[ad_1]

The tempo of trade isn’t slowing down. Shoppers’ expectancies have radically modified, they usually be expecting a lot more from their banking services and products than ever earlier than. To care for relevance, banks want to be at the pulse of those wishes and create merchandise to unravel them—to free up price for each their consumers and the financial institution.

The truth is that, over the last decade, banks’ merchandise have converged towards practical equivalence whilst changing into emotionally devoid. And as banks larger their reliance on virtual touchpoints throughout the pandemic, they was even much less hooked up with their consumers.

So as to add to this paradox, 0 charges have distorted the marketplace, using many banks to concentrate on person merchandise as a substitute of the buyer as a complete. As charges proceed to upward thrust, the restrictions of this manner shall be uncovered, proving a brand new fact of price for banks.

How can banks spark this alteration, making the most of a emerging charges setting to innovate for lately’s wishes and buyer values? We consider there hasn’t ever been a greater time to be within the banking trade, and banks have each the chance and the restored profitability to prioritize product innovation and gasoline enlargement.

Banks are neatly situated to take a proactive position as they face converting laws, moving shopper personal tastes and emerging rates of interest. As of late, they should rediscover their ingenious mojo and innovate for lately’s consumers.

On this information:

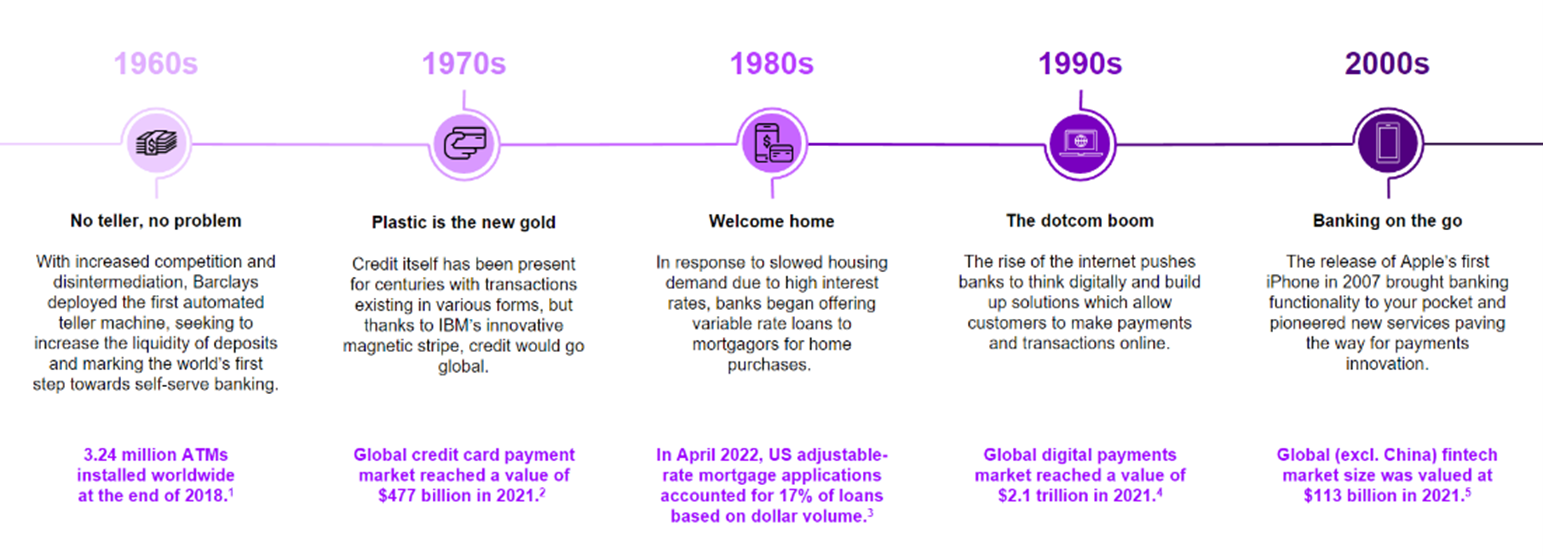

The historical past of product innovation in banking

Within the many years earlier than the Nice Recession, banks depended on unrelenting product innovation to pressure enlargement. From praise playing cards and no-fee checking to adjustable-rate mortgages, debit playing cards and rapid credit score, this innovation has benefitted consumers and banks alike.

However during the last 20 years, banks have shifted their center of attention clear of innovation. The 2008 monetary disaster became the eye of banks towards financial restoration, adhering to new regulatory requirements and using down prices by means of digitizing their processes and studies.

In parallel, adjustments in shopper wishes and the upward thrust of recent applied sciences set the level for a brand new working setting. However innovation didn’t decelerate. Neobanks, fintechs and bigtechs began using trade inventions akin to purchase now, pay later lending fashions and early payday lending.

As of late, new aggressive threats proceed to emerge in all styles and sizes. Bigtechs are leveraging their shopper information, complex analytics functions and massive community results to spouse with nimble fintechs, shooting important marketplace percentage throughout their increasing world footprint—all with no banking license. Those non-traditional competition display ambitions past changing into virtual banks, and their foray into monetary products and services makes a speciality of developing new assets of price and strengthening their ecosystem by means of reimagining trade fashions.

Banking Best 10 Tendencies for 2023: Our annual file predicts the tendencies that can form banking’s long term.

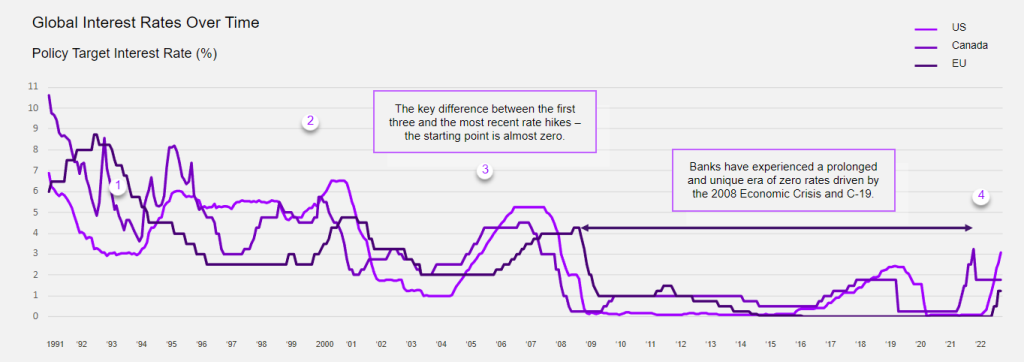

What have an effect on have 0 charges had on banking product innovation?

A decade of 0 charges distorted the marketplace by means of inflicting a flood of inexpensive money and enabling choice lenders and venture-capital-backed fintechs to gasoline the purchase of rising and underserved buyer segments. All through this era, the product calculus modified hastily, forcing banks to concentrate on optimizing and advertising and marketing person merchandise quite than growing built-in propositions for purchasers.

That is published within the shrinking position of banks relative to the total monetary gadget, new competition and different intermediaries. This pattern is plain in advanced economies akin to the USA, the United Kingdom, Europe, Japan and others. This has been partially engineered by means of regulators looking for to cut back possibility inside the banking gadget that was glaring within the 2008 monetary disaster.

Whilst those laws and possibility controls aimed to construct a extra resilient economic system, the prison, regulatory and coverage requirements have now not advanced to deal with the brand new aggressive banking setting. The decade noticed an explosion of non-regulated gamers, akin to fintechs, bigtechs and non-banks, and those competition have attacked the banking price chain to construct and serve all of the merchandise of a financial institution with out the restrictions of banking laws.

Moreover, throughout this time, the endurance of 0 rates of interest ended in 4 primary directional adjustments that drove consumers and enlargement out of doors the banking trade:

- The upward thrust of neobanks

- Non-public banking skilled a proliferation of recent fintech banks, attaining 250 globally in 2022. Affordable deposits and streamlined studies powered by means of greater than $300bn in investment helped neobanks open greater than 33mn accounts since 2019.

- The explosion of virtual lending

- Rock-bottom charges fueled large off-balance-sheet investment. The choice of private and shopper lenders exploded, whilst new entrants akin to neobanks quintupled the worth of virtual lending since 2010. (Even Goldman were given into the sport with Marcus providing private loans and financial savings.)

- The disaggregation of SMB merchandise

- Fintechs systematically disaggregated small trade banking, with entrants like Sq. and Kabbage rising. PayPal received Swift Monetary to strengthen its SMB lending trade. Brex constructed a SMB bank card trade. And Shopify and Uber began providing built-in banking.

- The substitute of banks by means of non-public fairness (PE) corporations

- Non-public credit score took off as corporations seemed to fill the void led to by means of the retreat of banks from middle-market and different kinds of ‘riskier’ lending alternatives. PE corporations introduced top yields for institutional and rich traders, outperforming the S&P500, the Russell 2000, and enterprise capital throughout a duration of low rates of interest.

Resources: The Monetary Emblem, Accenture Analysis, S&P Capital IQ, CB Insights, SVB, Insider intelligence, Bloomberg

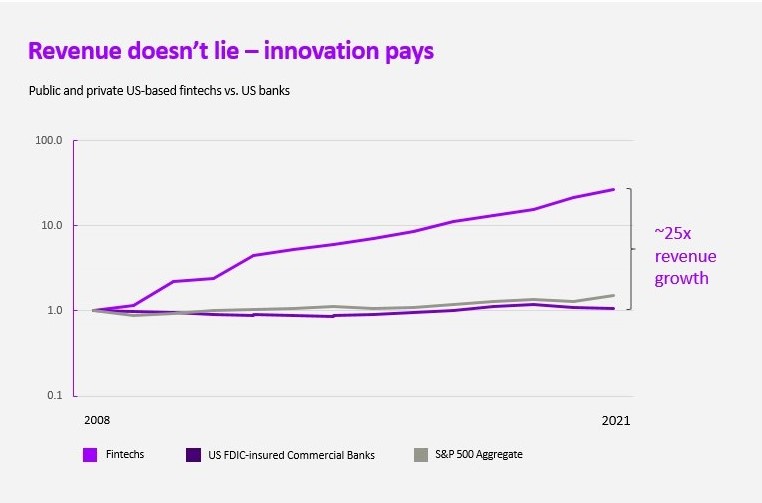

And earnings doesn’t lie—innovation will pay. The post-recession distinction is evidenced within the hovering earnings enlargement of fintechs whilst banks stagnated. Accenture analysis presentations fintech revenues have grown to a subject matter percentage: $100bn in the USA by myself. This pattern isn’t distinctive to the USA; new competition have captured the next percentage of earnings in the United Kingdom and China, additionally house to one of the most international’s main neobanks and bigtechs.

What’s the alternative for banking product innovation in a emerging charges setting?

As of late, amid emerging rates of interest, macroeconomic volatility and a converting regulatory panorama, banks have the merit. Robust and diverse steadiness sheets, consider, economies of scale and enjoy adapting to modify in combination set the level for banks to go back to their cutting edge roots.

And simply as 0 pastime distorted product economics, we see the emerging rates of interest because the gravity pulling trade and product methods again in combination. This may increasingly have quite a lot of affects:

- Deposits are the brand new rocket gasoline: Low beta deposits are the top class legal responsibility each financial institution desires. Emerging charges will pressure separation between hot-deposit banks and diverse banks that successfully use virtual studies to control front- and back-book spreads.

- From product siloes to the entire buyer: Banks will start providing holistic price propositions and end-to-end capability, growing merchandise that hyperlink deposits and lending and enlarge price.

- Unbundling and rebundling of banking: Banks will ship enlargement by means of unbundling their legacy tech and product distribution and rebundling with companions at decrease prices and quicker occasions to marketplace.

- A neo-normal: Neobanks funded by means of sizzling deposits are dealing with pullbacks in investor investment and falling valuations. Banks have a once-in-a-generation alternative to procure fintechs to search out new consumers, boost up innovation and soak up fascinating fintech skill.

- The latent virtual dividend: Popping out of the pandemic, 97% of purchaser touchpoints are both on-line or cell. Discovering a option to leverage trendy information and generation methods to go/up-sell merchandise in a similar way to a department enjoy will free up huge price in buyer relationships.

Qorus-Accenture Innovation Awards main the way in which in banking innovation

The Qorus-Accenture Banking Innovation Awards is a world program that honors trailblazers within the banking trade. The 2023 rite honored a decade of groundbreaking developments and showcased the 12 months’s maximum peculiar and promising inventions.

Bradesco used to be named World Innovator 2023 for the financial institution’s ongoing willpower to innovation, as a part of its dedication to handing over world-class studies to its consumers, companions and workers. Bradesco introduced a number of new services and products, together with its E-agro platform, that makes use of information analytics to give a boost to farmers’ get admission to to assets and beef up, and an inside e-commerce platform that permits workers to request and monitor company provides.

And there should be a man-made intelligence (AI) point out in terms of banking innovation. In reality, with its rising recognition, the awards noticed this generation infused in maximum classes. ABN AMRO took the Long run Team of workers award for ‘ABN AMRO Touch Centre GenAI’. It makes use of generative AI methods to allow name middle brokers to unexpectedly resolution buyer queries and give a boost to agent efficiency and process pleasure.

Intesa Sanpaolo won the Reimagining the Buyer Revel in award for ‘Ellis: Cognitive AI & GenAI Revolutionize Buyer Provider’. This clever virtual assistant operates around the financial institution’s cell app, web banking and public web site platforms and makes use of synthetic intelligence to speak with consumers.

The awards additionally highlighted the want to center of attention on sustainability throughout classes. BNP Paribas Fortis, as an example, claimed the Past Core Banking Choices award for its ‘HappyNest’ initiative that makes power environment friendly housing extra obtainable by means of providing new inexperienced homes to condominium consumers who can later purchase their houses at a cut price.

We inspire you to take a second and browse the whole record of 2023 successful inventions.

What are some cutting edge product concepts that banks can discover now?

To kickstart the ideation procedure, we requested our world banking group: “How would possibly we cope with the evolving monetary wishes and behaviors of shoppers with services and products that may pressure earnings enlargement in an an increasing number of unsure setting?”

We pitched over 150 product concepts, with the purpose of enlargement and assembly the desires of lately’s consumers. We’re sharing nearly 50 on this information, classified by means of 8 product subject matters, to assist banks rediscover their ingenious mojo for product innovation.

[ad_2]