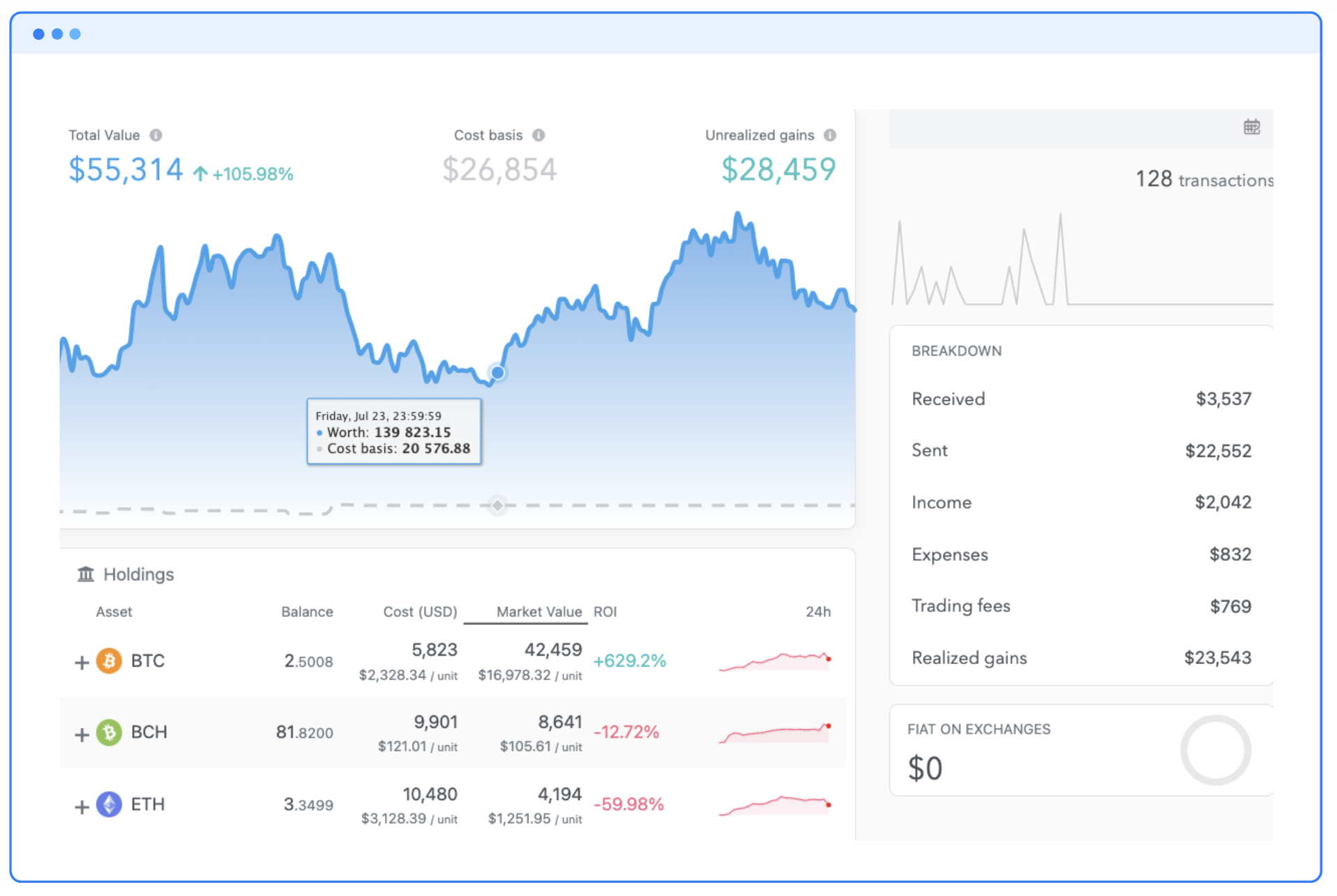

Portfolio Monitoring

Koinly’s dashboard supplies a swish evaluation of your portfolio price, holdings, efficiency via preserving, and the choice of transactions. It presentations you ways a lot fiat you’re preserving on exchanges and presentations a pie chart breakdown of your entire property.

The dashboard is somewhat minimum, and not more tough than a portfolio tracker like Kubera. On the other hand, the dashboard continues to be helpful for serving to you notice transaction discrepancies or and ignored transactions.

World Give a boost to

An benefit of Koinly over maximum crypto tax device is its global fortify. Lately, Koinly is to be had in over 20 nations for taxes, together with:

- Australia

- Belgium

- Canada

- Denmark

- Finland

- France

- Germany

- Japan

- Norway

- South Korea

- Spain

- Sweden

- United States

Whilst you trade your own home nation, Koinly creates localized variations of your tax experiences. This implies it’s doing extra than simply converting foreign money figures round. For instance, if you choose Sweden as your own home nation, Koinly will supply further tax file choices like a K4.

Are There Any Charges?

Koinly has a unfastened plan, however you should pay for usable tax experiences and bureaucracy. On the other hand, Koinly has a number of plans which can be each versatile and reasonably priced:

|

World Tax Reviews |

|||||

|

TurboTax And TaxAct Exports |

|||||

|

Mobile |

The unfastened plan is best for checking out Koinly’s person interface to look for those who just like the device. For tax reporting functions, imagine transaction limits when opting for a plan.

Every other great Koinly characteristic is the choice so as to add twin nationality to any plan for $49. The characteristic provides tax file downloads for one further nation, which will also be useful for virtual nomads and expats.

You’ll be able to additionally upload knowledgeable assessment to any plan. This selection has a Koinly tax knowledgeable double-checking your account to focus on possible problems. This assessment may well be value it in case you have a big and sophisticated portfolio. However be ready to spend a hefty quantity for the knowledgeable assessment, which is recently indexed as a $999 add-on in your self-service tax experiences.

How Does Koinly Evaluate?

Koinly is likely one of the marketplace’s maximum reasonably priced crypto tax device, and the unfastened plan method you’ll be able to check it out sooner than paying. Even though you don’t use it for taxes, the unfastened model’s monitoring options are just right sufficient you could wish to enroll regardless.

On the other hand, there are many different tax choices in the market. Right here’s how Koinly stacks up in opposition to ZenLedger and CoinLedger, two different well-liked contenders.

|

Header |

|

|

|

|---|---|---|---|

|

Change & Pockets Give a boost to |

|||

|

Tax Device Integrations |

|||

|

Supported, however there is no impartial software |

|||

|

Mobile |

Koinly is a wonderful selection for those who don’t business too incessantly and wish affordable plans. It’s additionally a really perfect choice in case you have numerous DeFi and NFT transactions since you’ll be able to upload them manually. On the other hand, Koinly has higher global fortify than ZenLedger and CoinLedger.

ZenLeger has higher local DeFi fortify because it integrates with 100+ protocols, however it is a small benefit except you’re closely desirous about DeFi or use less-popular platforms.

Koinly and ZenLedger are two of our favourite crypto tax device choices. Each have unfastened plans, making it simple to check out out each and every platform sooner than you improve and pay in your tax experiences.

How Do I Open An Account?

You’ll be able to join Koinly along with your Coinbase or Google account. You’ll be able to additionally enroll along with your identify, electronic mail, and password. You don’t want to input your bank card to check out Koinly’s unfastened options, which is some other plus.

When you enroll with a unfastened account, you’ll be able to attach limitless wallets, exchanges, and DeFi services and products to begin checking out the device. Koinly doesn’t require KYC (Know Your Buyer, which identifies and verifies purchasers) necessities both.

You’ll be able to arrange a brand spanking new account in a couple of mins. Relying at the complexity of your crypto holdings, uploading transaction information from exchanges can take round 15 to twenty mins.

Is It Secure And Safe?

Like different crypto tax device, Koinly makes use of read-only API connections to import transactions. This implies Koinly can’t make adjustments to any of your crypto exchanges or wallets. Koinly doesn’t require any non-public keys or write get admission to to do its process.

Moreover, Koinly encrypts information in transit and doesn’t retailer your fee main points. General, those practices make Koinly a protected and safe crypto tax device. You’ll be able to learn extra about Koinly’s dedication to safety on its site.

How Do I Touch Koinly?

There are a number of tactics to touch Koinly buyer fortify. The most straightforward way is to make use of its are living chat characteristic to message a buyer fortify agent.

Every pricing tier provides direct electronic mail fortify from professionals. You’ll be able to additionally ship normal questions to hi@koinly.io.

Koinly recently has a 4.8-star score on Trustpilot with just about 1,500 opinions, and a number of other customers cite dependable customer support as a perk. Unfavorable feedback basically stem from transaction import mistakes, however buyer fortify isn’t a criticism customers generally have.

Is It Value It?

Lively cryptocurrency buyers without a doubt want some form of crypto tax device. Sure, you’ll be able to record taxes by yourself, however the period of time and possible errors you save the usage of device is normally value the once a year value.

As for Koinly, it’s one of the crucial best possible crypto tax device in the marketplace. It has DeFi fortify and allows you to upload NFT transactions manually, making it somewhat tough. Whilst you tack on global fortify, Koinly is a competent selection for each U.S. and global crypto buyers.

You will have to nonetheless do your individual bookkeeping right through the 12 months and double-check Koinly’s tax experiences. But when you wish to have a serving to hand with submitting your taxes, Koinly may well be for you.

Why You Will have to Consider Us

Our crew is composed of cryptocurrency buyers and professionals. We’ve got hands-on enjoy with many crypto tax apps and different tax device. Our objective is that can assist you in finding the precise product on the proper value in your crypto tax submitting wishes. We center of attention at the prices and advantages of each product and paintings laborious to provide you with truthful, independent comments so you’ll be able to make an educated determination.

Koinly Options

|

Cryptocurrency tax device |

|

|

Supported Wallets & Exchanges |

|

|

|

|

Tax Device Integrations |

|

|

Common Buyer Provider Electronic mail Deal with |

|

|

Internet/Desktop Account Get entry to |

|

[ad_2]