[ad_1]

From genuine property funding trusts (REITs) to genuine property crowdfunding platforms, it’s by no means been more uncomplicated to spend money on passive genuine property. Previously, making an investment in industrial genuine property has been difficult. Industrial genuine property may also be very dear, making it onerous for the common investor to go into the marketplace.

Input Fundrise.

Fundrise is a personal marketplace genuine property making an investment platform that permits you to spend money on eREITs (digital REITs) that aren’t traded on public inventory exchanges.

However Fundrise provides extra than simply industrial genuine property. You’ll be able to additionally spend money on high-interest-yielding non-public credit score offers, and the inventory of emerging era corporations earlier than their stocks are made to be had to most of the people. With as low as $10, buyers be capable of take part in probably the most maximum sought-after inventory investments on Wall Boulevard.

While you mix non-public credit score and pre-IPO inventory in leading edge era corporations with the various industrial genuine property alternatives Fundrise provides, the result is likely one of the perfect on-line funding platforms to be had to common buyers.

In reality, Fundrise supplies a degree of funding diversification to small buyers that was once as soon as to be had simplest thru hedge price range.

We earn a fee from Fundrise spouse hyperlinks on WalletHacks.com. We aren’t a consumer of Fundrise. All critiques are my very own.

Desk of Contents

- What Is Fundrise?

- How Fundrise Works

- Running Era

- Account Sorts

- Actual Property Portfolio

- Project Portfolio – Innovation Fund

- Personal Credit score Portfolio

- eREITs and eFunds

- What Is Purpose-Based totally Making an investment?

- 4 Fundrise Portfolio Choices

- Fundrise Professional

- Who Can Make investments and How?

- What are Fundrise Returns?

- What are the Execs and Cons?

- Fundrise Possible choices

- Fundrise FAQs

- Ultimate Ideas

What Is Fundrise?

Fundrise is a crowdfunded genuine property making an investment platform that was once based in 2012 through two brothers (Ben and Dan Miller) in Washington, D.C. Fundrise’s first undertaking was once a $325,000 lift from 175 buyers (minimal of simply $100) within the H Boulevard NE Hall in D.C.

They’ve come some distance since then – as of 9/30/2022, Fundrise has over 371,000 lively buyers with $7 billion overall asset transaction price and over $226 million in internet dividends earned through the ones buyers.

As of late, you don’t make investments immediately in genuine property belongings – you buy eREITs or eFunds – non-public genuine property portfolios throughout the USA in keeping with your funding objectives. Some Fundrise funding price range are designed for revenue, others for fairness development.

Some desire this way over making an investment immediately in genuine property since you steer clear of the issue of taxable occasions. While you immediately personal bodily genuine property, like a holiday apartment belongings, you’ll understand a capital achieve while you promote. You don’t have that with a fund way.

Moreover, crowdfunded genuine property means that you can diversify your chance throughout a couple of houses.

Fundrise differs from different crowdfunded genuine property marketplaces since you spend money on price range, indirectly into houses. This could also be why you don’t want to be an accepted investor because you’re making an investment in a fund and no longer in a personal placement.

As Fundrise has persevered to develop and evolve, it’s added utterly new asset categories within the type of non-public credit score and pre-IPO era corporate shares. As discussed, those alternatives are to be had to small buyers for an funding of as low as $10. With a couple of hundred bucks, you’ll unfold your portfolio throughout a couple of funding categories.

Fundrise is likely one of the few genuine property crowdfunding choices for non-accredited buyers. Only a few corporations be offering the similar funding alternatives in one platform.

How Fundrise Works

Fundrise has developed its platform whilst concurrently increasing the funding choices to be had, all inside a couple of years.

Running Era

Fundrise has redesigned the funding control procedure, the use of software-enabled automatic programs to switch high-cost handbook workflows.

The method comes to a mixture of 3 programs:

- Cornice is the Fundrise interior investor servicing and control application device. It streamlines the method of managing greater than 500,000 particular person buyers as regardless that the platform had been managing only one unmarried account.

- Foundation is the application that manages genuine property operations. It’s a next-generation asset control device constructed on peak of a contemporary information warehouse, designed to supply real-time, automatic reporting throughout masses of particular person belongings.

- Equitize is a device offering quicker, fairer, and extra versatile investment answers.

The mix of those programs has enabled Fundrise to regulate masses of hundreds of investor accounts unfold throughout masses of asset categories with better pace, accuracy, and potency. The result’s a streamlined investor platform that’s confirmed to be extra user-friendly.

Account Sorts

Fundrise can accommodate each non-public funding accounts and IRAs. Personal funding accounts are designed particularly for normal, taxable funding accounts. They may be able to be opened with an funding as low as $10.

IRA accounts are to be had for each conventional and Roth IRAs. They require a minimal preliminary funding of $1,000. IRAs have an annual account charge of $125, which is waived in any yr during which you give a contribution a minimum of $3,000 or for any IRA account with a stability of more than $25,000.

IRA accounts are held with Millennium Agree with Corporate, LLC, because the custodian of belongings in every retirement account opened thru Fundrise.

Actual Property Portfolio

Fundrise is understood, at the beginning, as an actual property funding platform. The corporate has an actual property portfolio more than $7 billion unfold throughout masses of commercial houses, multifamily residences, or even single-family apartment houses.

The actual property portfolio comprises 294 lively and 141 finished initiatives, that have produced the next investor returns in recent times:

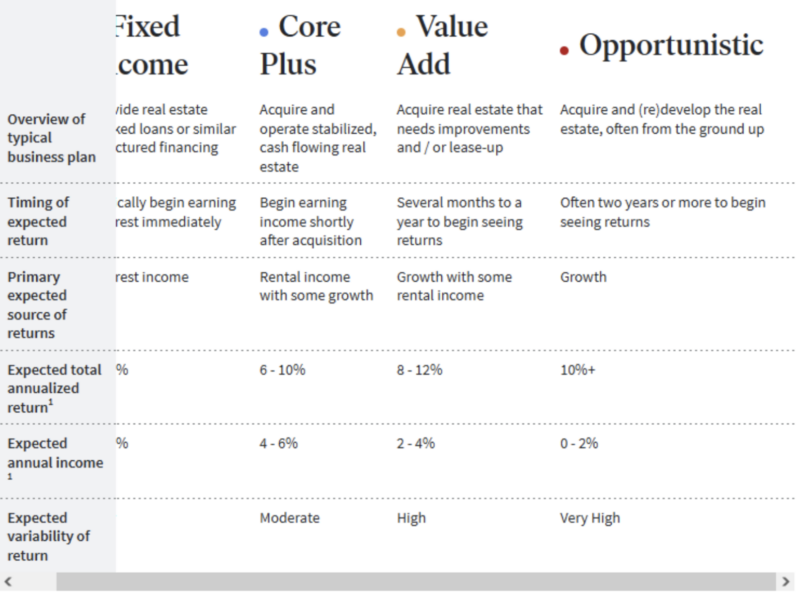

Actual property returns outcome from 4 other portfolio choices, which can be lined in some element beneath. Those come with Fastened Source of revenue, Core-Plus, Worth-Upload, and Opportunistic. Any genuine property portfolio you spend money on will come with a minimum of a small a part of every of the 4. Alternatively, the portfolio choices liked for your funding combine can be decided through your individual funding personal tastes or your chance tolerance.

However that is the place Fundrise has taken a departure from its conventional emphasis completely on genuine property making an investment. They now be offering two making an investment choices that transcend genuine property and promise to roll out much more making an investment choices someday.

Project Portfolio – Innovation Fund

Project Portfolio provides the chance to “spend money on the following day’s nice tech corporations nowadays.” The target is to permit buyers to spend money on top-tier era corporations all the way through the pre-IPO (“preliminary public providing”) section.

This technique calls for some clarification. Fundrise maintains that the majority of funding returns from IPOs happen all the way through the time when the issuing corporations are nonetheless privately owned. This is partially because of the truth that pre-IPO corporations are staying within the pre-IPO section longer than up to now, ceaselessly for a few years.

The Project Portfolio makes use of the Fundrise Innovation Fund to capitalize in this marketplace. The fund makes a speciality of the next 5 funding sectors:

- Synthetic intelligence and gadget finding out

- Trendy information infrastructure

- Construction operations (“DevOps”)

- Monetary era (“FinTech”), and

- Actual property and belongings era (“PropTech”)

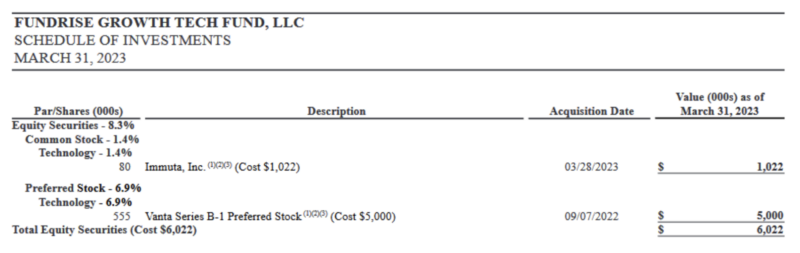

Alternatively, for the reason that Innovation Fund is a brand new mission, it these days holds an fairness place in one corporate referred to as Vanta. The placement within the corporate was once taken in November 2022 within the quantity of $5 million. Vanta is a high-growth tech corporate “with an answer on the intersection of the cyber safety and compliance industries.” (As of March 31, 2023, the Innovation Fund has additionally taken a $1 million place within the inventory of Immuta, Inc.)

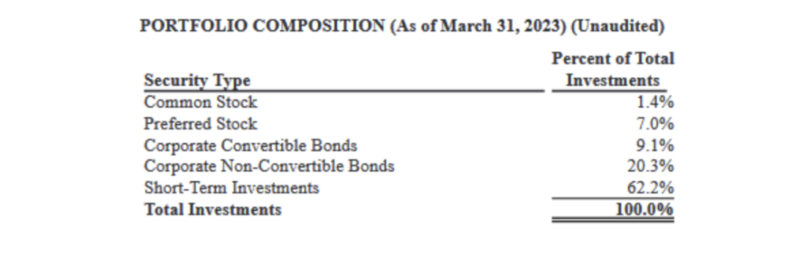

As you’ll see from the Portfolio Composition observation beneath, supplied through the Innovation Fund, simplest 8.4% of the fund is these days sitting within the inventory of pre-IPO corporations. As such, the fund is basically invested in company convertible bonds, company non-convertible bonds, and momentary investments.

Personal Credit score Portfolio

Personal Credit score comprises high-yield loans and different fixed-income investments. Those come with basically debt-related tools moderately than fairness. On account of the shorter length of personal credit score loans, they normally supply upper returns as a result of they’re non-public agreements moderately than publicly traded securities, like bonds.

As an example, in nowadays’s emerging price surroundings, momentary debt supplies upper charges of go back than long-term securities.

Personal Credit score supplies buyers having the ability to spend money on a majority of these debt responsibilities. Fundrise makes use of its revel in in financing genuine property buyers to go into this extremely successful asset magnificence. Personal credit score is composed of genuine estate-related loans, mezzanine financing (together with most well-liked fairness), financing residential development and building, and obtaining subordinate notes and high-yield investments within the asset-backed securities marketplace.

Fundrise’s Personal Credit score portfolio will spend money on particular initiatives within the type of high-yield most well-liked fairness. Those investments be offering low charges, versatile minimal investments, or even a chance for quarterly liquidity.

eREITs and eFunds

eREITs and eFunds are the root of genuine property making an investment thru Fundrise. An eREIT is an actual property funding believe however a privately traded one, to be had simplest on Fundrise. They include both fairness or debt investments in industrial belongings, together with retail area, condo complexes, place of business structures, and different traits.

eFunds are similar to eREITs in that they’re simplest to be had thru Fundrise. However moderately than making an investment in large-scale initiatives, they spend money on the purchase and/or building of particular person houses, like single-family houses, townhomes, and condominiums. Via making an investment in an eFund you’ll spend money on a portfolio of such houses.

What Is Purpose-Based totally Making an investment?

Fundrise allows you to, as an investor, pick out certainly one of 3 objectives:

Supplemental Source of revenue: Designed for buyers who wish to earn further passive revenue, have a moderate-term funding horizon, and is also making plans for retirement in a while. Source of revenue-focused belongings constitute 70% to 80%, and growth-focused belongings are the rest 20% to 30%.

Balanced Making an investment: For buyers who need most diversification, have a average to long-term funding horizon, and is also more moderen to making an investment outdoor the inventory marketplace. Source of revenue-focused belongings constitute 40% to 60%, and growth-focused belongings are the rest 40% to 60%.

Lengthy-Time period Enlargement: For many who wish to maximize returns over the lifetime of the funding, have a long-term funding horizon, and are pleased with extra doable variability yr to yr. Source of revenue-focused belongings constitute 20% to 30%, and growth-focused belongings are the rest 70% to 80%.

(There’s a questionnaire in the event you aren’t certain which form of investor you might be.)

You pick out one kind for those plans, open an account, and deposit cash. Fundrise handles the remaining.

The Lengthy-Time period Enlargement Plan initiatives annual returns of 9.7% to 11.6% (about part as revenue, part as appreciation) and would put you in 12 lively initiatives in a mix of chance classes (they let you know precisely how a lot of your portfolio could be going the place).

4 Fundrise Portfolio Choices

Fundrise makes use of 4 other portfolio choices for the true property investments it provides. The screenshot beneath supplies a abstract of the 4 choices and the fundamental purposes of every (we ask for forgiveness for the Fastened Source of revenue segment being truncated, as this is how it’s offered at the website online):

Fastened Source of revenue

Because the identify implies, the Fastened Source of revenue possibility is designed basically to supply stable revenue. That is supplied thru curiosity revenue generated through genuine property loans and different forms of financing.

The benefit of the Fastened Source of revenue possibility is that it generates revenue straight away and during the time period of the underlying investments. Fundrise depends on a portfolio of debt-related investments in order that loans which are paid off are changed through new ones to proceed the interest-generating procedure.

Core-Plus

Core-Plus depends on a mixture of strong revenue and doable for capital development. It’s performed through obtaining stabilized money flow-generating genuine property, which can ultimately be bought at confidently upper costs to supply capital positive factors someday.

Anticipated annual revenue is between 4% and six%, whilst anticipated overall annualized go back – which incorporates doable long term capital positive factors – is estimated at between 6% and 10% consistent with yr.

Worth-Upload

This can be the world of genuine property making an investment Fundrise is perfect recognized for. Worth-Upload is a procedure that comes to the purchase of genuine property that should both be stepped forward or leased up. The finishing touch of both task may end up in higher belongings values.

The main purpose of Worth-Upload is development with internet apartment revenue, slightly like a growth-income mutual fund in inventory. Regardless that there may be excessive go back variability, the predicted overall annualized go back is between 8% and 12% consistent with yr, with anticipated annual internet revenue within the 2% to 4% vary.

Opportunistic

Opportunistic comes to the purchase and building of genuine property from the bottom up. All the purpose of this selection is long-term development, and it’s anticipated to supply annualized returns in way over 10%.

That is, alternatively, an excessively long-term procedure, return-wise. Anticipated annual returns are estimated at between 0% and a couple of%, and the predicted variability of returns could be very excessive. While you make investments with this selection, be expecting no go back within the quick run and a retaining duration of 2 years or longer earlier than capital positive factors to your investments are discovered.

Fundrise Professional

Fundrise Professional is a characteristic that lets you spend money on custom designed portfolio allocations in funding price range presented through Fundrise. Funding choices may also be made thru both the internet model or Android and iOS cellular units. That incorporates probably the most greater than 5,000 residential belongings these days being presented at the platform. You’ll even have get right of entry to to monetary content material presented through the Wall Boulevard Magazine and WSJ Professional, however with out the desired charges the ones publications require.

Via Fundrise Professional, you’ll spend money on any fund presented through Fundrise for as low as $10. That small minimal funding will assist you to unfold a small amount of cash throughout many various price range. You’ll be able to even set asset allocation percentages around the other price range.

Fundrise Professional is these days being presented for a charge of $10 per thirty days.

However, you’ll pay a flat annual charge of $99, saving you $21 once a year. You’ll be able to join Fundrise Professional as an current Fundrise buyer. As well as, Fundrise Professional comes with a 30-day unfastened trial, and you’ll cancel your club anytime.

Who Can Make investments and How?

Any US resident over the age of 18 can grow to be an investor on Fundrise. You do not need to be an accepted investor. (World buyers can’t make investments immediately thru Fundrise).

Fundrise these days helps non-public and joint funding accounts, Trusts, LLCs, LPs, and C and S companies. If you wish to make investments along with your IRA, you will have to arrange an settlement with the Millennium Agree with Corporate, but it surely’s imaginable.

What are Fundrise Returns?

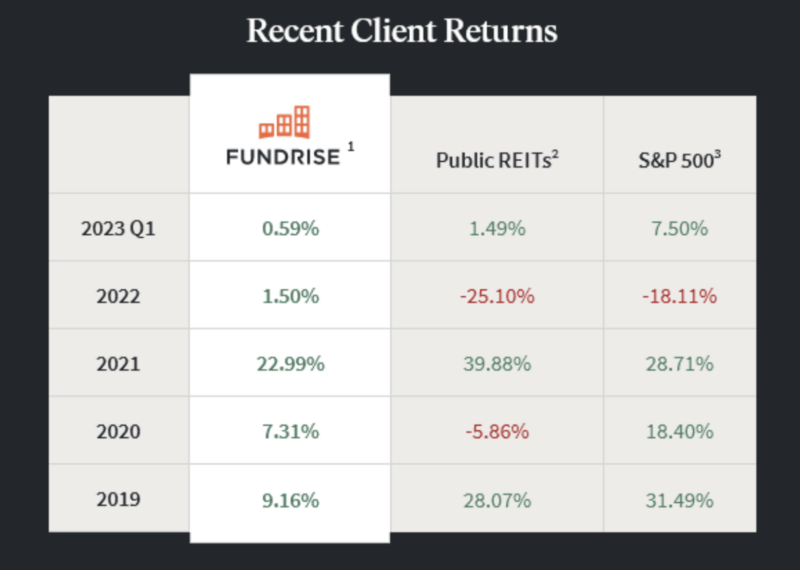

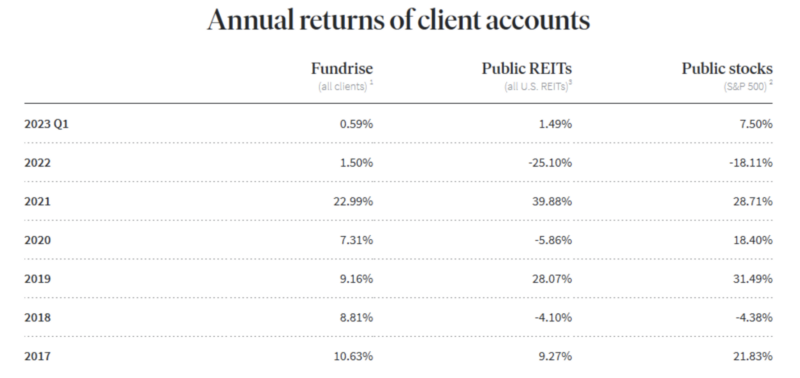

Fundrise has supplied the next returns from 2017 throughout the first quarter of 2023:

What’s most likely maximum noteworthy about those returns is that their efficiency has a tendency to be most powerful within the years when different asset categories are weakest.

As an example, understand that during 2022, when the S&P 500 was once down through greater than 18% and public REITs misplaced greater than 25%, Fundrise produced a 1.50% go back. That will not be spectacular at the floor, but it surely presented a go back all the way through the yr when each shares and publicly traded REITs took a major dive.

The location was once equivalent in 2018, when Fundrise returned just about 9%, whilst each public REITs and shares misplaced cash.

Possibly greater than the rest, Fundrise may well be observed as a real selection funding, acting neatly when different asset categories are susceptible.

What are the Execs and Cons?

Execs:

- You do not need to be an accepted investor

- Start making an investment with as low as $500

- Low funding control charges of as much as 1% consistent with yr

- 3 other funding objectives – Supplemental Source of revenue, Balanced Making an investment, and Lengthy-term Enlargement – are designed to satisfy your individual funding objectives and chance tolerance

- A cast monitor report of funding development, starting from 8.76% to twelve.42% since 2014

- Alternative to redeem your funding after simply 90 days, which is terribly strange within the crowdfunding trade

- Fundrise can pay distributions quarterly

- Now provides portfolios invested in high-tech development corporations and personal credit score along with genuine property

Cons:

- For the reason that it’s an actual property funding, be expecting to carry investments for no less than 5 years.

- Innovation Fund began simplest past due in 2022 and these days holds fairness positions in simply two corporations

Fundrise Possible choices

Fundrise has so much to provide, however in the event you’re in search of one thing else, listed below are some cast Fundrise choices.

Streitwise

Streitwise is very similar to Fundrise in that it’s an actual property funding believe. That still makes it much less of a real genuine property crowdfunding platform and extra of a standard REIT, regardless that it isn’t publicly traded. You’ll be able to start making an investment with as low as $5,000, and you’ll be both an accepted investor or non-accredited, topic to positive boundaries.

The advantage of making an investment with Streitwise is of their funding method. They search for houses positioned in “non-gateway markets,” because of this they’re decrease priced than houses in high-cost coastal markets. Homes will have to even have high quality development and a report of sustained excessive occupancy with high quality tenants. In addition they prohibit leverage to scale back chance.

Liquidity is extra restricted, alternatively. You can’t redeem your funding for the primary yr. After that, you’ll be topic to a redemption charge of as much as 10%, which can decline to 0 after 5 years. The corporate fees a 2% annual control charge. For extra main points, see our Streitwise overview.

Be told Extra About Streitwise

RealtyMogul

RealtyMogul is any other genuine property crowdfunding platform for accepted and non-accredited buyers. And you’ll in a similar way make investments with as low as $1,000. In addition they provide a chance to spend money on quite a lot of genuine property asset categories, together with industrial, retail, residential, multi-family, and different belongings varieties.

For non-accredited buyers, they’ve the Source of revenue REIT fund. It’s a mixture of each fairness and debt investments in industrial belongings, with an annual distribution goal of 8%.

However for accepted buyers, RealtyMogul provides direct investments in particular person houses. Those investments require at least $25,000 and feature extra really extensive long-term projected returns, regardless that in addition they include excessive charges. Learn our RealtyMogul overview for more info.

Be told Extra About RealtyMogul

Yieldstreet

In its present shape, the nearest selection to Fundrise is Yieldstreet. Just like Fundrise, it provides a wide array of asset categories, along with genuine property. Yieldstreet in a similar way purposes as a substitute funding platform and comprises asset categories like non-public credit score, structured notes, artwork, felony, finance, and transportation – along with genuine property investments.

Greater than $3.2 billion has been invested within the platform since it all started, with present internet annualized returns averaging 9.7% since 2015. For more info, take a look at our complete Yieldstreet overview.

Be told Extra About Yieldstreet

Fundrise FAQs

There is also consequences in the event you liquidate stocks early with Fundrise. As an example, in the event you withdraw price range out of your eREIT or eFund earlier than 5 years, you’re going to pay a penalty of roughly 1%. After 5 years, there’s no penalty. While you make investments with Fundrise, you will have a long-term mindset and be expecting to carry your funding for no less than 5 years.

No longer essentially. Alternatively, you will have to be over the age of 18, be an enduring U.S. resident, have a U.S. tax ID, and document your taxes within the U.S. If this is the case, you must be capable of make investments with Fundrise. Notice that Fundrise isn’t to be had in Canada.

Whilst you’ll reach diversification inside the true property asset magnificence through making an investment in a Fundrise eREIT, your funding isn’t assured, neither is it FDIC-insured. In different phrases, there’s a chance that you might want to lose cash with Fundrise. To reduce doable losses, simplest make investments cash that you’ll have the funds for to lose, and plan to carry your Fundrise funding for 5 years or extra. Your Fundrise funding must no longer be regarded as a core retaining for your funding portfolio.

Ultimate Ideas

The actual property crowdfunding area has grow to be crowded in the previous few years. However Fundrise stands proud as one of the crucial leaders within the box as a result of they provide small buyers a chance to spend money on one of the crucial perfect genuine property investments there may be, industrial genuine property.

And so they don’t prevent there. Fundrise additionally permits small buyers to take part in non-public credit score investments and pre-IPO purchases of leading edge era corporations – earlier than the ones shares are to be had to most of the people.

Perfect of all, you’ll achieve this with as low as $10 and no requirement to be an accepted investor. You’ll no longer simplest get pleasure from a completely various genuine property portfolio, however Fundrise supplies the power to liquidate your funding early – regardless that with positive boundaries and a penalty charge.

However that sticks out as a result of only a few genuine property crowdfunding platforms be offering any alternative for early redemption in any respect.

For those who’re new to genuine property crowdfunding making an investment, otherwise you simplest wish to devote a small amount of cash to a various portfolio, Fundrise is likely one of the perfect choices within the trade. You’ll additionally like Fundrise in the event you’re having a look to spend money on a real selection funding platform that combines genuine property with non-public credit score and pre-IPO era corporate shares.

[ad_2]