[ad_1]

After surging to a document top in October at the again of competition season-led sped up discretionary spending, bank card spends normalised in November, falling over 10 in line with cent month-on-month.

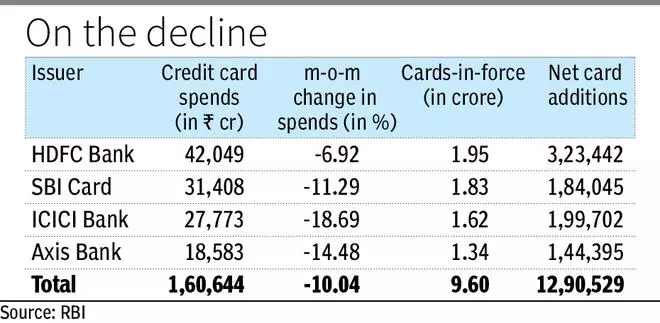

Spends for the month stood at ₹1.61-lakh crore, 10.04 in line with cent decrease m-o-m. In October, that they had surged over 25 in line with cent to the touch the document of ₹1.78-lakh crore, in keeping with knowledge by way of the Reserve Financial institution of India (RBI).

Maximum primary issuers registered a double digit decline in spends right through the month with spends for the highest 4 issuers falling 7-19 in line with cent. ICICI Financial institution noticed the perfect lower at 18.7 in line with cent adopted by way of Axis Financial institution at 14.5 in line with cent.

The percentage of e-commerce bills in mastercards spends fell to 63.3 in line with cent in November after ceaselessly expanding for the previous 3 months to 67.6 in line with cent as of October 2023. Alternatively, the proportion of PoS (point-of-sale) transactions jumped to 36.7 in line with cent in November after falling for the remaining 3 months to 32.4 in line with cent in October.

- Additionally Learn: Swan Power plans to prepay ₹300-cr debt

Different primary issuers comparable to Kotak Mahindra Financial institution, AU Small Finance Financial institution, DBS Financial institution India and Federal Financial institution too noticed a decline in spends, while IndusInd Financial institution and IDFC First Financial institution noticed an building up of one.8-2.0 in line with cent m-o-m.

Playing cards remarkable

At the same time as spends declined right through the month, credit score cards-in-force persisted to develop at a gradual tempo. Remarkable playing cards touched a brand new top of 9.60 crore playing cards in November, up 1.4 in line with cent from the former top of 9.47 crore playing cards in October.

The choice of mastercards rose by way of 12.9 lakh right through the month, less than 16.9 lakh playing cards in October and 17.4 lakh in September, in large part because of a decline within the choice of playing cards for banks comparable to Financial institution of Baroda, Karur Vysya Financial institution, and SBM Financial institution India.

A few of the most sensible 4 issuers, HDFC Financial institution used to be the chief relating to building up in choice of playing cards, breaking ICICI Financial institution’s three-month streak. HDFC Financial institution internet added 3.2 lakh playing cards right through the month to a complete of one.95 crore playing cards, keeping up its place as the most important card issuer within the nation.

SBI Card, ICICI Financial institution and Axis Financial institution all noticed internet additions of lower than 2 lakh playing cards right through the month. IDFC First Financial institution, IndusInd Financial institution, Kotak Mahindra Financial institution, RBL Financial institution and AU Small Finance had been the opposite issuers to peer sturdy internet addition in playing cards.

[ad_2]