[ad_1]

Privateness tokens face demanding situations assembly crypto trade record standards amid regulatory force, resulting in an rock bottom in liquidity, Kaiko’s information presentations.

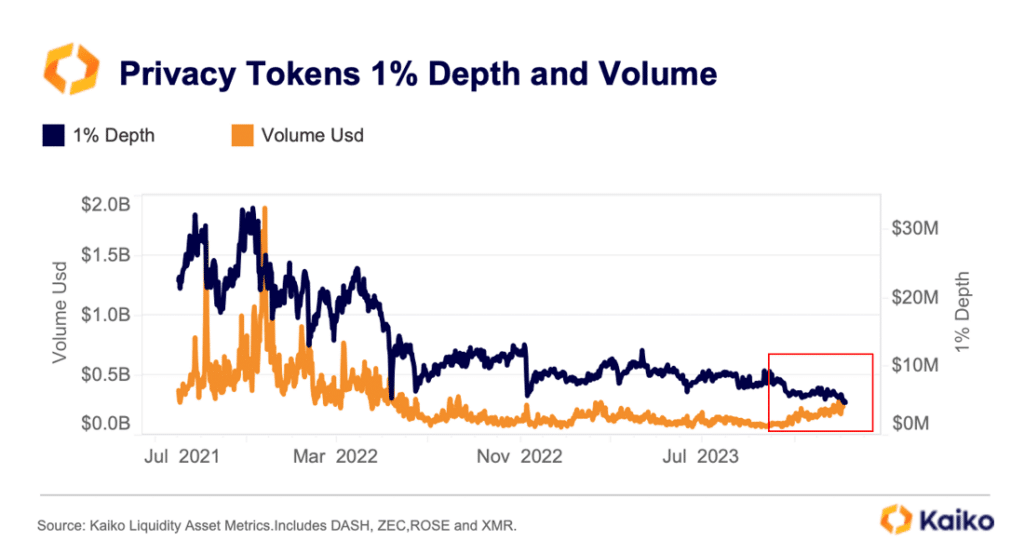

In a contemporary analysis file, analysts at Kaiko have published that marketplace liquidity for privateness tokens — together with Monero (XMR), Zcash (ZEC), and DASH — has reached all-time lows as crypto exchanges stay disposing of those property from their listings. In keeping with information, privacy-focused tokens witnessed closing week simply $5 million in liquidity following the removing of a number of buying and selling pairs with those property from OKX.

“Whilst industry volumes steadily larger since October, they’re nonetheless smartly underneath their 2021 ranges.”

Kaiko

Analysts at Kaiko identified that privateness tokens have more and more been delisted by way of main platforms because of regulatory force over the last few years.

This has helped to exacerbate the decline in liquidity all through the crypto endure marketplace. Each XMR and ZEC are these days at prime chance of being delisted on Binance because of low liquidity, Kaiko notes, including that ZEC has been the “maximum delisted privateness token over the last two years.” This has resulted in a better fragmentation of the marketplace, with XMR dominating on massive exchanges, whilst ZEC and DASH are most commonly traded on smaller unregulated venues, the analysts say.

In early January, crypto.information reported that Binance expanded the Tracking Tag protection with an extra 10 tokens, together with Monero (XMR) and Zcash (ZEC). The transfer got here amid larger makes an attempt by way of Binance to strengthen chance control after admitting to a litany of crimes in past due 2023, together with cash laundering and failing to conform to know-your-customer (KYC) laws stipulated by way of the U.S. Securities and Trade Fee (SEC).

In spite of the in style delistings, no longer everybody within the crypto trade stocks the similar point of view. In September 2023, Ethereum co-founder Vitalik Buterin identified that centralized entities like custodial exchanges are “inclined” and can also be corrupted, emphasizing that customers must be capable to transact at once at the Ethereum blockchain with out depending on centralized suppliers.

[ad_2]