[ad_1]

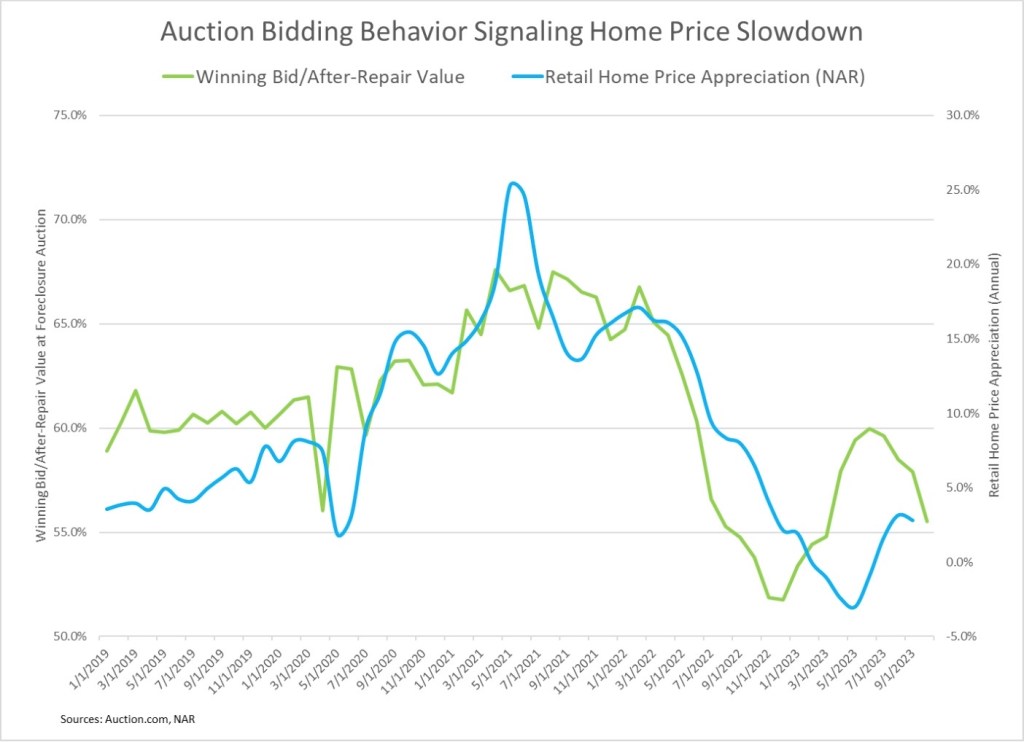

Area people builders bidding on foreclosure in the second one part of 2023 are signaling a slowdown in U.S. house value appreciation within the first part of 2024, with a emerging possibility that appreciation will dip again into unfavourable territory. The chance of a double dip in house value appreciation varies considerably by means of marketplace, even amongst some markets in the similar area and state.

Bidding habits for foreclosures houses on Public sale.com within the first quarter of 2023 reliably predicted a rebound in retail house value appreciation within the 3rd quarter of 2023. That prediction is documented in my ultimate marketplace outlook for HousingWire, revealed in Might.

As expected by means of distressed belongings bidding habits, median retail house costs larger on a year-over-year foundation for 3 consecutive months, from July to September, following 5 consecutive months of year-over-year declines, in keeping with knowledge from the Nationwide Affiliation of Realtors (NAR).

Now the similar Public sale.com bidding habits is indicating a slowdown, and imaginable double-dip, in retail house value appreciation over the following six months — specifically in some native markets.

What bidding habits is signaling a slowdown?

One key bidding habits metric is the fee bidders are prepared to pay for distressed houses relative to the estimated after-repair cost of the ones houses. The inverse of this metric is the bargain demanded by means of the bidders — the share beneath estimated after-repair cost. This metric is what appropriately expected the house value rebound in Q3 2023 and what’s now expecting a slowdown — and imaginable double dip — in house value appreciation in early 2024.

The successful bid of houses bought at foreclosures auctions within the 3rd quarter of 2023 was once 58.6% of the estimated after-repair cost of those self same houses — or 41.4% beneath the estimated after-repair cost — on moderate. That 58.6p.cwas once down from 59.2% in the second one quarter, the primary quarterly lower after two consecutive quarterly will increase. The 58.6% was once additionally beneath the 2019 moderate of 60.3%, which serves as a excellent benchmark of the distressed belongings pricing in a somewhat standard actual property marketplace with low single-digit house value appreciation.

Per month knowledge extra obviously displays the downward pattern in value demanded by means of bidders at foreclosures auctions. The ratio of successful bid to after fix cost reduced in each and every month right through the 3rd quarter, and it persevered to lower within the first month of the fourth quarter, shedding to 55.5% in October — just about 5 issues beneath the 2019 moderate.

Which native markets are in peril?

Native markets the place the successful bid-to-value ratio within the 3rd quarter of 2023 was once furthest beneath 2019 ranges (evaluating each and every marketplace to itself) are the ones maximum in peril for a double dip in house value appreciation in early 2024.

Amongst 148 metro spaces with enough knowledge, 73 (49%) had a successful bid-to- cost ratio in Q3 2023 that was once not up to it was once in Q3 2019. There have been 15 markets (10%) with a lower of a minimum of 10 issues within the successful bid-to- cost ratio at foreclosures public sale, together with New Haven, Connecticut, Charlotte, North Carolina, and Los Angeles, California. There have been 31 markets (21%) with decreases of a minimum of 5 issues, together with Austin, Texas, Memphis, Tennessee, and New Orleans, Louisiana.

At the different facet of the fee possibility coin had been markets the place foreclosures patrons had been prepared to pay a better value relative to after-repair cost in Q3 2023 than they had been in Q3 2019. Those markets are much more likely to peer proceeding house value appreciation in early 2024. There have been 20 (14%) markets with an building up of a minimum of 10 issues within the moderate successful bid-to-value ratio between Q3 2019 and Q3 2023, together with Pittsburgh, Pennsylvania, Hartford, Connecticut, Wichita, Kansas, Flint, Michigan, and Winston-Salem, North Carolina.

<script kind="textual content/javascript"> var divElement = file.getElementById('viz1705678246732'); var vizElement = divElement.getElementsByTagName('object')[0]; if ( divElement.offsetWidth > 800 ) { vizElement.taste.width="1366px";vizElement.taste.peak="795px";} else if ( divElement.offsetWidth > 500 ) { vizElement.taste.width="1366px";vizElement.taste.peak="795px";} else { vizElement.taste.width="100%";vizElement.taste.peak="977px";} var scriptElement = file.createElement('script'); scriptElement.src="https://public.tableau.com/javascripts/api/viz_v1.js"; vizElement.parentNode.insertBefore(scriptElement, vizElement); </script>Comparable

[ad_2]