[ad_1]

LISTEN TO THIS FUEL FOR

THOUGHT PODCAST

The car trade is achieving an

inflection level that can reshape its near-term long run,

caused by way of the hooked up automotive period – often referred to as utility

explained cars or “SDVs.” This will likely impact each and every facet of long run

mobility, from Generative AI implications in Degree 2+ autonomy to

the HMI of the cockpit area utility.

At the eve of CES, automakers and providers are

carefully tracking the evolution of hooked up automobiles – encapsulated

within the “CASE” acronym of Attached, Self reliant, Shared, and

Electrical. This transition shall be a very powerful to rebalancing the

car cost chain and to how OEMs exert regulate over the

car meeting procedure. However this comes to extra than simply the

development of the software-defined car. Automakers additionally will

try to extract extra cost from the carrier existence of those

cars.

OEMs want to wrest again regulate from

tier 1 and system-on-chip (SoC) providers involving income that

can accrue over a car’s lifetime, together with in-vehicle

packages and digitized products and services that SDVs facilitate with

ease.

The facet impact shall be a duration of upheaval

and rebalancing within the provider cost chain, thus making the

transition complicated.

This transformation threatens to upend the trade’s

cost chain, which has been taken without any consideration since Henry Ford’s

first shifting manufacturing line in 1913 at Highland Park, and the

authorised orthodoxy of the Toyota Manufacturing Device that is formed

the trade’s cost chain during the twentieth century and early phase

of the twenty first.

After all, any such reshaping of the car

cost chain shall be strewn with stumbling blocks and opposition –

geopolitical and sensible – and OEMs will face opposition from

trade individuals reluctant to cede their position on the

desk.

Traditionally, the car trade has

fascinated by cost-optimizing {hardware}, similar to with semiconductors.

Instrument used to be noticed as essential, however no longer as strategically necessary

as {hardware}. Tesla’s unleashing of the software-defined car –

with its over-the-air updates – challenged the established order. It is not

that utility wasn’t strategically necessary, simply that the

trade simplified utility to the price of reminiscence.

Construction of digital purposes used to be rooted

in each expediency and price. The symbiosis between {hardware} and

utility used to be simple: Extra code merely translated to a extra

dear microcontroller unit (MCU). Minimized {hardware} prices

minimized utility measurement. This justified the proliferation of MCU

derivatives in response to other reminiscence sizes as long as smaller

reminiscence translated into decrease {hardware} charge.

This manner has ruled car R&D

considering for many years, with mild evolution becoming very easily

inside the present car cost chain buildings and

conventional platform redesign cadences. OEMs orchestrated subject matter

flows and wielded cost-down energy.

Electrical

cars and the hooked up automotive alternative

OEMs are emboldened by way of the brand new E/E

architectures and product construction procedure shifts happening.

Those adjustments shall be evidenced in 2024 and 2025, when Degree 2+

computerized cars, entire with the standard adoption of

over-the-air (OTA) updates, will develop into extra mainstream.

OTA brings a couple of

income alternatives. OTA updates additionally permit the car to be

maintained, up to date, and feature options added over its lifetime

with out visiting a dealership. With OTA, the preliminary sale of the

car turns into the beginning, somewhat than the tip, of the

value-extraction procedure for the automaker.

Inside the present trade construction, there may be

little incentive in the case of go back on funding for automakers to

stay the established order. The present apply is for {hardware} providers

to embed their utility in deliverables. A living proof is

Mobileye’s dominant place within the pc imaginative and prescient area, the place

they are able to leverage each their {hardware} and utility stack. The place the

utility is embedded and there’s a requirement for post-delivery

customization, there both is a price implication for the OEM, or

the income generated from the innovation is shared with the

seller.

With the Degree 2+ rollout, OEMs are cautious of

repeating that have and being bypassed. With an expanding

set of products and services being introduced over a car’s utilization existence cycle –

all enabled by way of utility – and figuring out that carrier revenues come

with two- to 4 instances the margins of {hardware}, OEMs see an

alternative to not be neglected.

Tesla as

harbinger of exchange

The early good fortune that new-era OEMs like Tesla,

Xpeng, and Nio have had in internalizing utility construction —

and due to this fact revenues — has aroused resentful glances from

legacy automakers. And they have got some degree – up to some extent. Tesla’s

EBITDA margin continues to outpace its competition. In 2022, Tesla

recorded a margin of 21.4%, whilst a collection of 11 of its

established competition controlled a mean of 12.6%. Tesla’s margin

in 2022 used to be just about 50% greater than that of Honda, which used to be the

strongest-performing competitor, consistent with S&P World Marketplace

Intelligence.

After all, Tesla’s margins aren’t only

because of its utility manner, even though it indisputably

is helping. It eschews promoting, and its platform vary is slender,

which slashes prices. Moreover, different methods such because the

one-piece gigacasting will

give a contribution to its base line.

However Elon Musk sees the sale of a utility

explained car as simply the place to begin of the patron

dating. All the way through Tesla’s This autumn 2022 incomes name, Musk mentioned,

“We are the one ones making automobiles that, technically, lets promote

for 0 benefit every now and then yield super economies within the

long run thru autonomy. No person else can do this.”

Musk put that declare to paintings on the finish of 2022,

when Tesla started deep worth cuts to its fashions which reduced its

margins – however nonetheless equipped a better go back than its friends,

inflicting jitters in competition’ electrification methods.

Tesla’s SDVs additionally problem car construction

orthodoxy. Moderately than a car present process pricey minor bodily

engineering adjustments each and every 3 years, then main architectural and

platform redesigns each and every six years, the SDV permits for a distinct

manner by means of OTA updates. Legacy OEMs will dissent, then again,

mentioning that adopting Tesla’s practices will lead to quantity decay

for cars who are suffering lengthy cycles between design adjustments.

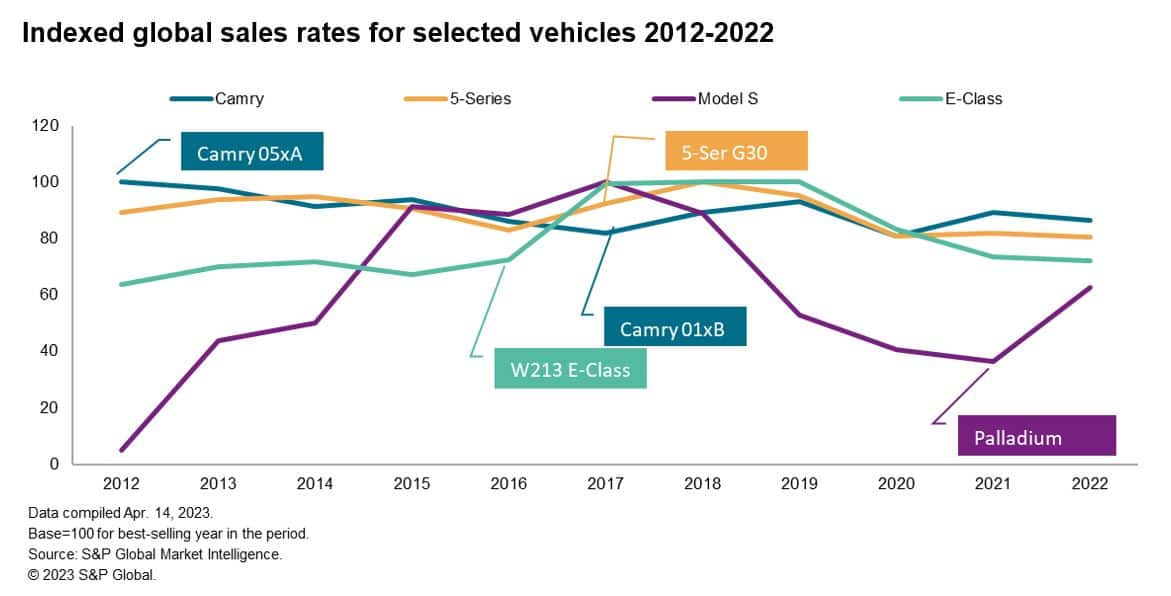

The chart beneath indexes gross sales of E-segment

cars that compete with the Tesla Style S globally over a duration

– starting with the Style S’s release yr of 2012 thru 2022.

Over the ten years, competing fashions all underwent vital sheet

steel adjustments, whilst the Style S’s 2021 ‘Palladium’ replace used to be a ways

much less concerned on a subject matter foundation. Whether or not legacy OEMs will abdomen

the possibility of such pronounced gross sales decay is a moot level.

Middleware and Attached Automobile construction

The battleground for the SDV cost chain is

already creating – and the primary conflict comes to middleware.

Foundational parts like working methods

aren’t a space that OEMs will strategically spend money on, however as a substitute

deal with like a commodity by way of signing long-term contracts. The

construction of a digital utility layer between {hardware} and

utility by way of automakers is any other house of intense analysis. This

layer would allow the interpretation of complicated {hardware} and utility

sources right into a easier layout within the higher layer

utility stack.

Attaining this purpose permits the separation

of the {hardware} lifecycle from the utility serve as construction.

Every can then serve as independently, offering extra choices for

long run collaboration with the brand new utility provide chain.

The commodity middleware hyperlink may have a

level of customization and there shall be some collaborative

funding, however it’ll be with one eye on long run infrastructure

necessities for SDVs. These days, that is the place firms similar to

Mobileye and Nvidia exist.

However automakers need to broaden and personal the

strategic middleware area. Distributors must stay the seller’s

code or its interfaces, main to a price for each and every customization

and, occasionally, a license rate payable on a per-vehicle foundation.

Providers rebut this place, insisting that utility isn’t a

core OEM competency – pointing to VW’s notoriously stricken CARIAD

utility construction. Moreover, distributors similar to Mobileye have

constructed a powerful energy base that can turn out difficult for OEMs

to split duties for utility from {hardware}.

No longer all OEMs may have the wherewithal or

want to possess this house of the worth chain. Some automakers

in truth see a turnkey middleware answer as horny. This

may well be because of the OEMs missing in-house utility capacity, no longer

actively creating SDVs or Degree 3 cars, or a choice to be

a quick follower somewhat than a primary mover and profit from

decrease construction prices.

The human-machine interface (HMI) and consumer

enjoy (UX) is a key a part of any OEM’s core competency – and a

emblem differentiator in an international of more and more homogenous car

design. If regulate of the API and middleware is secured, this may

be a space of 100% OEM participation.

There is also the SDV’s backend to believe.

SDVs want a right away uplink and downlink cloud connection. As

latency is very important in supporting the brand new trade fashion, it’s

most likely that OEMs will even search to possess the relationship between cloud

platform products and services and the middleware. This can be a trail that BMW, VW,

and Tesla have already embarked upon, and others are certain to

practice.

SDVs and

parallel cost chains

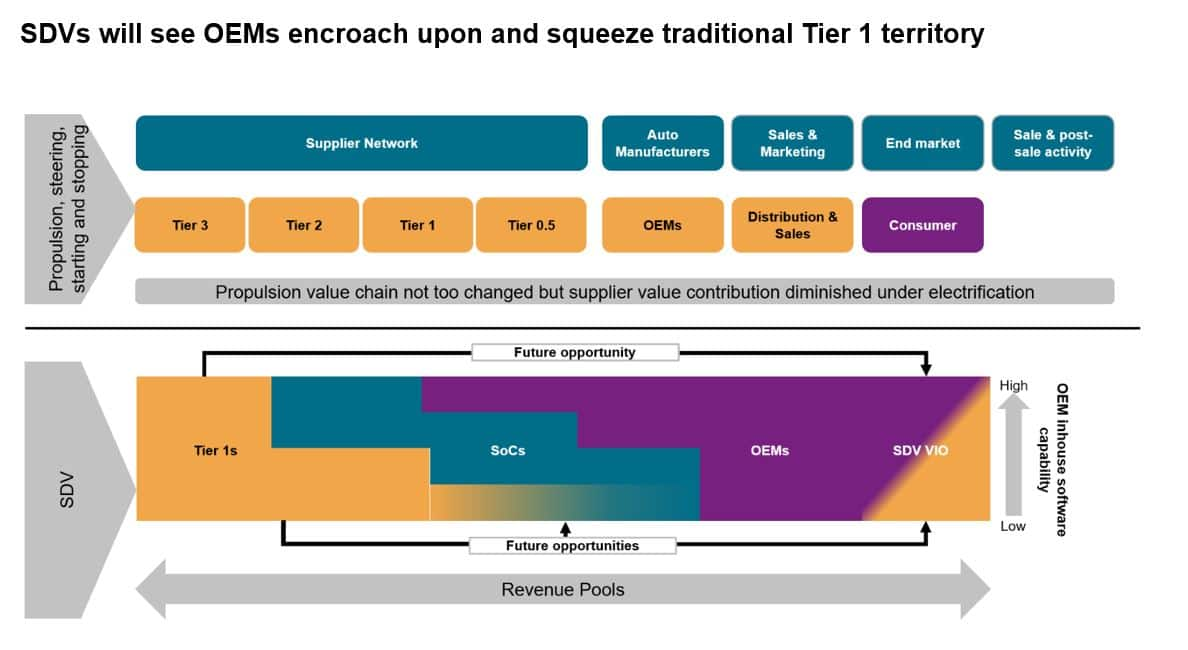

The decoupling of the car construction

procedure from a car’s {hardware} and utility integration underneath

the SDV megatrend will see two cost chains broaden in tandem.

Whilst the normal view of the worth chain will remaining, its center of attention

will shift to what makes the car transfer, exchange route, and

get started and forestall.

Electrification will diminish the worth that

conventional mechanical parts give a contribution to a invoice of fabrics

(BOM), because of the battery and electrical motors changing into larger

constituent parts in comparison to inside combustion. On account of

the E/E and utility revolution, conventional mechanical parts

will develop into more and more commoditized, hanging power at the

provide base.

Tier 1 providers hoping to make use of their car

utility experience to money in on SDVs and migrate from their position

as formula integrators to utility integrators face a fight. In an

idealized situation, OEMs are reluctant to cede flooring to both the

SoC distributors or the tier 1s. Alternatively, given the selection of who’s

extra central to long run trade, they’re most likely to make a choice the SoC

distributors.

OEMs will lead the

determination

Automakers are crucial in figuring out how the

SDV cost chain develops. The level in their involvement will boil

all the way down to the extent of in-house utility capacity. This can also be

formed from a philosophical or strategic point of view, or it may be

because of the supply of economic and human sources.

The ones with out the monetary capacity to head it

on my own will go for construction partnerships in commodity middleware

and foundational portions of the strategic middleware. Right here, an OEM

can then use the platform a spouse provides to broaden their API.

This permits an OEM to no less than have some pores and skin within the recreation.

For the provider of the middleware platform

any such partnership additionally gives some way ahead — however is based upon

the provider having evolved an answer set in-house (e.g., Bosch

and ETAS, ZF and Mediator) or obtaining the aptitude. Such an

association used to be shaped in April 2023 by way of JLR with Elektrobit, which

is owned by way of Continental. From 2024, JLR’s EVA Continuum platform

will use Elektrobit’s utility platform and working formula.

Those new partnerships may portend the tip of

eras explained by way of regularly confrontational and adverse provider

family members. The arrival of the SDV may herald a extra

collaborative period, permitting extra trade individuals to percentage in

the spoils on be offering from the SDV revolution.

————————————————————–

Dive deeper into those mobility insights:

MORE ON THE FUTURE OF MOBILITY AND

CONNECTED CARS

MORE ON AUTONOMY, CAR SHARING AND

ELECTRIFICATION

AUTOMOTIVE PLANNING AND

FORECASTING

TECHNOLOGY VEHICLES IN

OPERATION

This newsletter used to be printed by way of S&P World Mobility and no longer by way of S&P World Scores, which is a one at a time controlled department of S&P World.

[ad_2]