[ad_1]

Retail marketed stock information for January 2024: S&P

International Mobility delivers the next US new car marketplace

insights:

Total business inventories

To be had new car trader stock listings for the USA

marketplace persevered to surge as of the tip of December. A gradual

upward build up in marketed inventories has persevered since

August, and now stands at 2.45 million cars.

After all, gross sales also are on the upward thrust. However plotting

year-over-year stock enlargement, as opposed to year-over-year gross sales

enlargement, displays that relative to quantity, inventories are up 30%.

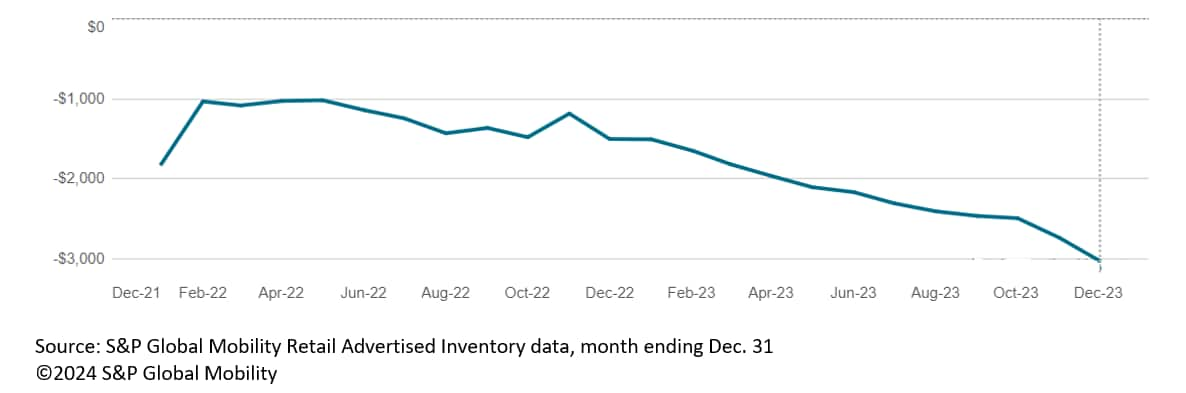

As inventories develop, indexed costs and reasonable MSRPs are

losing – signaling automakers are development lower-trim fashions. However

additionally the choice of cars with marketed costs indexed under

MSRP are rising often. On the finish of November, the typical

marketed bargain used to be $2,742; on the finish of December, it had

grown to $3,030 (double the extent of December 2022). And that’s

the marketed value prior to negotiations or hidden

factory-to-dealer incentives – reminiscent of stair-step quantity bonuses –

are factored in.

Reasonable bargain from MSRP

Which car segments are sizzling, and don’t seem to be?

Most likely probably the most flooded primary phase, relative to gross sales, is

that of full-size pickups (extra on that under). In the meantime, the

compact SUV phase has probably the most stock – however it is consistent with

general business enlargement – and with registrations buzzing alongside at

about 200,000 per 30 days, the C-SUV phase fits the best ratio

of 2 months’ provide.

So far as segments the place one may argue there is not sufficient

stock, the compact automotive, compact pickup, compact luxurious SUV, and

full-size SUV segments are tight on gadgets marketed in trader

inventories.

Too many full-size pickups?

The entire-size truck is a key benefit generator for the Detroit 3.

But if too many are on showroom flooring, deep discounting occurs

in a hurry. On the finish of December, there have been 307,000 full-size

pickups to be had, up from 229,000 the similar time final 12 months.

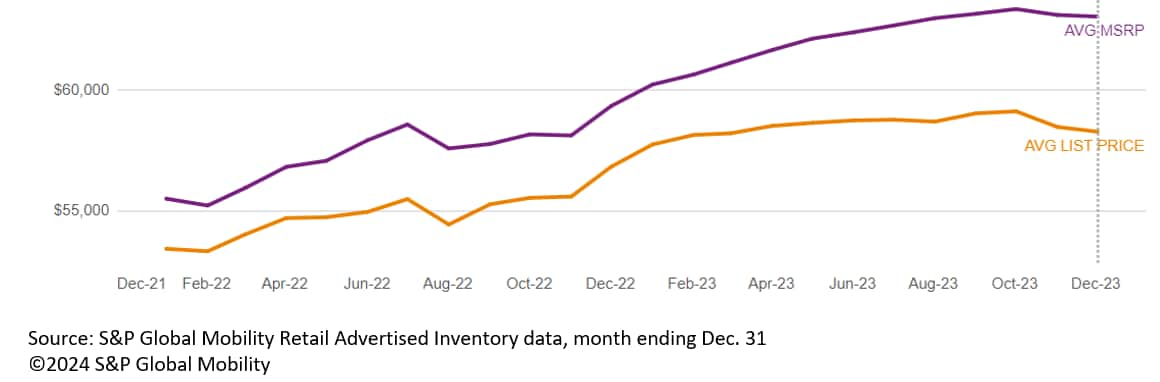

In the meantime, the typical MSRP has defied the business pattern,

expanding to $63,000, from $59,300 in December 2022 and $55,400 at

the beginning of 2022. However S&P International Mobility research reveals

marketed reductions often higher throughout 2023, with

$4,740 the present reasonable bargain.

Reasonable MSRP and listing value, full-size pickup truck

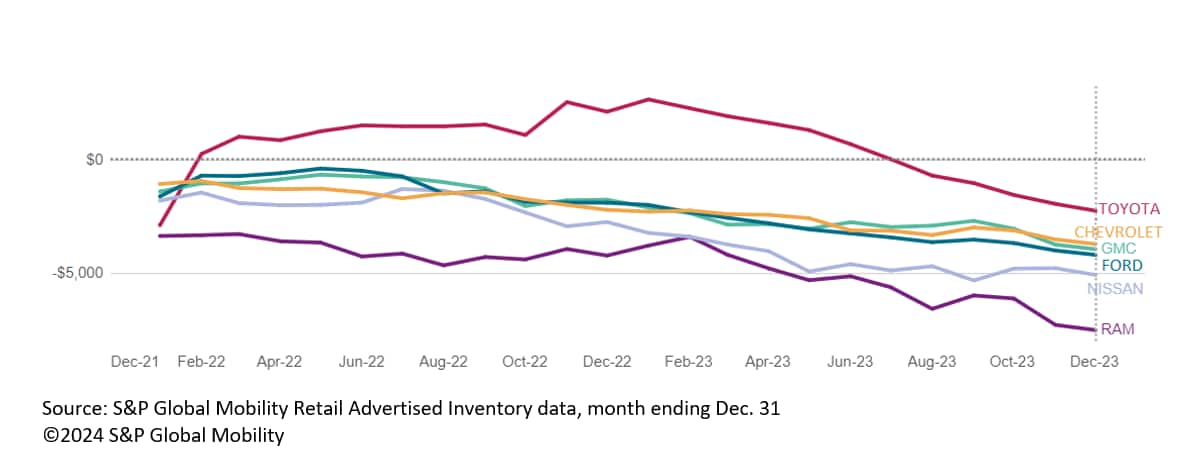

Who’s slashing their giant pickup costs? Ram sellers, with 75% of

dealer-advertised gadgets under MSRP. The typical bargain could also be

sizably greater than that of the tight pack of Chevrolet, GMC, and

Ford. However even Toyota is discounting. Sizzling take? There’s a large number of

stock available in the market…offers may well be coming.

Reasonable bargain from MSRP, full-size pickup truck

The mid-sized pickup battleground looming?

Toyota historically outsells its mid-size truck competition

handily. <span/>However with

the redesigned 2024 Tacoma in manufacturing unit ramp-up mode, and likewise in

top call for, inventories plummeted throughout the fourth quarter. At

the tip of December, there have been fewer Tacomas in trader marketed

stock than Jeep Gladiator or Nissan Frontier. Whilst Toyota

sellers scramble to search out gadgets, would possibly Jeep and Nissan sellers take hold of

at the alternative to conquest customers who <span/>can not wait round for the brand new Tacoma?

Midsize pickup truck inventories

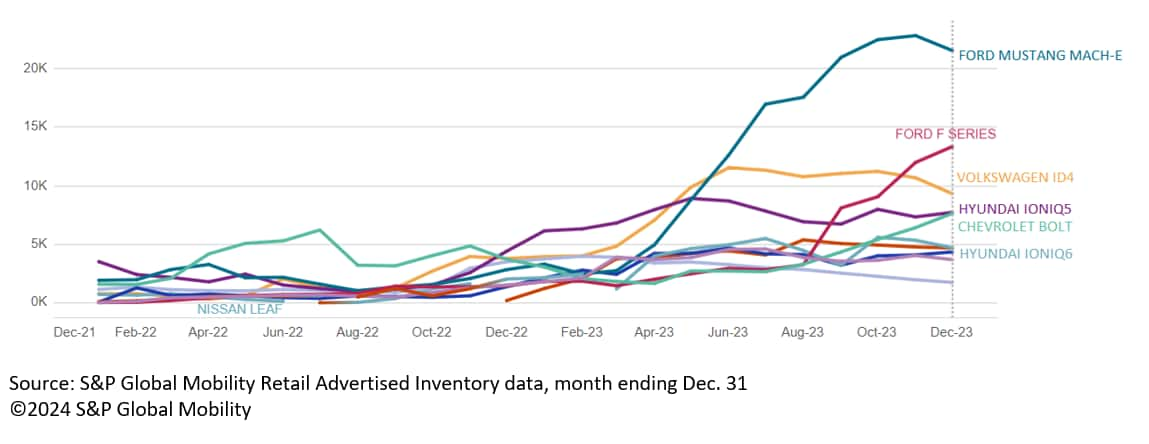

EV inventories stabilizing

After rising via maximum of 2023, the tip of December marked

the primary drop in stock all 12 months for Ford’s Mustang Mach-E. However

with Ford promoting fewer than 5,000 Mach-Es in a month, there nonetheless

is sizable backlog. A more difficult story to inform is F-150 Lightning,

which in spite of chopping manufacturing has observed stock develop from 3,200

gadgets in August to 13,000 on the finish of December. No less than Ford is

now promoting lower-trim variations; the Lightning reasonable MSRP is

kind of $74,000, while in December 2022 it carried a mean

MSRP of $80,000 plus an $8,000 top class.

Different producers are adjusting their EV inventories to

recognize marketplace realities. Maximum EV inventories – VW ID4 and

Hyundai Ioniq, to call two leaders – have leveled off and are

burbling alongside between 3,000 and 5,000 gadgets for the final quarter

or two, maintaining tempo with gross sales. The one actual climber is the

Chevrolet Bolt EV/EUV, however Chevy sellers are also including extra

reductions on its compact EV. The important thing query nonetheless to be spoke back:

Are we seeing suppressed EV gross sales because of a loss of stock, or a

loss of call for?

Electrical car inventories

FOR MORE ON INVENTORY DATA AND MARKET

INTELLIGENCE

LIGHT VEHICLE SALES FORECASTING

DOWNLOAD OUR TOP 10 INDUSTRY TRENDS

NEWSLETTER

This newsletter used to be printed through S&P International Mobility and now not through S&P International Scores, which is a one by one controlled department of S&P International.

[ad_2]