[ad_1]

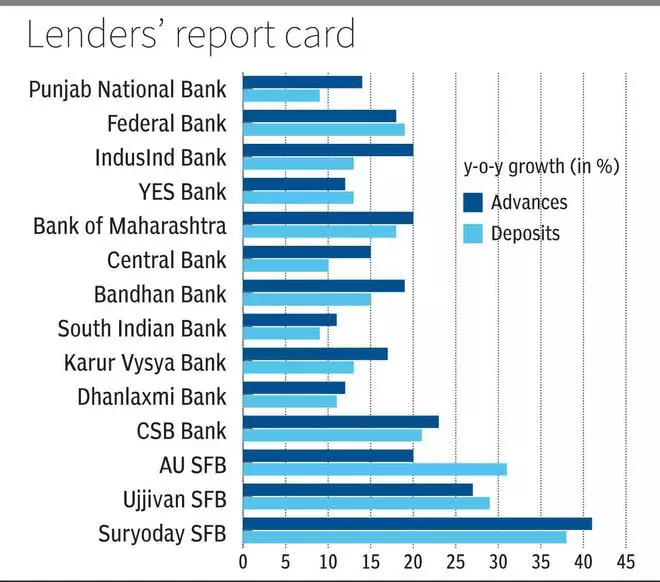

MUMBAI Banks, each public sector and personal, persisted to publish tough double-digit mortgage expansion of 11-23 consistent with cent y-o-y in Q3 FY24, as consistent with provisional figures declared via the lenders for the quarter.

Credit score expansion for banks akin to YES Financial institution, South Indian Financial institution and Dhanlaxmi Financial institution was once on the decrease finish of 11-12 consistent with cent while for lenders akin to IndusInd Financial institution, Financial institution of Maharashtra and CSB Financial institution was once on the upper finish of 20-23 consistent with cent. Enlargement for small finance banks was once over 20 consistent with cent given their small base with Suryoday SFB posting mortgage expansion of 41 consistent with cent on yr.

NBFCs akin to Bajaj Finance and Mahindra Finance too posted sturdy credit score expansion for the quarter, with their property beneath control emerging via 35 consistent with cent and 25 consistent with cent, respectively, on yr. Poonawalla Fincorp, with a smaller asset base, posted a expansion of 57 consistent with cent y-o-y.

- Additionally learn: Indian banks have closed 25 consistent with cent in their international branches since FY19

Deposit expansion for banks remained secure within the reporting quarter however persisted to lag mortgage expansion barring for Federal Financial institution and YES Financial institution, which noticed fairly upper deposit expansion. Upward thrust in deposits for Punjab Nationwide Financial institution and South Indian Financial institution fell under the double-digit mark at 9 consistent with cent.

Small finance banks noticed sped up upward thrust in deposits posting expansion of 29-38 consistent with cent, most probably at the again of upper rates of interest being presented via those banks on financial savings accounts and stuck deposits to hasten deposit accretion and construct their legal responsibility profiles.

Sequentially, mortgage expansion for banks was once within the vary of 2-8 consistent with cent, while deposit expansion was once at 1-8 consistent with cent. Right here too, deposit expansion lagged mortgage expansion for many primary banks.

CASA deposits

A lot of the deposit expansion right through the quarter was once led via mounted and bulk deposits as CASA (present and financial savings accounts) deposits remained beneath power. CASA deposits were slowing down for many lenders during the last a number of quarters as traders are transferring to raised yielding funding avenues. This has greater banks’ reliance on different kinds of deposits, together with considerably expanding charges on time period deposits. This resulted in RBI to not too long ago cautioning banks in opposition to over-reliance on bulk deposits.

CASA ratios for banks, that have declared their provisional numbers, fell to twenty-five.3-50.2 consistent with cent from 26.2-52.5 consistent with cent within the yr in the past length. Suryoday SFB was once the outlier seeing an build up in its CASA ratio to 18.5 consistent with cent from 14.1 consistent with cent, whilst its percentage of CASA deposits stay a lot under the business reasonable.

[ad_2]