[ad_1]

Coming into 2024, car sector well being displays combined

messaging, fractured markets, and demanding implosive forces

affecting main megatrends. For all 4 CASE methods (Hooked up,

Computerized, Shared, and Electrified), 2023 confirmed cracks within the

growth charges and long-term outlooks of those building center of attention

spaces. However the place does battery uncooked fabrics acquisition through OEMs and

providers have compatibility into the image?

As marketplace point signs corresponding to rates of interest, mortgage to

worth, mortgage delinquency, and go back to marketplace all display headwinds –

OEM messaging has modified from assured growth towards considered one of

worth proposition. Providers with over the top debt coming to time period

will want to rebalance their near-term technique towards making

bills on greater rates of interest as a substitute of long-term

investments.

Underpinning all OEMs and Tier 1 providers are subject matter provide

chains that immediately resolve which efforts will be successful through

converting the commercial feasibility, marketplace achieve, and technical

prowess in their investments.

EV Battery Uncooked Fabrics

As an example, Uncommon Earth Components underpin the magnets in lots of

electric motors, give a boost to the fabric traits of legacy

fabrics, and allow ubiquitous era corresponding to contact delicate

presentations. This one class of minerals building feeds a lot of

the complex era programs observed as sumptuous and even merely

aggressive through shoppers.

But additionally beneath scrutiny is a fairly mundane mineral: copper.

The mining of copper is lately underinvested and pivotal inside of

power transition efforts, however we are already seeing tier 1

providers and OEMs taking a look to interchange this subject matter in electrified

automobiles. Battery bus bars and charging cables are shifting towards

aluminum in a cycle lengthy recognized to the infrastructure-based use

instances. In the ones packages, a 4:1 worth ratio will power subject matter

adjustments to infrastructure builds, and vehicle-based packages

might see a an identical tipping level. Teardown services and products are figuring out

enhancements in meeting and price which come from this subject matter

exchange.

The fabrics provide chain lately stands as the second one main

blockade to mainstream battery electrical automobile adoption charges. The

mining sector faces a battle to persuade a widening moral

investor base of its ESG credentials.

Investments and crossing the chasm

Because of some buyers maintaining again dedication to the mining

sector it has now not but garnered the funding required in mineral

exploration and extraction to enhance a mainstream transition to

electrical automobiles. For each voice proclaiming the way forward for

car to be electrical, there stays a chasm in funding

which bolsters the validity of Major Side road hesitancy towards EV

adoption. Whilst business professionals, trade leaders and entrepreneurs

all level towards battery electrical automobiles, mainstream shoppers

have not begun to search out the issue that electrical automobiles remedy of their

day-to-day lives.

The timidity of institutional buyers might come from the

realities of EV adoption charges out there – particularly in North

The united states. Or it should level to the difficulties in getting uncooked

subject matter markets to transport ahead – a job that takes a long time of

approvals and stays extremely delicate to marketplace call for.

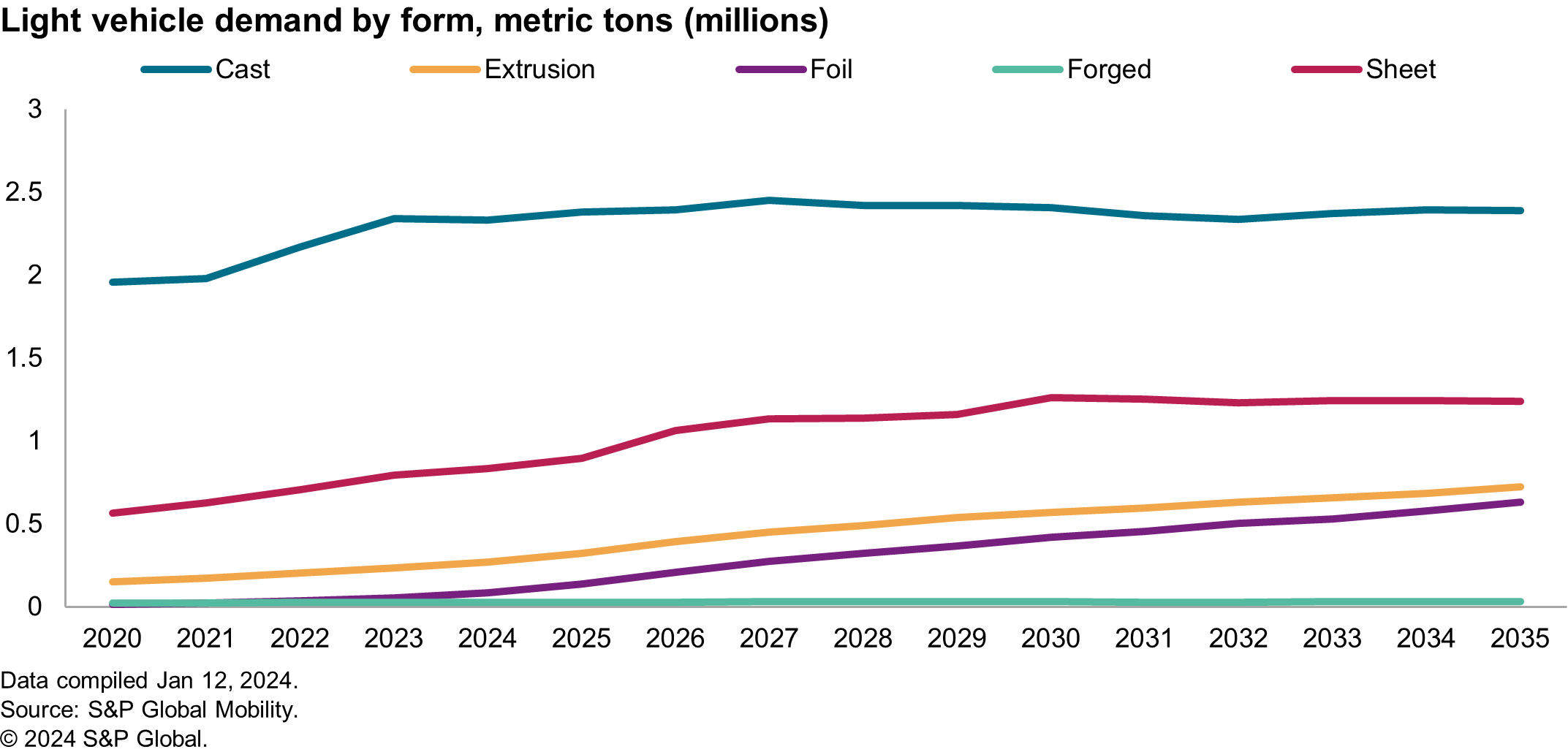

As an example, the chart beneath displays North American call for for

aluminum – a regular element for the battery to survive, however

additionally a provide pinch level. Propulsion call for throughout a couple of

parts shifts from the decrease worth castings of conventional

methods in opposition to extrusions, top of the range castings, or even foil

sheets. These types of paperwork require aluminum with fewer impurities,

which influences scrap prices and might require dilution with

further number one aluminum.

In 2023, the Platt’s Aluminum Symposium famous that top of the range

assets of aluminum recycling corresponding to beverage cans would now not be

in a position to bridge the call for gaps for North The united states, and the newest

business deficit numbers replicate the accuracy of this prediction.

In number one markets there are nonetheless vital hurdles to

conquer in popularizing the re-processing of bauxite residue, additionally

referred to as pink dust, and different mining waste to offer further

marketplace worth with advanced environmental affect. Low benefit

margins, lengthy length payback, excessive making plans menace, and excessive

sensitivity to operational excellence is also why buyers have now not

supported the minerals extraction marketplace up to is also

required. Nevertheless it is also baking in consumer-adoption

headwinds. Analysis performed through S&P World Mobility in in 2023

discovered expressed pastime in refining tailings to extract excessive worth

minerals whilst bettering environmental <span/>stewardship, however voiced the trouble in

discovering buyers.

Nation Possibility Review

In the previous few years, a number of provide chain disruptions to main

subject matter assets have essentially modified the way in which OEMs review

the chance of accepting a brand new subject matter inside of automobiles. And occasionally

the reasons of provide chain snarls are extraordinary. For example,

arrangements for the iciness Olympics in Beijing, mainland China

led to shortages in Magnesium (because of energy vegetation being

pressured to near across the match to agree to harder blank air

regulations which led to a discount in smelting capability). This

illustrated how the reliance on a unmarried town for 80% of the worldwide

provide of a commodity may just lead to shortfalls – inflicting

providers to frantically hunt for recycled fabrics.

Regional sourcing of fabrics corresponding to Nickel, Manganese and

Cobalt have turn out to be extra sensitized inside of OEMs. Some corporations have

signed <span/>ESG

declarations in regards to the beginning in their subject matter sourcing, to

keep away from the brand-damaging results of societal dangers related to

positive areas of manufacturing. Best possible-in-class fabrics is also

changed through “highest in menace aversion.”

In spite of the occasionally bulky decision-making processes at

OEMs, alignment of value and menace aid can transfer briefly. With

the new graphite shortfall of the battery business, provide chain

localization efforts are taking a look additional into the uncooked subject matter

sourcing methods to make sure menace is minimized.

ESG and Sustainability

For most of the people in trade, “sustainability” generally considerations

the longevity of financials, product efficiency, and the aid

of waste inside of methods. Messaging round sustainability has, in

some circles, turn out to be identical to carbon accounting.

Efficiency of fabrics in real-world stipulations will likely be

contrasted with advertising messages and idealistic eventualities. For

engineers being requested to give a boost to recycled subject matter content material in

parts, cut back carbon footprint, or combine biomaterials into

their parts, the duty is normally related to value

neutrality. However with the present macroeconomic stipulations,

car product portfolios, and converting optics of high-level

tasks, sustainability might evolve towards its preliminary

definition of general environmental duty.

OEMs in Europe are lately operating to fulfill recycled subject matter

content material regulatory necessities previous to formal approval. Alternatively,

there are main issues of the incumbent laws from the

point of view of OEMs and subject matter providers.

The EU mandate of recycled content material isn’t a fine-based device,

however relatively a compliance-based metric which can resolve whether or not a

automobile can also be offered within the area. In instances of fine-based methods,

OEMs can tolerate a combined changeover plan wherein they will inch

towards compliance inside of a regulatory framework whilst accepting the

greater value of doing trade within the quick time period. Alternatively, in

this example, any automobile with not up to 25% recycled plastic won’t

be authorized on the market within the EU marketplace.

Element engineers wish to their providers for recycled

content material which can also be briefly built-in into present automobiles –

and this can be a primary friction level within the fabrics business.

Chemical corporations have present recycled content material compounds

to be had for business use, however they’ve now not made it via

validation processes.

It is conceivable the OEMs have now not allotted sufficient finances for

those intensive and dear recertification processes, according to

S&P World Mobility analysis throughout the provide base. One

element redesign researched was once within the finances vary of $50-80

Million, and those actions have slowed because of budgets being

reallocated to battery device building, in line with the

provider. Moreover, S&P World Mobility has realized that

those subject matter providers are extremely reluctant to put money into new

processing methods that permit for integration of post-consumer

waste into the feedstock. Even supposing this can be a cutting-edge

procedure, many of those publicly-traded providers are risking

profitability within the procedure.

Totally loaded or decontented?

Whilst fabrics is usually a geopolitical and regulatory menace, there

are unsung advantages of correct subject matter variety when evaluated

from a bottom-up point of view.

Some teams view subject matter variety as infrastructure: If it

works, an organization will handiest make investments the volume had to stay the

wheels rolling. For others, subject matter variety is the end of the

innovation spear affecting shoppers immediately. Use instances of

automobiles are without equal workforce of demographics, intersectionality,

and practicality.

Automakers make large investments in tactile surfaces, however

decontenting a automobile with the elimination of things corresponding to carpet, or

the use of material or uncovered non-woven surfaces, might produce a automobile

that gives the look of rugged luxurious. For any other user,

seeing a automobile with an eco-conscious pledge of 0 landfill

waste, biopolymer use, or metrics reflecting the volume of recycled

content material, might align with their core values and emotional sentiment

of why they acquire the automobile.

Fabrics priorities within the provide chain

So, are fabrics thought to be as infrastructure or innovation?

Each definitions are proper. Uncooked fabrics enhance the methods

teams officially categorized as infrastructure, perhaps striking

minerals because the grandparents to those methods.

OEMs have tried to safe the growth portfolios in

lithium, foreseeing an undersupply of this mineral when put next

with their product plans. Alternatively, this isn’t the one at-risk

subject matter for OEMs, as geopolitical, compliance, and marketplace

sentiment are dictating other phrases. OEMs want to carry uncooked

subject matter provide chains again towards meeting vegetation, give a boost to the

subject matter’s inside visibility, and stay inflationary pricing in

test.

The car business isn’t any stranger to advanced methods,

logistical sensitivities, and even vertical integration. Lots of the

said targets for OEMs are lately competing for finances, ability,

and advertising consideration.

2024 might display the priorities of OEMs in a aggressive targets

setting, wherein single-metric grading scales are not

suitable strategies of gauging their marketplace efficiency. Some

stretch targets of company efficiency might center of attention on core worth

propositions, user wishes, and profitability. Sturdy trade

instances that embody grit, potency positive aspects, and waste aid are

anticipated to be profitable subjects.

FOR MORE ON MATERIALS AND LIGHTWEIGHTING

FEATURES AND TECHNOLOGY BENCHMARKING

THE LOOMING EV SUPPLIER SHAKEOUT

AUTOMOTIVE PLANNING AND FORECASTING

This newsletter was once revealed through S&P World Mobility and now not through S&P World Scores, which is a one after the other controlled department of S&P World.

[ad_2]