[ad_1]

In a up to date building, the Bitcoin value witnessed a exceptional surge of seven% inside of 24 hours, attaining a top level of $45,300. This important value building up coincides with the anticipation surrounding the possible approval of a Bitcoin spot exchange-traded fund (ETF) via the United States Securities and Trade Fee (SEC).

As well as, marketplace professionals, sponsored via a couple of fashions aligning to suggest greater value motion and bullish momentum, counsel that Bitcoin may quickly achieve the $50,000 degree and probably identify a brand new all-time top (ATH).

Bitcoin Worth Poised To Succeed in New All-Time Top?

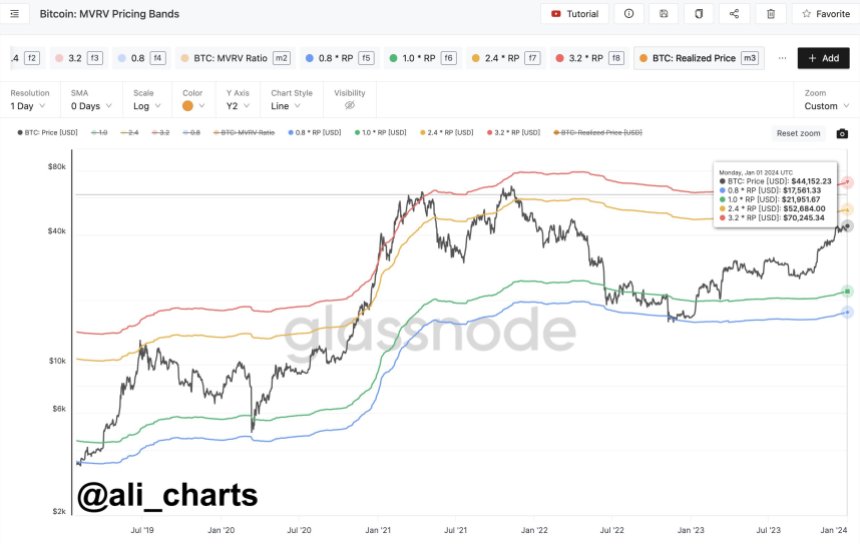

At the vanguard of this research is Ali Martinez, a famend crypto analyst, who emphasizes the dear insights equipped via the Bitcoin Marketplace Worth to Learned Worth (MVRV) pricing bands.

Those bands function a metric to research the associated fee motion and attainable ranges of Bitcoin, or some other cryptocurrency, via evaluating the marketplace price to the common price at which cash have been final moved on-chain. The MVRV ratio assesses whether or not Bitcoin is hyped up or undervalued relative to its historic on-chain task.

A top MVRV ratio means that the marketplace price of Bitcoin has surpassed the common price at which cash have been final moved, indicating a possible overvaluation. Conversely, a low MVRV ratio might point out that Bitcoin is undervalued.

Taking into consideration those elements, Martinez highlights the importance of the MVRV pricing bands, which disclose key value objectives for Bitcoin at $52,680 and $70,250, surpassing its earlier ATH of $69,000.

This research gifts an positive outlook for Bitcoin’s long term efficiency and reinforces the conclusion amongst buyers that the cryptocurrency’s upward momentum is more likely to proceed.

On the other hand, regardless of those Bitcoin value projections that might propel the biggest cryptocurrency available on the market into uncharted waters, every other analyst issues to a extra prudent prediction.

Cooling Duration For BTC?

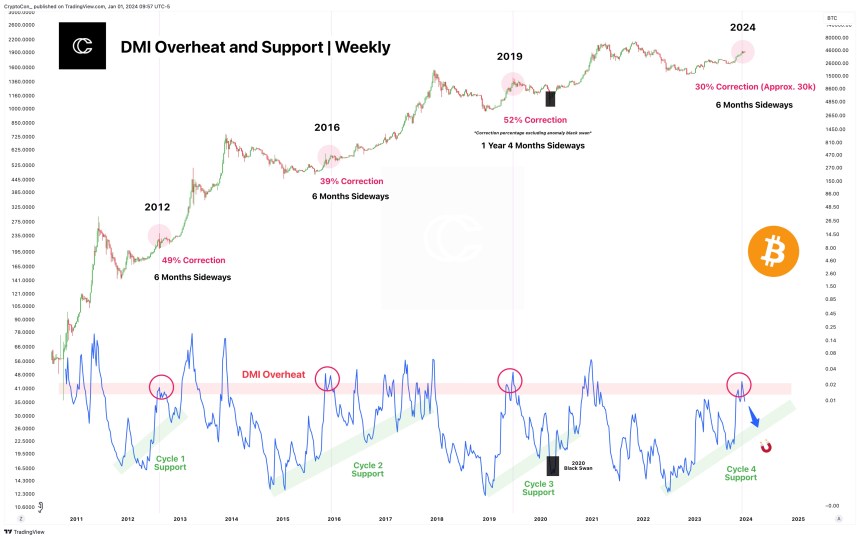

In accordance to famend crypto analyst Crypto Con, regardless of a year-long bullish stance, he believes it’s time for a cooldown as the brand new yr, 2024, starts.

Crypto Con predicts a 30% correction from the directional motion index (DMI) overheat zone, projecting costs round $30,000. The overheat zone discussed via Crypto Con means that the cost of Bitcoin has skilled a vital upward motion and could also be because of a correction or cooling duration.

As noticed within the chart above, when the associated fee enters this zone, it’s noticed as a sign that the rage will have develop into overextended and may probably opposite or revel in a pullback.

Drawing parallels to the instance in 2019, characterised via a double height in crimson, Crypto Con anticipates a drawdown this is each smaller in magnitude and shorter in length.

Moreover, the analyst issues to the constant strengthen introduced via diagonal inexperienced zones right through each and every cycle, suggesting a trend that has been held so far.

Whilst some analysts undertaking a brand new all-time top for the Bitcoin value, attaining uncharted waters above $70,000, others, similar to Crypto Con, recommend for a cooling duration and look ahead to a correction within the close to time period.

Featured symbol from Shutterstock, chart from TradingView.com

Disclaimer: The item is equipped for academic functions most effective. It does now not constitute the reviews of NewsBTC on whether or not to shop for, promote or grasp any investments and of course making an investment carries dangers. You might be prompt to behavior your individual analysis ahead of making any funding selections. Use knowledge equipped in this web site solely at your individual chance.

[ad_2]