[ad_1]

In accordance with his historic prediction of 2015 and 2019, PlanB stays assured that the Bitcoin worth may just rally to $500K all the way through the mega bull run of 2025.

After a robust begin to the yr 2024 ultimate week, Bitcoin has been dealing with some promoting force however has controlled to carry above $43,500 ranges. On the other hand, this hasn’t stopped Bitcoin analysts from making bullish predictions for the crypto. PlanB, the writer of the stock-to-flow style not too long ago made a daring prediction for Bitcoin after the Bitcoin halving. At the side of the spot Bitcoin ETF approval, the Bitcoin halving may well be every other main catalyst to propel the BTC worth to new highs.

PlanB, a outstanding determine within the cryptocurrency house, not too long ago shared reflections at the trajectory of Bitcoin (BTC) and public sentiment over time. Recalling the yr 2015 when the acquisition of the primary BTC was once made at $400, PlanB highlighted that all the way through that point, many brushed aside Bitcoin as a demise asset.

Rapid ahead to 2019, when BTC reached $4,000, PlanB authored the Inventory-to-Go with the flow (S2F) article, boldly predicting a long run price of $55,000 for Bitcoin. In spite of the skepticism confronted at the moment, PlanB’s forecast proved correct as BTC soared to new heights.

Within the present panorama with BTC priced at $40,000, PlanB emphasizes the importance of the Inventory-to-Go with the flow style, projecting a staggering $532,000 valuation after the 2024 halving match. Common crypto analyst Michael van de Poppe said that the objective doesn’t glance unattainable bearing in mind institutional cash flowing into BTC.

The place’s Bitcoin Worth Heading Subsequent?

We’re simply two days clear of the approval of the spot Bitcoin and Bitcoin bulls are keeping up a robust watch. As in step with a document from Bloomberg, the USA Securities and Trade Fee (SEC) will habits a vote at the 19b-4 bureaucracy inside the following few days. The candidates for the Trade-Traded Fund (ETF) are more likely to post Shape S-1 via 8 am on Monday, January 8, 2024.

Previous analyses via Bloomberg indicated that the chance of the ETF rejection reduced to five%, bearing in mind contemporary conferences between SEC officers and representatives from companies searching for approval. The document famous, “If the SEC grants each units of required approvals, the ETFs may just start buying and selling as early as the following trade day.”

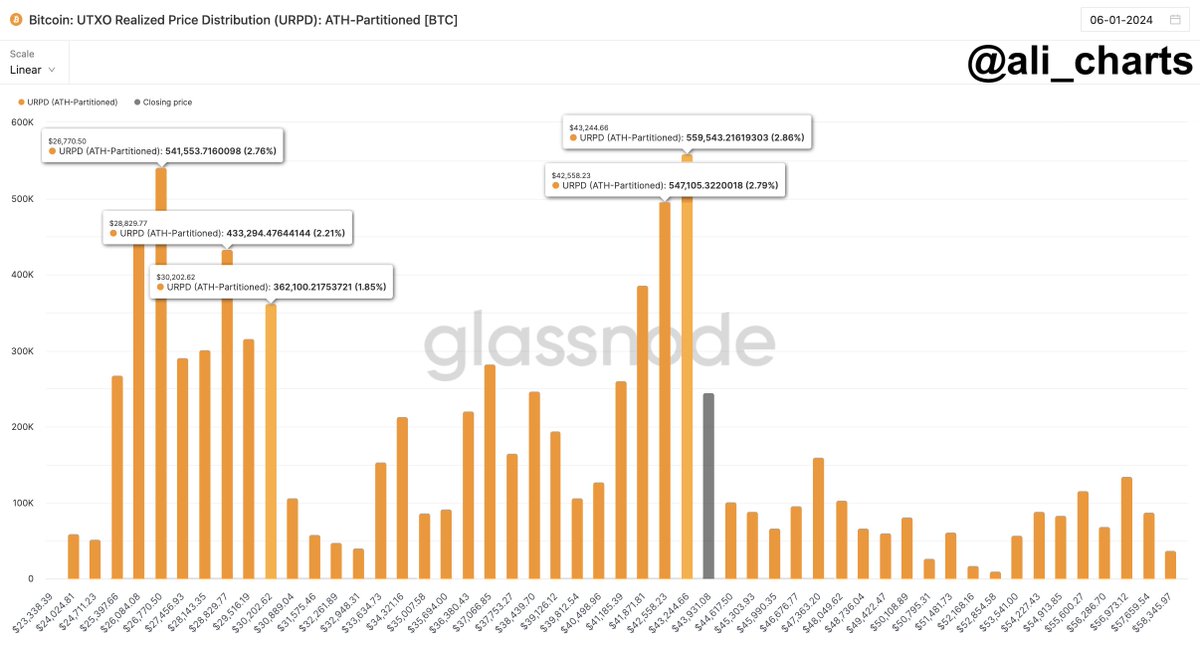

Cryptocurrency analyst Ali Martinez has seen a considerable fortify wall within the Bitcoin (BTC) marketplace, with roughly 1.11 million BTC bought in the cost vary of $42,560 to $43,245. Significantly, the patrons have no longer offered their BTC, setting up a strong basis for the virtual asset.

Martinez means that if Bitcoin manages to care for its place above this fortify degree, the upward motion stays intact with restricted resistance. On the other hand, a failure to carry the variety between $42,560 and $43,245 may just doubtlessly result in a downward development, with the following vital house of pastime mendacity between $26,770 and $30,220.

-

Photograph: Ali charts

- Amidst the escalating ETF pleasure, Milkybull Crypto, a well-regarded analyst within the crypto house, anticipates important affects on the cost of Bitcoin (BTC). In line with their projections, the fervor surrounding ETFs may just propel BTC to $80,000 in 2024 and a staggering $200,000 via 2025. Moreover, Milkybull Crypto posits that those tendencies may also carry sure results for Ethereum (ETH) and more than a few different altcoins available in the market.

[ad_2]