[ad_1]

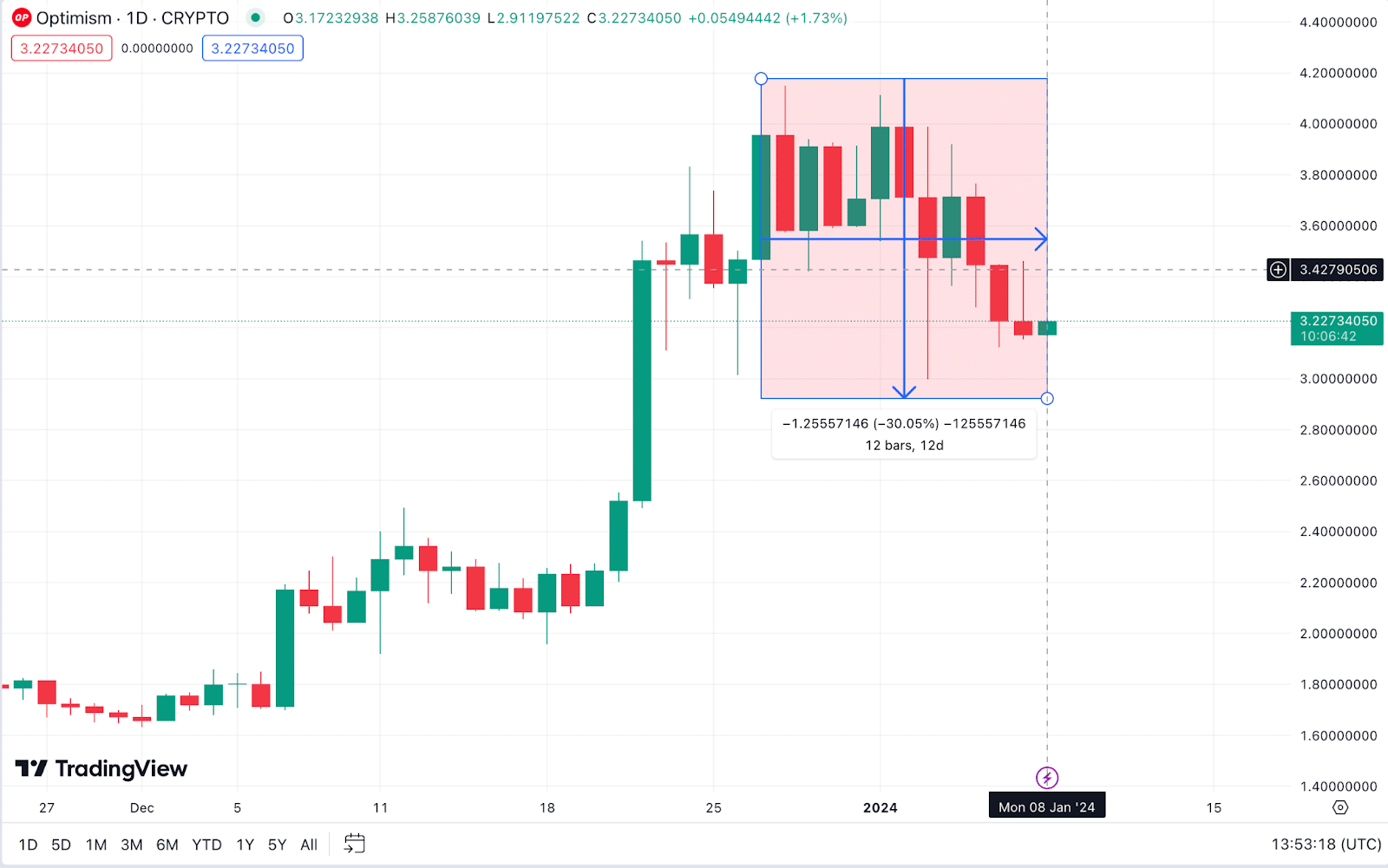

Optimism value plunged to a 14-day low of $2.90 on Jan. 8, marking a 30% decline from the $4.18 all-time top recorded on Dec. 27.

The speedy value decline got here at the again of $2.45 million LONG Optimism (OP) futures contracts liquidations inside of a frenetic 24-hours. Spinoff marketplace information developments supply key insights into how dramatic shifts in Optimism futures buying and selling may have an effect on OP spot value motion within the days forward.

Why is Optimism’s value down?

Optimism value reached an all-time top of $4.18 on Dec. 27 as Ethereum Layer-2 scaling protocols recorded groundbreaking network-usage milestones. However on the flip of the 12 months, the altcoin marketplace rally slowed, and OP holders started to e-book earnings.

Remarkably, OP value tumbled under the $3 mark within the early hours of Jan. 8, triggering hundreds of thousands of losses within the derivatives markets. The newest OP value downswing brings it to a 30% decline from the $4.18 all-time top recorded on Dec. 27.

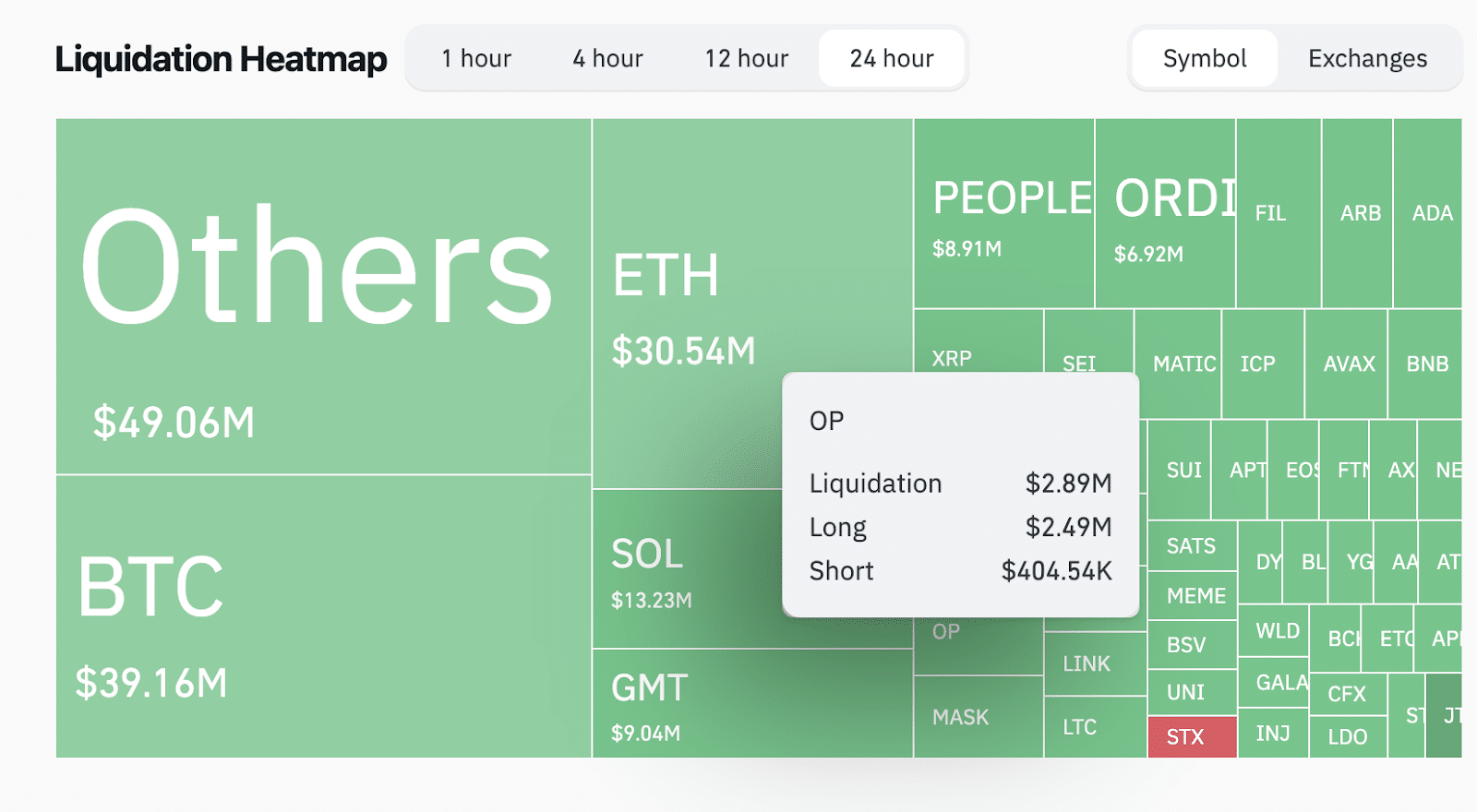

Optimism’s fresh value downtrend seems to have stuck bullish futures buyers unaware. Indicatively, the cost downswing on Monday used to be heralded by way of well-liked liquidations within the by-product markets. The Coinglass’ Liquidation Heatmap chart presentations that OP’s damaging value motion on Jan. 8 burnt up over $2.8 million of futures contracts.

A liquidation match happens when adversarial value actions drive speculative buyers to near because of inadequate margin quilt. The Liquidation information heatmap from Coinglass presentations a real-time snapshot of the dominant path of losses.

The fairway bars above display LONG buyers suffered a disproportionately top occurrence of day by day losses in comparison to bears. Significantly, by way of noon Japanese Time on Jan. 8, the Optimism bulls bore 86% of the warmth, with $2.49 million OP LONG positions erased.

Optimism open pastime has gotten smaller in 12 Days

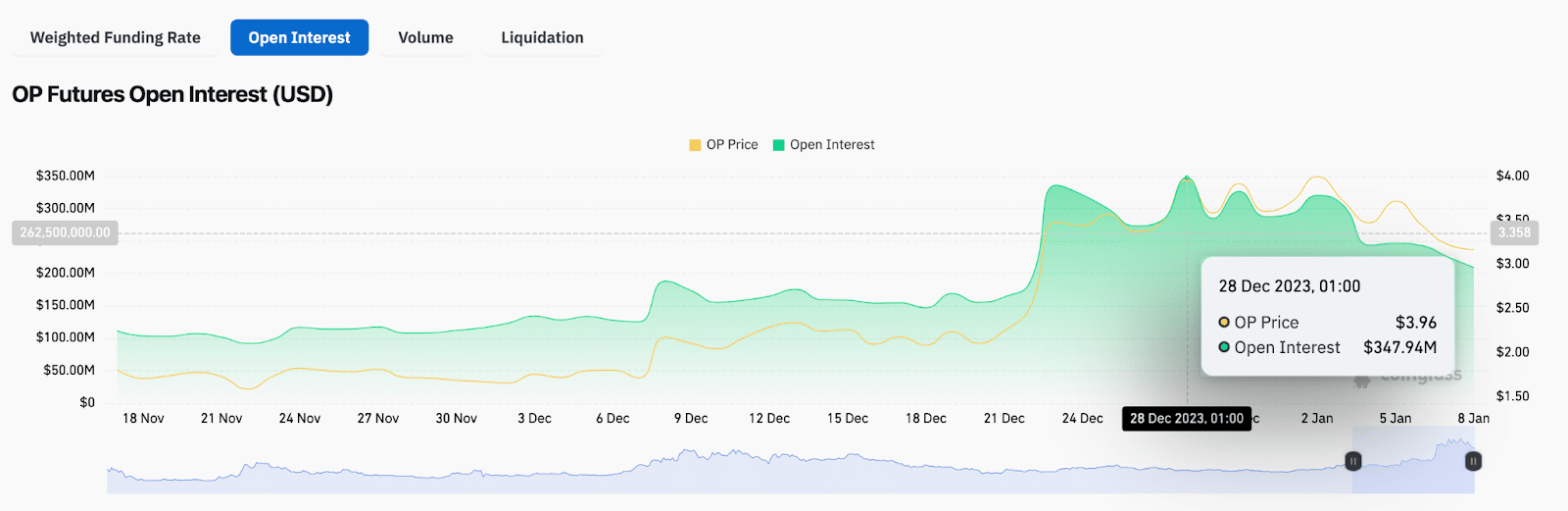

The emerging spate of Optimism open pastime relative to identify costs within the ultimate 12 days is any other important marketplace indicator highlighting the rising bearish power on OP. Since Dec. 27, Optimism open pastime (OI) has plummeted 10% sooner than value, signaling a wave of voluntary exits as marketplace momentum flips bearish.

As illustrated under, Optimism open pastime has declined 40% from $347.9 million to $209 million between Dec. 27 and Jan. 8. Relatively, OP spot costs have most effective declined 30% from $4.11 to an area backside of $2.90.

Open pastime quantifies the overall capital invested in energetic derivatives contracts for a particular crypto asset. Strategic traders imagine it a bearish sign when open pastime for an asset shrinks. It signifies that extra capital flows out of the markets, than traders bringing recent budget.

The present marketplace dynamics illustrate a 30% drop in OP value since rejecting from the marketplace most sensible on Dec. 27. However on a extra regarding notice, capital inventory within the Optimism futures contracts have gotten smaller 10% sooner.

The $2.4 million spike in OP LONG liquidations on Jan. 8 signifies compelled promoting, the place buyers are forced to go out their lengthy positions because of adversarial value actions. Moreover, open pastime declining sooner than Optimism value signifies that no longer most effective are buyers voluntarily last positions, but additionally an sped up liquidation impact.

This bearish alignment suggests additional value drawback, doubtlessly pushed by way of margin calls and stop-loss triggers.

OP Value Forecast: Can the $3 Enhance Grasp?

In line with the present marketplace information developments, OP value seems to be set for a retest of the $2.50 territory. However to completely capitalize at the rising damaging momentum, the bears will have to first smash down the mental make stronger degree at $3.

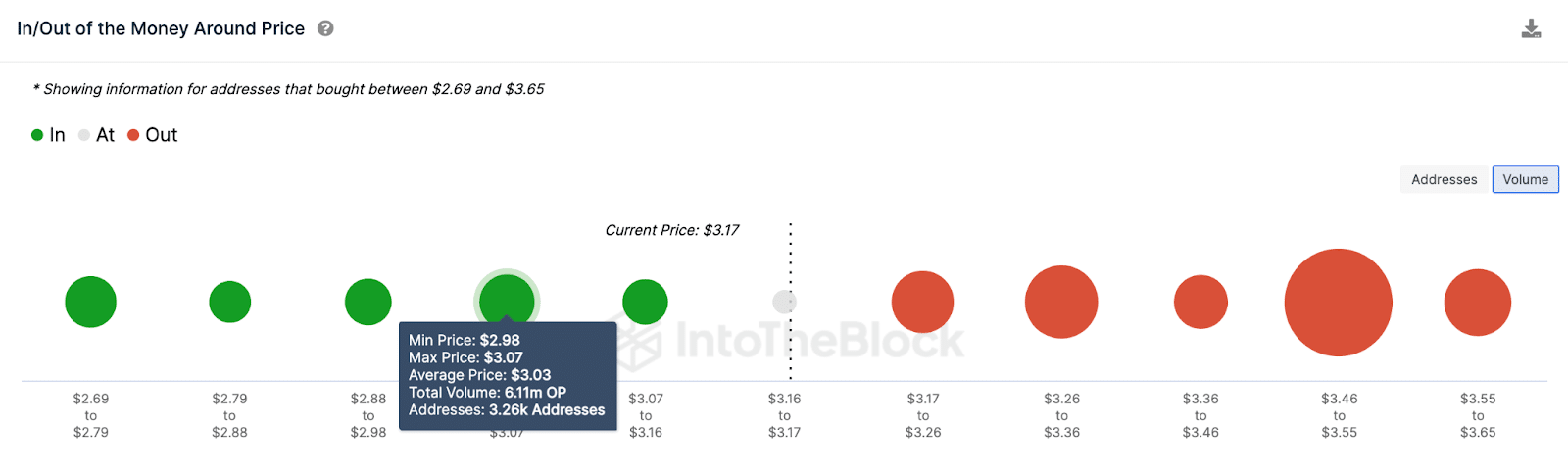

IntoTheBlock’s In/Out of the Cash Round value (IOMAP) information makes use of present OP holders’ ancient access costs to stipulate key make stronger and resistance zones. It presentations that the bears may face vital pushback within the $3 space.

As noticed under, 3,260 addresses had bought 6.1 million OP tokens at a mean value of $3.03. If this crucial cluster of traders makes short-covering purchases to shield their positions, OP value may rebound.

Then again, a detour under $3 may prompt any other wave of margin calls and stop-loss triggers. As predicted, this bearish situation will most probably open the doorways to a $2.50 OP value retest.

At the upside, the bulls may regain regulate of the marketplace of Optimism value reclaims $4. However if that’s the case, the 7,800 addresses bought 44.3 million OP on the moderate value of $3.50. If traders make a choice to e-book early earnings, OP value will retrace once more.

Then again, a favorable spot Bitcoin ETF may unfold bullish headwinds to the altcoin markets. If this situation, OP bulls may acquire enough momentum to breach that $3.50 resistance sell-wall.

[ad_2]