[ad_1]

Retail marketed stock knowledge for

the week of Nov. 6-12: S&P World Mobility delivers the

following insights referring to the USA marketplace.

General {industry} inventories down from

top

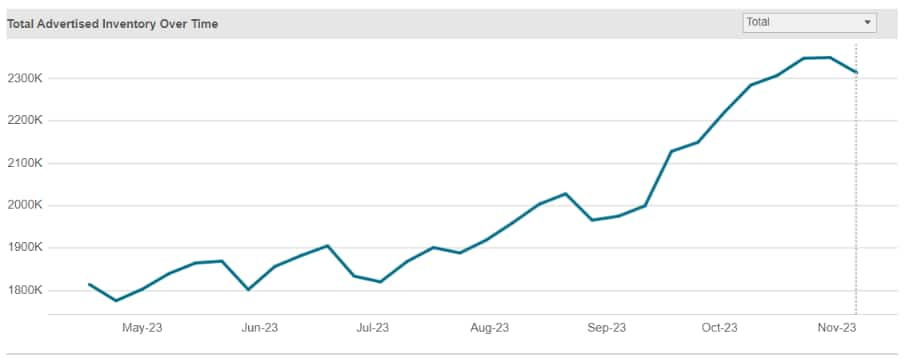

New automobile broker stock listings peaked in

mid-October simply shy of two.5 million gadgets, and feature observed a slight

lower since then – from an end-of-October stage of two.35 million

to be had broker marketed gadgets to about 2.3 million

mid-November.

Supply: S&P World Mobility Retail

Marketed Stock knowledge, week of Nov 6-12, 2023

©2023 S&P World Mobility

A BEV plateau?

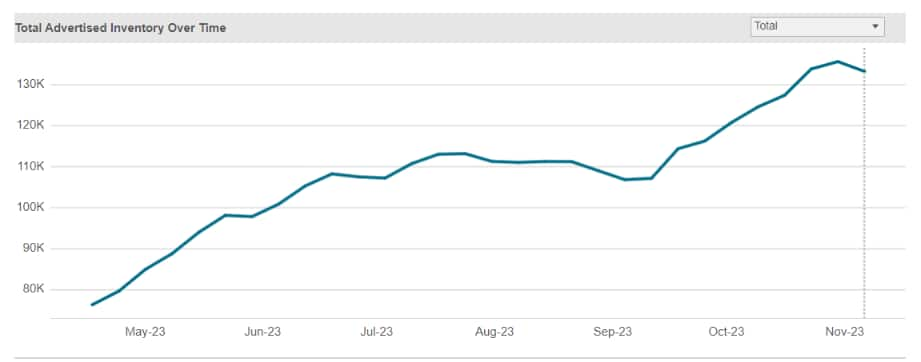

Electrical automobile broker marketed inventories

(now not together with Tesla) additionally peaked the similar week in October at

135,000 gadgets, and feature declined quite since then. Maximum EVs have

reached a listing plateau and flattened off, aside from the Ford

F-150 Lightning, which has grown sharply to ten,000 gadgets. Ford

reported overall gross sales of about 2,000 Lightnings in August and

September blended, however then speeded up to three,712 gadgets in October.

The chart under displays industry-wide BEV retail marketed stock

(now not counting Tesla).

Supply: S&P World Mobility Retail

Marketed Stock knowledge, week of Nov 6-12, 2023

©2023 S&P World Mobility

Mustang Mach-E reductions

Then again, Ford’s dedication to creating the

Mustang Mach-E a gross sales good fortune has come at a value – or quite a

value minimize. Greater than part of Mach-E’s retail marketed stock

is sporting a below-sticker be offering. In Maryland and Virginia

dealerships, Mach-E has a mean cut price of greater than $5,000.

Large reductions at the Mach-E will also be present in Mississippi,

Oklahoma, Connecticut, Minnesota, and Kentucky. The chart under

displays EV retail marketed inventories via nameplate.

Supply: S&P World Mobility Retail

Marketed Stock knowledge, week of Nov 6-12, 2023

©2023 S&P World Mobility

Hybrids nonetheless revving arduous

As shoppers faucet the

brakes of their willingness to decide to the electrical automobile

way of life, a hybrid-electric

powertrain is being accredited as a suitable midway

choice. As of Nov. 12, there have been 219k hybrids in broker

marketed inventories – a host that were rising all summer season

to satisfy gross sales call for. About one-third of that overall comes from the

compact SUV section, as observed within the chart under.

Supply: S&P World Mobility Retail Marketed Stock knowledge,

week of Nov 6-12, 2023

©2023 S&P World Mobility

Strike cars strike

again

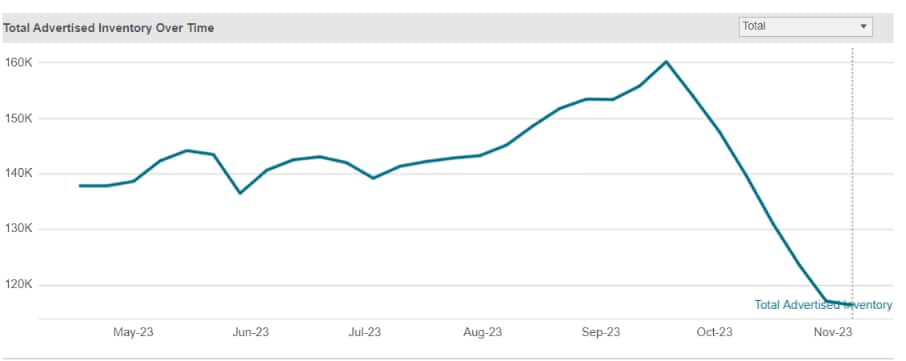

In anticipation of the UAW strike motion, GM,

Ford, and Stellantis cranked up centered vegetation in order that blended

volumes of the Ford Ranger, Ford Bronco, Ford Explorer, Lincoln

Aviator, Chevrolet Colorado, GMC Canyon, Chevrolet Traverse, Buick

Enclave, Jeep Wrangler, and Jeep Gladiator had been at post-pandemic

highs of about 160,000 gadgets as of Sept. 18. Regardless of the strike

lasting handiest six weeks at the ones vegetation sooner than employees returned,

gross sales have driven inventories right down to about 116,000 gadgets. For

instance, pre-strike, the Jeep Wrangler had the second-most

stock of any compact SUV; as of Nov. 12, that they had fallen to

fourth-most stock within the section. Even though the meeting vegetation

go back to complete manufacturing temporarily, there’s the infrastructure

factor of having gadgets to dealerships. Apparently volumes of strike

cars have reached their backside, as observed within the chart under.

Supply: S&P World Mobility Retail

Marketed Stock knowledge, week of Nov 6-12, 2023

©2023 S&P World Mobility

Promoting down 2023s

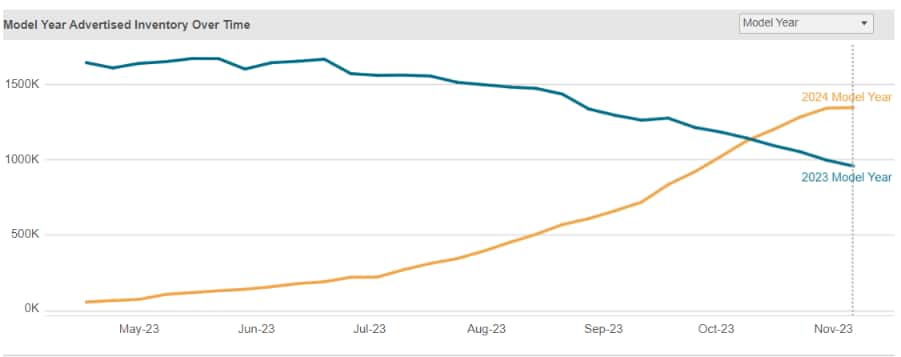

As of mid-October, there have been nonetheless extra

marketed broker stock of outgoing 2023 MY fashions than

incoming 2024s, whilst the 2024 MY stock was once rising at a sooner

price than the 2023 MY sell-down. However as of mid-November, that tide

turns out to have reversed; there are actually fewer 2023s (about 955k) than

2024s (about 1.34 million).

Supply: S&P World Mobility Retail

Marketed Stock knowledge, week of Nov 6-12, 2023

©2023 S&P World Mobility

2023s and mainstream

manufacturers

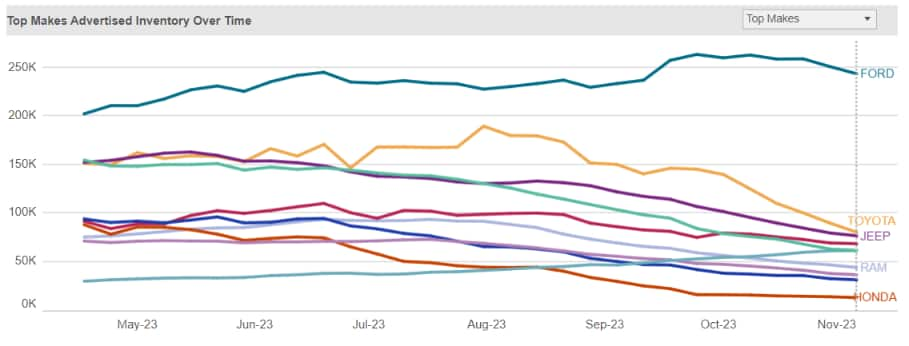

So, who’s managing the sell-down splendid? Many

manufacturers activated fall selldowns, however Ford is sporting the 2023

type yr deeper into the yr – particularly for the best-selling

F-Sequence pickup, which may have a 1Q 2024 rollout of the mid-cycle

refresh 2024 type. Recently Ford has about 250k gadgets of 2023 MY

cars, of which 105k are the F-Sequence and Lightning. Ford additionally

is sporting the 2023 type Explorer into 1Q 2024, which provides to the

2023 MY rely as smartly. From Ford’s stage, this can be a good distance right down to

Toyota and Jeep in the case of leftover 2023s; taking out the F-Sequence

and Explorer, on the other hand, brings it a lot nearer to the pack. The chart

under displays 2023 type yr retail marketed inventories via

emblem.

Supply: S&P World Mobility Retail

Marketed Stock knowledge, week of Nov 6-12, 2023

©2023 S&P World Mobility

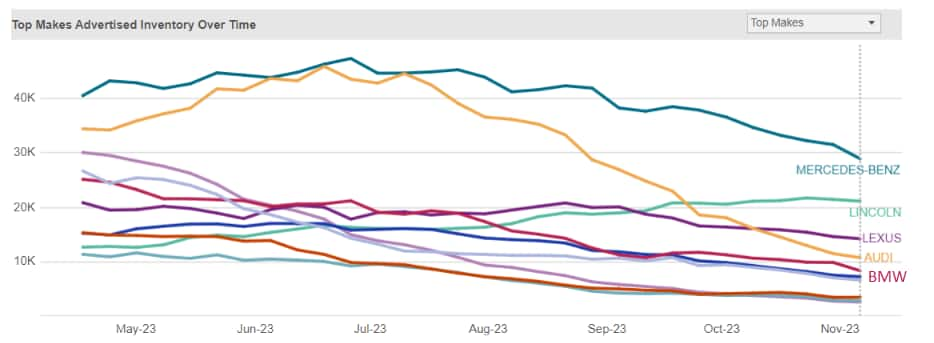

2023s and comfort manufacturers

Maximum luxurious manufacturers have cleared out their

2023s, aside from for Mercedes-Benz – which continues to be watching for the

arrival of its re-engineered 2024 E-Elegance sedan. Even supposing Mercedes’

summer season selldown dropped its broker marketed inventories of 2023

MY cars from round 250k in Would possibly right down to 116k right now, the

2023 E-Elegance ramped up broker marketed inventories in September –

ranges which might be nonetheless increased for the reason that refreshed 2024s aren’t

but in broker shares. The chart under displays retail marketed

inventories via luxurious manufacturers.

Supply: S&P World Mobility Retail

Marketed Stock knowledge, week of Nov 6-12, 2023

©2023 S&P World Mobility

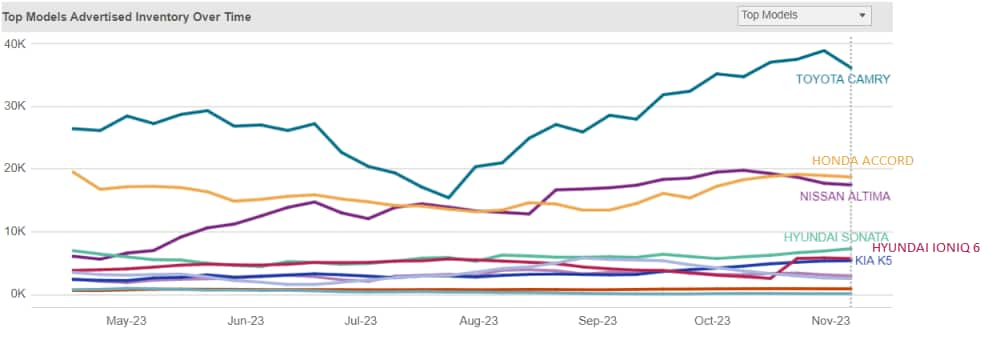

Take into account midsize sedans? Toyota

does.

With a brief 2024 type yr of the Toyota

Camry sooner than the Ninth-generation redesign arrives as a 2025 type in

spring, Toyota is cranking up the outgoing type. It was once the

best-selling passenger automobile for 20-plus years, till the RAV4

compact SUV took its position in 2017 – however it is nonetheless close to the highest of

the gross sales charts. However that hasn’t stopped Toyota’s want to stay

sedans in driveways. Broker marketed inventories of Camry are

these days double the ones of the gross sales runners-up competition – the

Nissan Altima and Honda Accord.

Supply: S&P World Mobility Retail Marketed Stock knowledge,

week of Nov 6-12, 2023

©2023 S&P World Mobility

FOR MORE ON INVENTORY DATA AND

MARKET INTELLIGENCE

LIGHT VEHICLE SALES

FORECASTING

SUBSCRIBE TO OUR TOP 10 INDUSTRY

TRENDS NEWSLETTER

This newsletter was once revealed via S&P World Mobility and now not via S&P World Scores, which is a one at a time controlled department of S&P World.

[ad_2]