[ad_1]

U.S. single-family lease development softened year-over-year in October, however remained above pre-pandemic ranges.

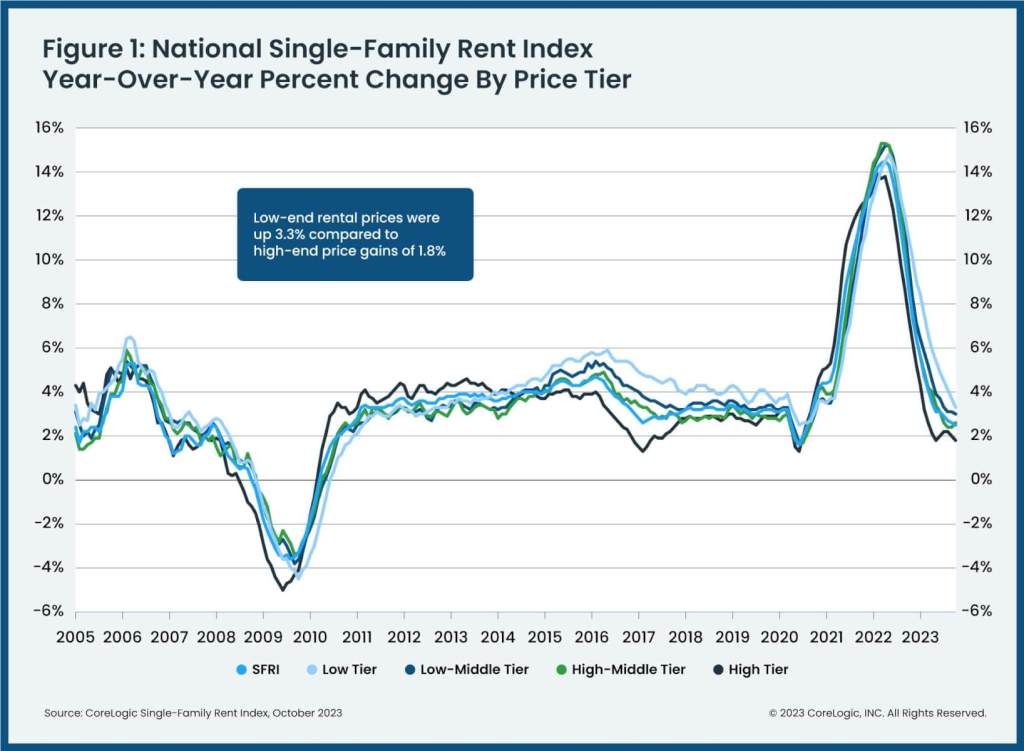

Apartment costs have been up by way of 2.5% yearly in October, cooling from 2.6% annual development in September. It was once the most important drop between September and October in additional than a decade. Hire development was once additionally the bottom for the reason that summer time of 2020. That’s in line with CoreLogic’s Unmarried-Circle of relatives Hire Index (SFRI), which analyzes single-family lease worth adjustments nationally and throughout main metropolitan spaces.

“Whilst slowing lease development is welcome information for tenants, affordability has suffered during the last few years, with median single-family rents expanding by way of about $500 nationally since February 2020,” Molly Boesel, primary economist for CoreLogic, mentioned in a commentary.

Cumulative will increase around the nation have registered nearly 30% since February of 2020.

CoreLogic tested 4 tiers of apartment costs: lower-priced (75% or lower than the regional median); lower-middle priced (75% to 100% of the regional median); higher-middle priced (100% to 125% of the regional median) and higher-priced (125% or greater than the regional median). The information company additionally analyzed two assets sorts: hooked up as opposed to indifferent houses.

For those classes, rent-growth adjustments in October 2023 over October 2022 have been:

- Decrease-priced: Hire development was once down 3.3% as opposed to 11%.

- Decrease-middle priced: Hire development was once down 3% as opposed to 9.8%.

- Upper-middle priced: Hire development was once down 2.6% as opposed to 8.8%.

- Upper-priced: Hire development was once down 1.8% as opposed to 7.4%.

In the meantime, hooked up single-family lease costs grew by way of 3% yr over yr in October; indifferent rents grew by way of 2.1%.

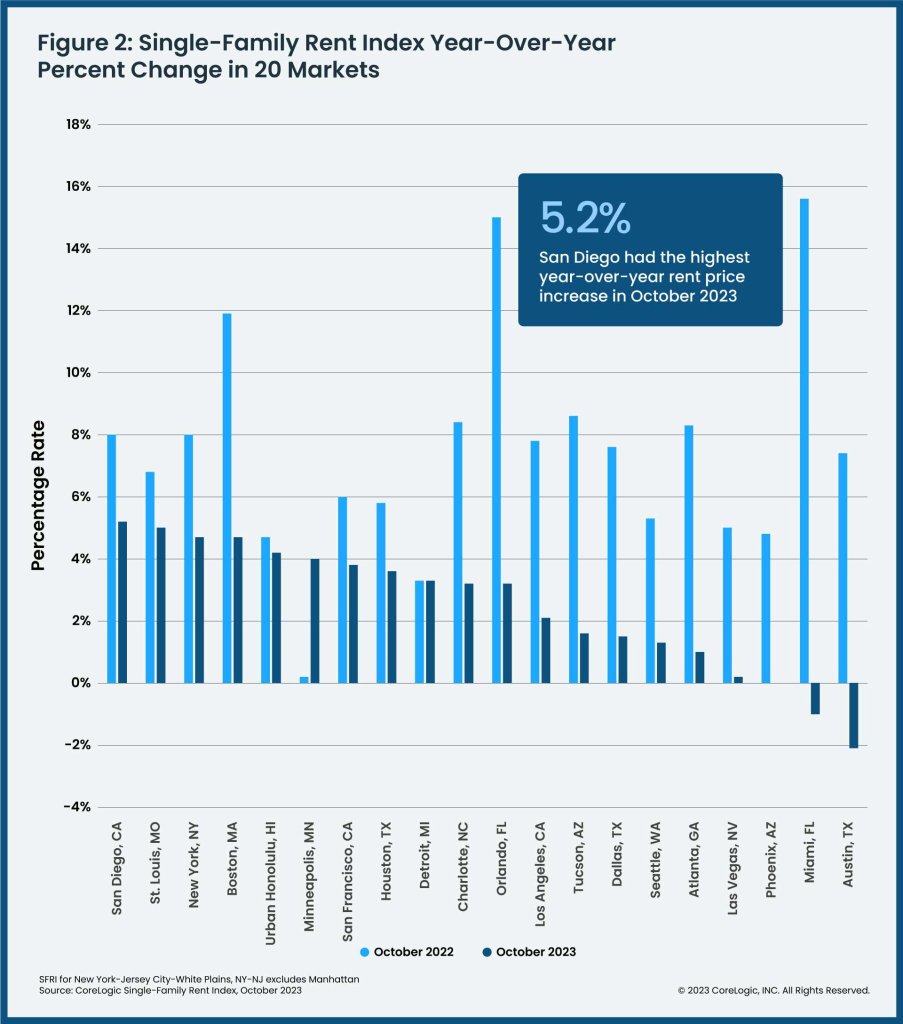

San Diego posted the quickest year-over-year build up in single-family rents in October 2023 at 5.2%. In the meantime, St. Louis posted the second-highest annual acquire at 5%, adopted by way of Boston and New York, each at 4.7%. Austin and Miami posted the most important annual declines at -2.1% and -1%, respectively. Hire development remained flat in Phoenix.

Comparable

[ad_2]