[ad_1]

Proportion this text

Tether, the sector’s biggest stablecoin issuer of USDT, with a marketplace cap exceeding $90 billion, has frozen six new wallets at the Ethereum blockchain, in step with a document by means of the US-based blockchain knowledge company ChainArgos.

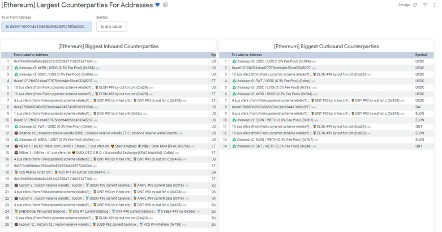

After examining the Ethereum addresses hooked up to those wallets, ChainArgos found out explicit odd patterns related to an outdated Russian rip-off, Finiko, which defrauded traders with guarantees of as much as 30% per thirty days returns on investments over $1,000.

Some transfers to those addresses seemed suspicious and could have connections to the Finiko Rip-off, as evidenced by means of analyzing a TRON deal with, which gained a unmarried inbound switch of roughly $7,000 USDT from Bitfinex.

This newest restriction comes after Tether moved to freeze over 150 wallets tied to folks and entities sanctioned by means of the USA Treasury Division’s Place of work of Overseas Property Regulate (OFAC). By way of proactively barring wallets at the Specifically Designated Nationals record, Tether targets to agree to US sanctions necessities.

Closing week, Paolo Ardoino, CEO of Tether, mentioned that:

“By way of executing voluntary pockets deal with freezing of latest additions to the SDN Checklist and freezing prior to now added addresses, we can fortify the certain utilization of stablecoin era additional and advertise a more secure stablecoin ecosystem for all customers.”

The transfer comes as regulators power crypto corporations to strengthen compliance and save you utilization by means of sanctioned events like Russia and Iran. Stablecoins like USDT have confronted specific scrutiny because of their in depth use on main exchanges like Binance.

Proportion this text

[ad_2]