[ad_1]

Bullish outlooks prevailed on crypto social media as proponents inspired tapping worth dips whilst Bitcoin fell over 10% in one day.

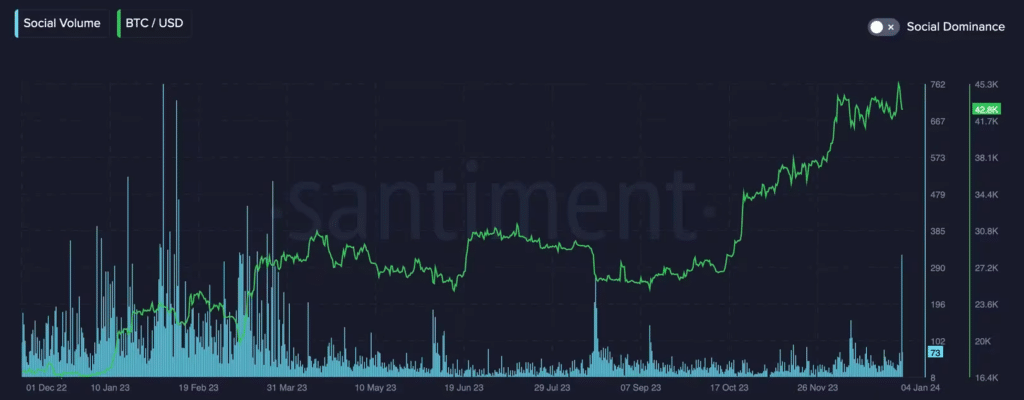

Consistent with blockchain knowledge supplier Santiment, the selection of “purchase the dip” calls on platforms like Telegram, Reddit, Twitter, and 4chan skyrocketed past a 323 stage now not observed since March 2022.

Purchase the dip sentiment surged following a pointy drop in the cost of Bitcoin (BTC), crypto’s most sensible token through marketplace cap. BTC’s brief nosedive under $41,000 reportedly flushed out many leverage positions, with over $700 million in lengthy liquidations in 24 hours.

The vast marketplace decline used to be supposedly brought about through a Matrixport file, which surmised that the U.S. Securities and Trade Fee (SEC) would possibly reject all spot Bitcoin ETF bids in January. Then again, it didn’t take lengthy sooner than crypto investors tagged the inside track as worry, uncertainty, and doubt (FUD) and deployed capital towards predicted worth increments.

As crypto.information reported, Deribit noticed vital pastime in $50,000 BTC name potions set to expire through Jan. 26, just about two weeks after business mavens foresee approval for a minimum of one spot BTC ETF through Gary Gensler’s SEC.

A couple of conferences between issuers and the securities regulator have cushioned the bullish sentiment, and on Jan. 3, the SEC held emergency conferences with Nasdaq and the NYSE to talk about BTC ETFs, which might translate to listings on primary exchanges through the second one quarter of this 12 months.

In the meantime, Bitcoin has recovered from its retrace and exchanged palms above $44,000 on Jan. 4 as issuers like Constancy, Grayscale, and VanEck submitted Shape 8-A submitting. This type alerts securities registration with the SEC, which is procedural sooner than bringing an ETF to marketplace.

[ad_2]