[ad_1]

Percentage this text

Over the last week, inscriptions minted on a variety of blockchains have stuck the eye of crypto investors and builders alike because of huge transaction volumes that generated atypical quantities of fuel charges. On Layer 2 (L2) chains like Arbitrum and Layer 1 chains like Avalanche and Solana, there was a proliferation of inscriptions: on-chain items of information which might be saved inside of transaction calldata.

At the Solana community, transactions reached greater than $1 million in cumulative worth since November 13, 2023; Solana task additionally spiked on December 16, with 287,000 new inscriptions created in one day. Those inscription-based NFTs and tokens observe a equivalent construction to Bitcoin’s BRC-20 same old according to Bitcoin Ordinals, with Solana adopting the SPL-20 token layout.

On Avalanche, inscription-related transactions had been recorded to have reached over $5.6 million in one day for fuel prices, as recorded on December 16, 2023. This document is adopted through Arbitrum One at $2.1 million for fuel prices spent on inscriptions.

On December fifteenth, Arbitrum skilled a two-hour outage. Arbitrum remains to be investigating the precise purpose, however its preliminary research discovered a surge in community site visitors stalled the sequencer, reversing batch transactions and draining the sequencer’s Ether reserves. Whilst compromised all over the outage, Arbitrum’s core capability was once restored in a while after.

A contemporary research through the pseudonymous Twitter account Cygaar, a core contributor at Ethereum L2 community Body, sheds gentle at the inside workings of inscriptions and the way those started to get spammed into L2 networks and L1 chains in contemporary weeks.

Persons are ready to junk mail those txns as a result of they are extraordinarily reasonable in comparison to good contract txns.

This has ended in Arbitrum being taken down, and resulting in degraded enjoy on different chains like zkSync and Avalanche.

It is still noticed when this craze will finish.

— cygaar (@0xCygaar) December 18, 2023

What are Inscriptions?

Inscriptions are items of information recorded or ‘inscribed’ onto a blockchain. This knowledge can come with transaction main points, good contract codes, metadata, and extra. The addition of inscriptions to a blockchain now not best provides complexity and richness to the generation but additionally will increase its attainable for securing and managing all forms of information.

In step with Cygaar, inscriptions retailer token or NFT metadata in on-chain transaction calldata. This permits low cost transactions for “xRC-20” tokens – the place “x” represents requirements like BRC-20, ZRC-20, and so forth. – for the reason that bulk of the good judgment and enforcement occurs off-chain. Against this, good contacts retailer vital information on-chain and require extra computational sources and thus, upper charges. Different inscription token requirements come with PRC-20, BSC-20, VIMS-20, and OPRC-20.

“Good contracts wish to execute good judgment and retailer information on-chain. Inscriptions best contain sending calldata on-chain, which is way less expensive to do,” Cygaar explains.

Inscriptions are being spammed on networks like Avalanche, Arbitrum, and Solana prone to protected an early place for buying and selling speculative, low marketplace capitalization alternatives. Then again, those repetitive computerized mints and transfers be offering little application and feature led to congestion and outages. If those inscription transactions proceed to dominate task, adjustments to those protocols is also required to restrict their disruption.

Chain Analytics: Best networks minting inscriptions

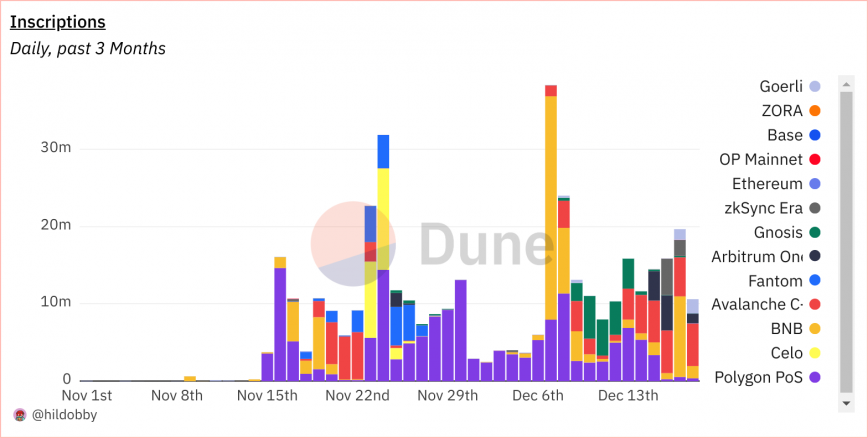

A dashboard on Dune Analytics printed through Hildobby, an on-chain analyst at crypto undertaking capital company Dragonfly, supplies some insights into the have an effect on of inscriptions on EVM chains.

In step with the dashboard, inscriptions have exploded throughout all primary EVM-compatible blockchains during the last week.

Between November 15 and December 18, chains like Polygon, Celo, BNB Chain, Arbitrum, and Avalanche are seeing day by day inscription transaction volumes within the tens of millions, with the highest six chains representing over part of all 13 indexed chains.

Polygon PoS has probably the most choice of inscriptions (161 million), whilst BNB Chain has probably the most choice of inscriptors (217k). Ethereum has probably the most choice of inscription collections, regardless of best having 2 million inscriptions minted through 84,000 inscriptors.

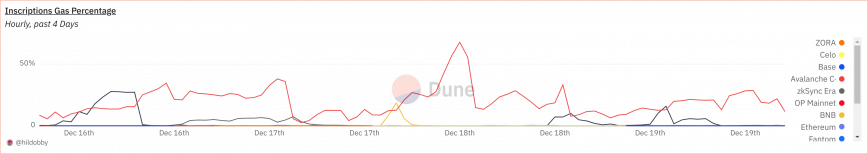

Many of the fuel prices are claimed through the Avalanche C Chain, which crowned all different chains, claiming 68% of all transactions on December 18.

Potentialities for inscriptions

Despite the fact that some protocols get pleasure from the task spikes as a result of income from fuel reimbursements, analysts argue that systemic adjustments like adjusting fuel pricing algorithms, restricting which transactions qualify for compensation, or outright blocking off identified junk mail accounts will probably be crucial to verify those don’t impair community capability.

Then again, the proliferation of inscription-related task additionally incentivizes miners. Miners get pleasure from higher quantity and cumulative rate income regardless of minimum per-transaction fees. Particularly, on Avalanche, transaction charges are paid in AVAX, and the transaction rate is mechanically deducted from one of the most addresses managed through the person. The associated fee is burned (destroyed ceaselessly) and now not given to validators.

The hot spike in low cost inscription transactions on EVM-compatible blockchains seems to be pushed extra through momentary income than actual application. Arguably, coverage adjustments round transaction charges or restrictions is also important to forestall the prevalence of network-disrupting transaction volumes from meaningless task. For inscriptions to mature as a scalability resolution moderately than only a fad, they will have to permit treasured packages as a substitute of repetitive token minting.

Percentage this text

[ad_2]