[ad_1]

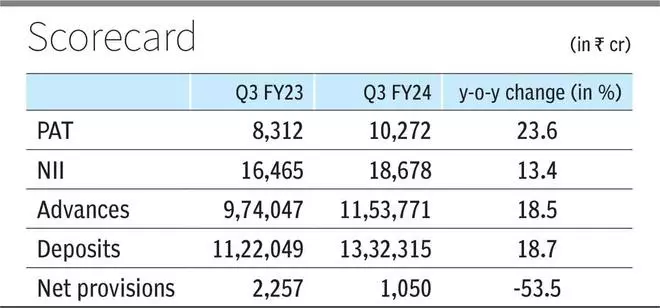

ICICI Financial institution’s web benefit rose 23.6 in step with cent y-o-y to ₹10,272 crore in Q3 FY24. Sequentially, the benefit after tax was once flat from ₹10,261 crore 1 / 4 in the past, in large part because of upper provisions.

Provisions for the quarter have been ₹1,050 crore which integrated a one-time have an effect on of ₹627 crore equipped in opposition to the financial institution’s AIF investments.

Internet hobby source of revenue (NII) greater 13 in step with cent y-o-y and a pair of in step with cent q-o-q to ₹18,678 crore. Internet hobby margin (NIM) for the quarter was once 4.43 in step with cent, not up to each 4.53 in step with cent 1 / 4 in the past and four.65 in step with cent a 12 months in the past.

Within the profits name, Govt Director Sandeep Batra mentioned that whilst margins are below force because of upper price of price range, margins for FY24 must be at a identical degree as 4.48 in step with cent for FY23.

Advances

Overall advances greater 18.5 in step with cent y-o-y and three.9 in step with cent q-o-q to ₹11.5 lakh crore, of which home loans have been at ₹11.1 lakh crore, up 18.8 in step with cent on 12 months and three.8 in step with cent on quarter, with Batra pronouncing there are enlargement alternatives throughout retail and company segments.

Retail loans grew 21 in step with cent y-o-y and 5 in step with cent q-o-q to ₹6.4 lakh crore, comprising 54.3 in step with cent of general loans as of December 2023. Industry banking loans have been up 32 in step with cent on 12 months, SME industry through 28 in step with cent, rural portfolio 18 in step with cent and home company loans through 13 in step with cent.

EXPOSURE TO NBFC

ICICI Financial institution’s publicity to NBFCs has fallen to round ₹74,000 crore from ₹79,900 crore 1 / 4 in the past, essentially because of compensation through positive PSU firms, Batra mentioned, including that the financial institution has reviewed the portfolio and is “ok with the standard of the guide”.

Deposits grew 18.7 in step with cent y-o-y and a pair of.9 in step with cent q-o-q to ₹13.3 lakh crore. Time period deposits have been up 31 in step with cent on 12 months and 5 in step with cent on quarter to ₹8 lakh crore, with Batra pronouncing that the financial institution continues to peer robust traction in retail time period deposits.

CASA deposits grew 3.8 in step with cent y-o-y and have been flat on quarter at ₹5.3 lakh crore, in large part because of a sequential decline in financial savings deposits. Reasonable CASA ratio stood at 39.4 in step with cent, not up to 40.8 in step with cent within the earlier quarter and 44.6 in step with cent within the earlier 12 months.

The financial institution mentioned that deposit and mortgage enlargement has been somewhat balanced, and it doesn’t see any demanding situations in investment this degree of enlargement or constraints in garnering deposits.

Slippages for the quarter have been ₹5,714 crore which Batra attributed essentially to seasonal NPAs within the KCC (Kisan Credit score Card) portfolio and normalisation of NPAs within the retail portfolio. Those have been in large part offset through recoveries and upgrades of ₹5,351 crore and mortgage write-offs price ₹1,389 crore.

Gross NPA ratio declined to two.30 in step with cent from 2.48 in step with cent 1 / 4 in the past and three.07 in step with cent a 12 months in the past. Internet NPA ratio was once at 0.44 in step with cent, relatively worse than 0.43 in step with cent within the earlier quarter however higher than 0.55 in step with cent within the earlier 12 months.

[ad_2]