[ad_1]

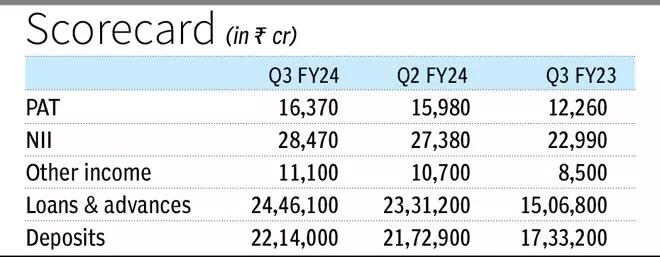

HDFC Financial institution posted a 33.5 according to cent year-on-year upward thrust in internet benefit for Q3 FY24 at ₹16,370 crore, at the again of sturdy enlargement in each internet passion source of revenue and different source of revenue. Sequentially, the benefit after tax used to be 2.5 according to cent upper.

Internet passion source of revenue (NII) rose 23.9 according to cent y-o-y and four.0 according to cent q-oq to ₹28,470 crore. Different source of revenue for the quarter used to be up 31 according to cent y-o-y and four according to cent q-o-q to ₹11,140 crore, led by way of robust enlargement in charges and commissions, and buying and selling and mark to marketplace positive factors.

The year-on-year figures for the financial institution come with the affect of the merger of erstwhile mum or dad HDFC efficient July 1, 2023, and are thus indirectly related.

Gross advances had been at ₹24.69-lakh crore, registering an build up of 62.4 according to cent on 12 months. Home retail loans grew 111.1 according to cent, industrial and rural banking loans by way of 31.4 according to cent, and company and different wholesale loans (except non-individual loans of eHDFC Ltd of roughly ₹98,900 crore) grew by way of 11.2 according to cent. In another country advances constituted 1.7 according to cent of overall advances.

Within the put up profits name, CFO Srinivasan Vaidyanathan mentioned a lot of the economic and rural banking e-book, which has observed robust enlargement, is eligible underneath precedence sector lender (PSL), and is thus additionally serving to the lender meet its PSL objectives.

- Additionally learn: HDFC Financial institution Q3 PAT observed up over 30 according to cent, margins underneath force

Within the retail section, the financial institution sees just right alternatives within the loan e-book, each from present and new shoppers. Within the non-mortgage e-book, the lender has a robust pipeline of pre-approved and eligible shoppers, and the financial institution now has a dominant percentage within the prime credit score high quality (above 760 credit score rating) shoppers. Vaidyanathan mentioned the financial institution will proceed to concentrate on extra margin accretive segments and expects the proportion of retail and loan loans to proceed to upward thrust from the present degree.

At the wholesale aspect, whilst the financial institution is seeing call for it has became reasonably wary because of pricing competitiveness out there, particularly from PSU banks. Even so, HDFC Financial institution will proceed to deal with trade relationships with all its consumer corporates to facilitate different investment avenues similar to provide chain finance and tapping the capital markets, Vaidyanathan mentioned.

Core internet passion margin for the quarter used to be at 3.4 according to cent on overall property, and three.6 according to cent on passion incomes property, flat when put next with the former quarter. Within the 12 months in the past length, NIM used to be 4.1 according to cent on overall property and four.3 according to cent on passion profits property.

Vaidyanathan mentioned margins will proceed to stay underneath force because of the continuing deposit repricing which has a tendency to occur with a lag, and the propensity of shoppers to put money into upper yielding investments similar to time period deposits against the tip of a charge cycle to be able to lock-in the upper returns. Alternatively, the financial institution’s margin sensitivity has traditionally been low at 5-10 bps and margins must proceed inside this vary going ahead supported by way of the expanding percentage of retail loans within the asset combine.

- Additionally learn: HDFC Lifestyles posts ₹1,157 crore PAT for 9M FY24, premiums up 11%

Deposits of the financial institution rose 27.7 according to cent yoy to Rs 22.14 lakh crore, led by way of 42.1 according to cent enlargement in time deposits and 9.5 according to cent in CASA deposits. CASA ratio of the financial institution stood at 37.7 according to cent on the finish of December.

Gross NPA ratio of the financial institution fell to one.26 according to cent as of December 31, 2023 from 1.34 according to cent 1 / 4 in the past, however used to be reasonably upper than 1.23 according to cent a 12 months in the past. Internet NPA ratio stood at 0.31 according to cent, with Vaidyanathan announcing that the credit score high quality of the portfolio is ‘solid to bettering’ and the credit score atmosphere stays benign.

[ad_2]