[ad_1]

Developments are a laugh.

It’s nice that Stanley is having it’s second with their colourful Quencher trip mugs (they usually’re $45 a pop!). An iconic emblem with excellent merchandise getting an enormous spice up on account of advertising and marketing and social media? Completely glorious.

Developments are excellent for expanding your enjoyment. It’s additionally in reality excellent at isolating you out of your cash. A brand new development way the outdated developments are out of fashion… and you wish to have to shop for extra stuff. I’m now not towards that.

This isn’t a publish slamming purchasing extra stuff. Purchase no matter you wish to have. 😁

But if developments get started venturing into different spaces, equivalent to making an investment, that’s when issues get bad.

Right here’s what it seems like and easy methods to keep away from it:

Desk of Contents

How Do Developments Get started?

Developments are all about consideration.

The media ecosystem is a straightforward one. Everybody needs consideration. Those that have a large number of it wish to stay getting it.

If you wish to generate profits, you wish to have to promote commercials and to promote commercials, you wish to have consideration.

“Trendsetters” change into trendsetters as a result of they establish developments prior to they change into mainstream. With social media platforms like Instagram, with publicly to be had perspectives and likes and feedback, aspiring influencers can see what’s getting consideration and check out to latch on. The ones new other folks are seeking to change into trendsetters, in order that they percentage and prefer and touch upon standard posts and reels.

In the end, this broadens to the “mainstream” tv presentations just like the Lately Display and Excellent Morning The usa. They’re additionally seeking to stay their current viewership so they’re doing the similar factor because the aspiring influencers… they percentage what are noticed as developments on social media.

In addition they have airtime to fill, so why now not latch onto a brand new development?

This implies there’s a continuing barrage of “new” developments. No person will get consideration sharing outdated stuff. It needs to be what’s new and recent.

What Does This Glance Like In Making an investment?

Stanley mugs are something, what does this seem like in making an investment?

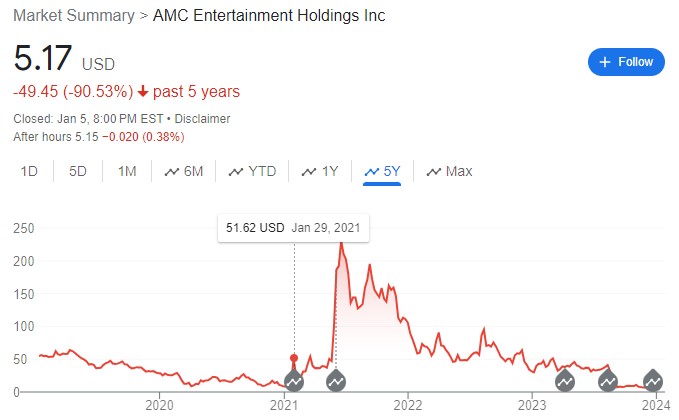

Do you keep in mind Gamestop and AMC all through the pandemic? There was once a large number of consideration paid to them on account of the whole lot going down in a Reddit subreddit known as WallStreetBets. Beginner investors have been the usage of leverage to gamble at the shares as they skyrocketed. There have been congressional hearings involving the CEOs of Robinhood, dealer Keith “Roaring Kitty” Gill, and others about Gamestop.

Completely bonkers.

They have been in a position to pump up each shares, get the eye of mainstream media, or even spawned a couple of documentaries.

It introduced a large number of consideration again to the speculation of day buying and selling shares and choices (we remaining loved that development again all through the dot com growth).

Heck, it would have even tempted you!

How Do Those Developments Get started?

There’s by no means a unmarried method {that a} development begins however there are patterns. And probably the most clearly one to spot is the person who has to do with cash.

Purchasing index price range is a attempted and true technique this is each dull and now not that winning for agents. You’ll be able to purchase stocks of Leading edge’s 500 Index Fund Admiral Stocks (VFIAX) with out paying a fee and the expense ratio is handiest 0.04%. The minimal is a modest $3,000.

For each $10,000 of funding, Leading edge will accumulate $4.

Constancy would handiest fee you handiest $1.50. (0.015% expense ratio)

That’s not anything. (however superb for you, the investor!)

The commission-free agents don’t fee for trades however they generate profits promoting order float. If you purchase and hang, that’s now not a lot process (no order float!) they usually don’t make a lot cash.

Agents make far more cash whilst you dabble in choices. They may not fee you for the choices industry however they are going to fee a per-contract charge. Maximum agents fee round 65 cents consistent with contract (which covers 100 stocks). And whilst you open a freelance, you must sooner or later shut it too. That’s the place the cash is.

If you happen to industry on margin, they earn pastime too. Some other money cow.

In abstract, they don’t make a lot when you simply purchase and hang they usually make even much less on index price range.

The cynical view is they make extra whilst you chase developments and are a extra energetic investor. That is why agents are satisfied when there’s a large number of volatility available in the market. Volatility equals motion and movements equivalent commissions.

Why Is This Unhealthy For You?

There are necessarily two techniques to take into accounts your benefit in making an investment. (this can be a very elementary summarization)

- If in case you have an edge, generally one in response to wisdom, you wish to have to benefit from it. (informational benefit)

- If you happen to don’t have an informational edge, then your handiest benefit is time. (time benefit)

Everybody has a time benefit, now not everybody has an informational benefit.

A large number of other people assume they have got an informational benefit, however they don’t. Actively controlled mutual price range if truth be told surrender their time benefit as a result of they have got to turn quarterly and annual returns. Maximum actively controlled fund returns lag index fund returns.

There are 3 dangerous issues whilst you chase developments:

- You assume you’ve got an informational edge as a result of you understand about it “early” (apart from you’re now not early)

- You’re seeing everybody else’s good fortune tales and assume it’s simple (a little bit of affirmation bias)

- You assume the craze will finish quickly, so you’re feeling drive to leap on prior to it does. (shortage impact)

Developments come and move.

The issue with making an investment with developments, particularly when you accomplish that with leverage, is that after they move, it may be devastating. In 2020, Alex Kearns was once a 20-year outdated dealer who was once buying and selling choices the usage of Robinhood and took his personal existence when he concept he had misplaced $730,000. Whilst you industry choices and on margin, it’s very conceivable to lose an important quantity if issues activate you.

And nobody each tells you the tale about how they misplaced their blouse on an funding, so that you handiest pay attention tales about their improbable beneficial properties (survivorship bias).

Bear in mind, AMC was once the darling of WallStreetBets when it was once over $230 a percentage… it’s now only some cents over $5. Ouch.

There are some other folks nonetheless protecting out hope that it’ll “rebound.” (it received’t)

What if I chase only a little bit?

Las Vegas makes billions of greenbacks each and every 12 months as a result of other people love to gamble. There are presentations and eating places, in fact, however persons are there to bet.

And playing a bit bit may also be a laugh and thrilling. I am getting it. Get that dopamine hit.

If you happen to in reality really feel the itch, carve out a little a laugh cash portfolio to speculate on your hunches. Simply acknowledge it for what it’s – a laugh cash to play with. It’s now not an funding. It’s now not prudent. It’s for a laugh.

(truthfully, I’d most probably quite gamble on sports activities than on shares!)

You’re now not quitting your activity to gamble professionally, don’t liquidate your 401(ok) to put money into the following scorching sector.

If it in reality will get you excited, chase a bit bit. Scratch the itch. However stay your nest egg in index price range.

It’s Now not That Unhealthy, Is It?

If you happen to steer clear of leverage and keep at the lengthy aspect of investments (the place you imagine that the funding will building up in price), you received’t have large losses that exceed your funding. Essentially the most you’ll lose with any funding is what you installed. The in reality dangerous stuff handiest (generally) occurs if you find yourself brief (hoping the funding is going down) or whilst you use leverage.

That mentioned, shedding cash remains to be dangerous.

And spending your time to lose it makes it even worse. And the ones are years that the energy of compounding may just’ve been operating for your behalf.

That is all to mention that you simply must stick to dull index price range. Possibly a attempted and true three-fund portfolio. Then reside the remainder of your existence in peace understanding your investments are lined. Move fishing 🐟 or play golfing. 🏌️

You received’t pay attention that recommendation on mainstream media as it’s dull.

However that’s the most productive method to making an investment and has labored for many years.

And whilst you received’t have the ability to move to cocktail events and inform tales about your wild investments, does any individual in reality like listening to the ones tales? (no) 😆

[ad_2]