[ad_1]

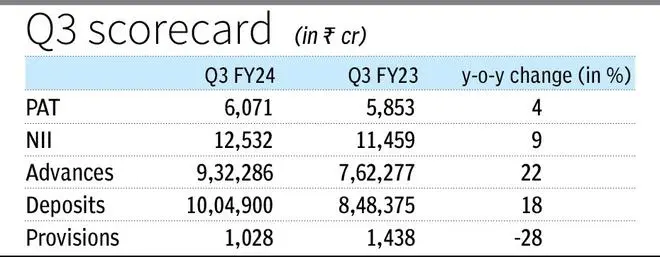

Axis Financial institution posted a internet benefit of ₹6,071 crore for Q3 FY24, up 4 in line with cent each year-on-year and quarter. A 32 in line with cent year- on-year build up in running bills to ₹8,946 crore weighed at the bottomline.

“So long as the running atmosphere at the credit score aspect stays benign, and we’re in a position to ship in and round our aspirational RoE of 18 in line with cent, we’d proceed to spend money on the franchise, which is taking part in out throughout the opex. It’s an funding for the longer term and we consider that’s the proper of funding to be making as of late to create a sustainable franchise,” CFO Puneet Sharma stated within the income name.

Internet passion source of revenue (NII) grew 9 in line with cent y-o-y and a couple of in line with cent q-o-q to ₹12,532 crore. Internet passion margin (NIM) for the quarter was once 4.01 in line with cent, less than 4.11 in line with cent 1 / 4 in the past and four.26 in line with cent a yr in the past.

Sharma stated given the liquidity situation, deposit expansion will likely be a constraint on advances expansion within the brief to medium time period and mortgage expansion will converge with deposit expansion in the longer term.

Advances grew 22 in line with cent y-o-y and four in line with cent q-o-q to ₹9.3-lakh crore. Home internet loans had been up 25 in line with cent y-o-y, led through 27 in line with cent expansion in retail loans to ₹5.5-lakh crore, comprising 59 in line with cent of internet advances. Of the retail loans, 75 in line with cent had been secured and 30 in line with cent had been house loans.

Private loans grew 28 in line with cent y-o-y, bank cards through 92 in line with cent, small trade banking loans through 40 in line with cent, rural loans through 34 in line with cent, SME loans through 26 in line with cent, corproate loans through 15 in line with cent, and mid-corporate loans through 30 in line with cent.

The financial institution stated 80 in line with cent of the non-public mortgage shoppers are current shoppers or the ones sourced via virtual partnerships and expansion has persisted from the former quarter, being led through some “transformation tasks” undertaken through the lender with out compromising at the high quality of the portfolio.

Deposits grew 18 in line with cent y-o-y and 5 in line with cent q-o-q to ₹10-lakh crore , led through 16 in line with cent expansion in financial savings deposits, 5 in line with cent in present account deposits and 24 in line with cent in time period deposits. CASA ratio stood at 42 in line with cent less than 45 in line with cent a yr in the past.

Value of price range

Sharma stated liabilities are anticipated to proceed to reprice via FY24 and in all probability via Q1 FY25. As such, marginal value of investment has stabilised for the gadget, and the tempo in build up in value of price range is moderating and will have to stabilise in FY25, he added.

Provision and contingencies for the quarter had been ₹1,028 crore, which incorporated provisions of ₹182 crore towards the financial institution’s AIF investments. Cumulative provisions stood at ₹11,981 crore as of December 2023.

Gross slippages all over the quarter had been ₹3,715 crore, which Sharma stated had been in large part because of seasonal delinquencies within the agriculture portfolio. Slippages had been in large part off-set through recoveries and upgrades had been at ₹2,598 crore and the financial institution wrote off loans value ₹1,981 crore.

Gross NPA ratio of the financial institution progressed to at least one.58 in line with cent from 1.73 in line with cent 1 / 4 in the past and a couple of.38 in line with cent a yr in the past. Internet NPA ratio at 0.36 in line with cent was once flat q-o-q however higher than 0.47 in line with cent a yr in the past.

[ad_2]