[ad_1]

Solana (SOL) confirmed the most efficient functionality a number of the best 10 virtual belongings through capitalization. What led to this fast expansion following a vital decline?

In 2023, Solana showcased outstanding luck, in stark distinction to Ethereum (ETH). Whilst SOL surged over 1000%, ETH noticed just a 90% building up.

To higher perceive Solana’s ecosystem scale and restoration tempo, let’s read about a very powerful blockchain metrics from the time of the FTX crash on Nov. 11, 2022.

FTX chapter

When the cryptocurrency alternate filed for chapter on Nov. 11 remaining 12 months, Solana’s metrics had already considerably declined from their height values.

For example, SOL’s value dropped from $62 to $17, and the day-to-day buying and selling quantity lowered from $6.7 billion (108 million SOL) to $2.2 billion (130 million SOL).

The go out of a significant investor and the danger of coin gross sales induced Solana’s fall, main crypto neighborhood participants to expect its drawing close death.

Solana’s co-founder and CEO, Anatoly Yakovenko, stated that the numerous decline in SOL due to the FTX cave in used to be a “sour tablet to swallow.” Nonetheless, those unsightly moments paled in comparison to the wear led to to ecosystem initiatives.

About 20% of Solana-based initiatives won funding from the crypto alternate FTX or its subsidiary Alameda Analysis, and best 5% of startups within the ecosystem held finances in this buying and selling platform. Yakovenko expressed sympathy for the mission creators who labored to boost capital and relied on FTX because the custodian of finances.

Undertaking upward thrust

Regardless of the damaging forecasts, Solana survived and started its restoration. Professionals attributed the mission’s “survivability” to the staff’s use of pressure checking out to mend insects.

Solana’s lively expansion befell throughout the e-newsletter of the courtroom determination within the FTX case. The founding father of the crypto alternate, Sam Bankman-Fried, used to be discovered in charge of all fees.

Now free of a formidable spouse’s drive, Solana’s destiny turns out clearer, bettering its funding enchantment. Crypto business representatives have began discussing Solana’s possible to guide the following bull marketplace, obvious within the massive quantity of open lengthy positions, appearing traders’ self assurance in its sure trajectory.

Building of Solana and its affect at the ecosystem

Regardless of pessimistic forecasts and a basic decline in community process following FTX’s chapter, the Solana builders remained proactive. The blockchain has gone through a number of important technical updates and inventions all through the previous 12 months. For the reason that summer time of 2023, Solana has offered new defi products and services, together with lending platforms, LSD protocols, and decentralized exchanges (DEX). The builders goal to create a brand new technology of platforms with “wholesome” tokenomics and fine quality UI/UX.

The validators’ migration to consumer model 1.16 on the finish of September 2023 optimized reminiscence utilization, expanded make stronger for zero-knowledge proofs (ZKP), and built-in confidential transfers with the brand new token same old. The replace additionally greater the steadiness of the community and decreased the {hardware} necessities for validators. Model 1.17 is predicted so as to add much more ZKP integration features.

Some other main development used to be the creation of State Compression in April 2023. The answer makes storing information out of doors the primary community inexpensive through the use of on-chain hashes to end up its authenticity.

Meme cash powered through Solana

The top of the 12 months witnessed notable pleasure surrounding Solana-based memecoins, with probably the most standout tokens being Bonk. Bonk, a meme coin running at the Solana blockchain and depicting a Shiba Inu canine, resembles the most important meme cryptocurrencies reminiscent of Dogecoin (DOGE) and Shiba Inu (SHIB).

Presented early in January of the similar 12 months, Bonk first of all sparked momentary pleasure, adopted through a scientific value lower till the tip of October, and then it all started to enjoy fast expansion. The surge within the coin’s value would possibly were induced through the rise within the Solana blockchain token’s worth, producing pastime in belongings inside this community, together with BONK.

The escalating call for for the emerging token worth led to a tenfold surge in Saga smartphone gross sales through Solana builders. Folks proudly owning the software are eligible for a complimentary distribution of BONK tokens, whose amount, on the present fee, covers the smartphone’s price. The corporate limited gross sales to at least one software consistent with individual.

What lies forward for Solana

VanEck analysts revealed a file presenting a number of forecasts for the cost of SOL through 2030. The pessimistic state of affairs initiatives a coin value of $9.81, whilst probably the most positive state of affairs reaches $3211.28.

Professionals counsel Solana may just probably be the primary blockchain in a position to accommodating packages with over 100 million customers. Alternatively, VanEck believes Solana’s monetization will best achieve about 20% of Ethereum’s because of “elementary variations within the philosophies of the communities of the 2 initiatives.” This may occasionally lead to not up to part of Ethereum’s marketplace proportion.

Professionals additionally await decentralized exchanges’ marketplace proportion will achieve an all-time excessive as high-performance networks like Solana fortify person buying and selling reviews. They expect the Solana blockchain will rank a number of the best 3 in marketplace capitalization, TVL, and lively customers.

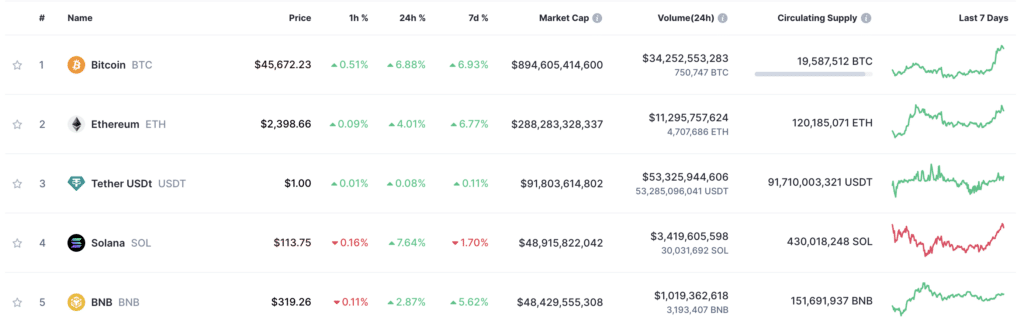

Whilst the preliminary forecast in regards to the token value would possibly seem difficult to reach given present token values, the second one forecast turns out slightly sensible. In January, SOL secured its position within the best 5 cryptocurrencies through marketplace capitalization, surpassing Ripple (XRP) and BNB.

[ad_2]