[ad_1]

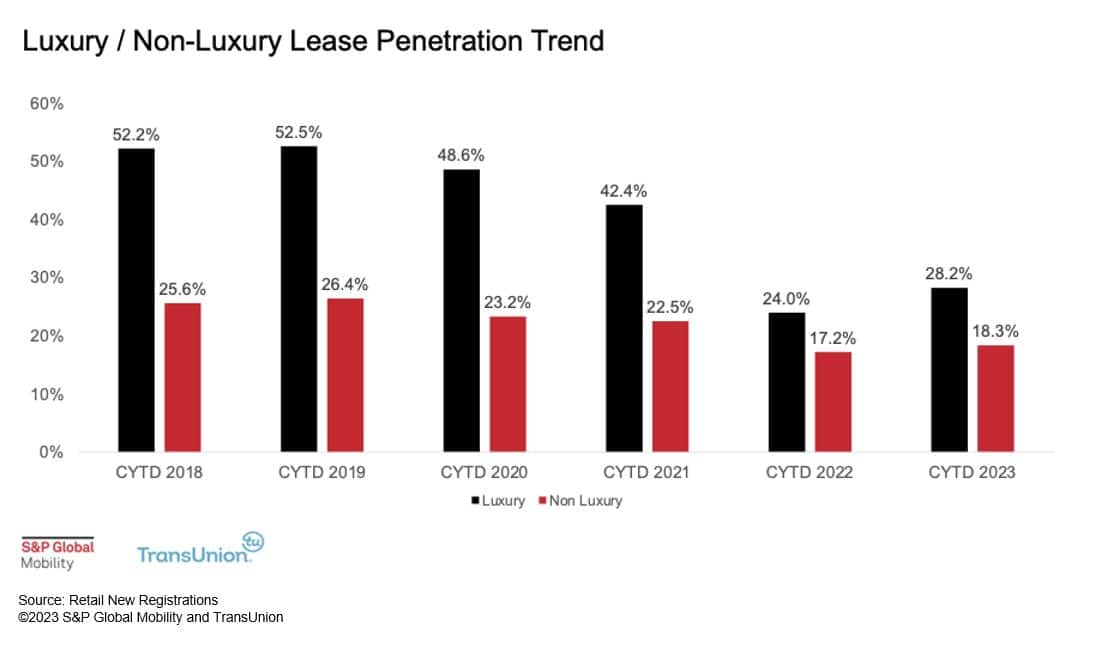

Within the years prior to the pandemic, new automobile leasing

accounted for 25-30% of all retail transactions, and marketplace

penetration used to be as top as 53% within the luxurious sector. However right through the

pandemic, new automobile rentals fell to as little as 17%, and the

restoration has been gradual. A marketplace research of knowledge from S&P

World Mobility and TransUnion predicts leasing will go back to shape

when stock ranges creep closer to conventional ranges which then

ends up in a necessity for greater incentives. Nevertheless it has a protracted approach to

get well.

At a time when a loss of automobile

affordability is crushing family budgets, leasing must be

a great way to entice consumers with Champagne tastes however beer

budgets. Information from AutoCreditInsight from S&P World Mobility

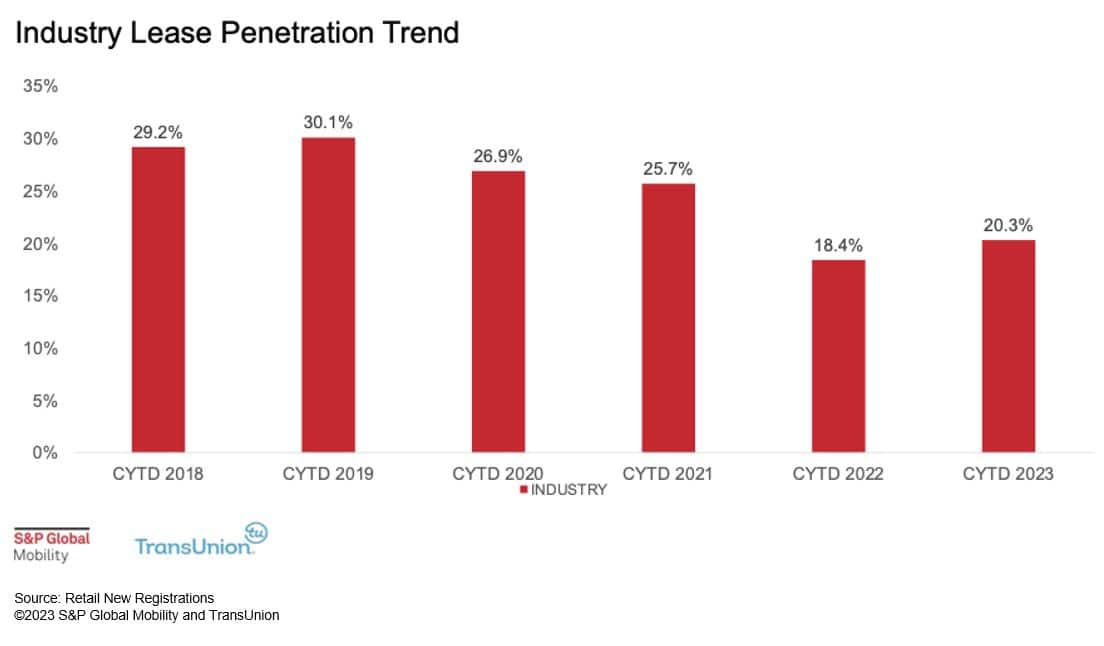

and TransUnion presentations that leasing penetration has scarcely

recovered from its pandemic low, with only a slight rebound to

20.3% for CYTD 2023 thru September.

The new underlying rent tendencies aren’t wholesome. Whilst just about

part of rent returnees opted to rent once more in 2019, that quantity

dropped to twenty-eight% in 2022. What is extra, first-time lessees in 2022

have been not up to 30 % of the leasing marketplace.

That is unhealthy information for sellers and OEMs, as a result of fewer first-time

lessees lower the long-term price of that client as a

doable returning buyer – at the side of reduced alternatives

for qualified pre-owned gross sales sooner or later.

Leasing and emblem loyalty

To know the decline in leasing, you should go back to the brand new

automobile stock disaster of 2021. As new automobile inventories

declined because of logistical problems and chip shortages, broker

mark-ups rose, and client incentives disappeared. Sellers sought after

a successful acquire transaction over leasing; customers in want

of a automobile weren’t able to barter and thus weren’t

introduced with leasing choices on the dealership.

The mix of those marketplace stipulations intended leasing used to be a

tertiary concept for everybody concerned. As those tight stipulations

retreat, the marketplace will see a go back of stock and negotiating

energy for the patrons – and leasing will once more to be thought to be

by means of the sellers.

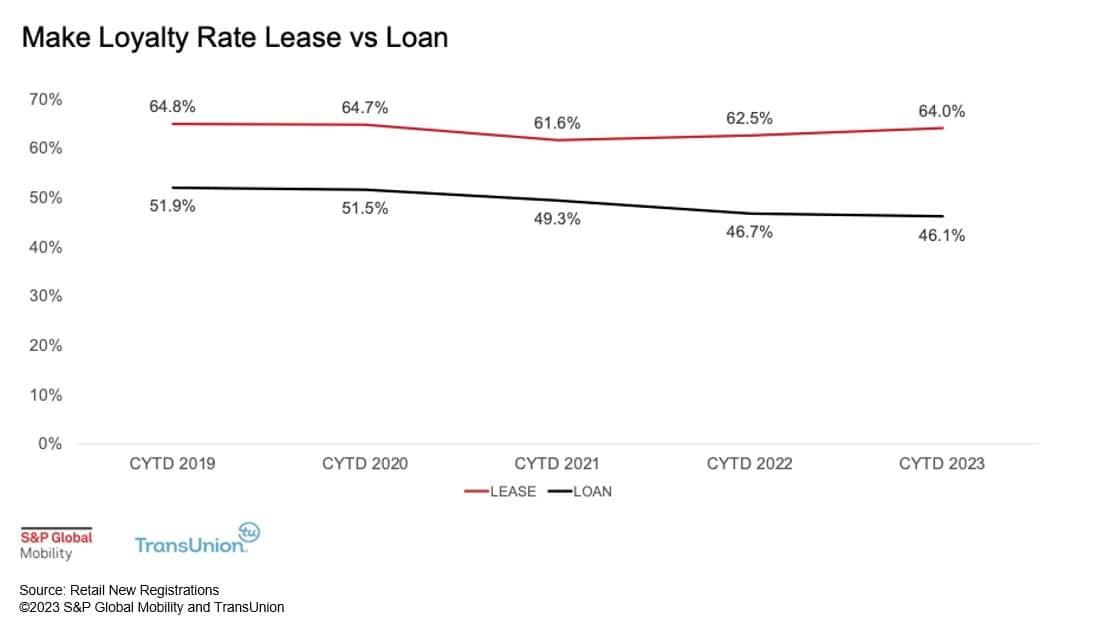

On account of the quick-turn nature of leasing, the energy of the

captive leasing incentive systems, and the most likely go back of the

automobile to the unique broker – in comparison to a brand new automobile that used to be

financed for a long run – leasing carries a ways more potent loyalty

charges.

If one have been to use the rent penetration price from 2022 to the

quantity of 2023, it is estimated that there would were greater than

630,000 further cars leased. When making use of the rent loyalty

raise vs acquire or finance, there would were just about 103,000

extra transactions that most likely would have stayed emblem dependable,

in keeping with S&P World Mobility estimates.

To jumpstart the speculation of leasing, producers will understand the

wish to re-start the extremely precious advertising gadget they

created. However it’ll take baseline components of declining pastime

charges, pricing balance, and normalization of stock

ranges.

“Producers have been promoting to the partitions each and every month when

inventories have been constrained, so they’d no reason why to supply

incentives. In truth, the most well liked cars have been ceaselessly being

offered for over MSRP,” stated Jill Louden, affiliate director for

AutoCreditInsight at S&P World Mobility.

“The celebs will align if producers would activate subvented

leasing as soon as they’re extra happy with stock days’ provide

and begin to see greater festival. Leasing trade flows

thru their very own captive finance corporations as there’s much less

festival from different lenders in leasing,” Louden added.

Louden stated subvented rentals might appear short-sighted, however they

result in loyalty to the emblem. In truth, 79 % of customers who

rent once more are make-loyal – which makes it prudent for sellers to

keep involved with leasing consumers to stay them from defecting to

some other emblem. That is very true with luxurious manufacturers.

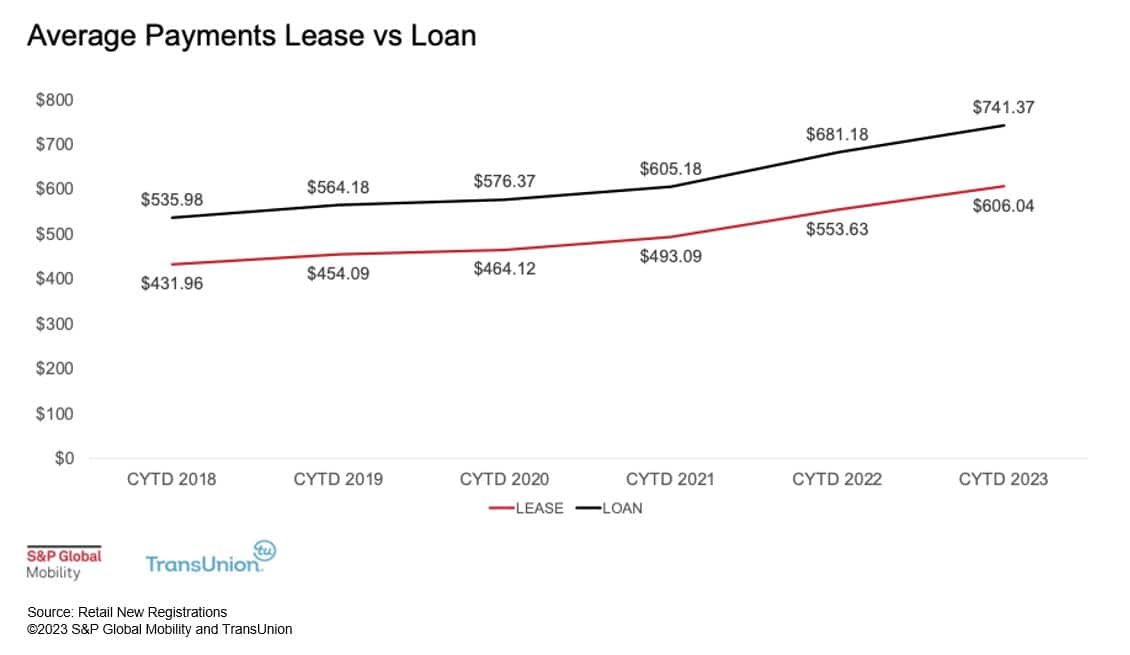

Client advantages of leasing birth with a decrease per thirty days fee

for the similar automobile, roughly $175 much less per thirty days on

new non-luxury bills.

On the other hand, per thirty days rent bills have no longer escaped the

inflationary spiral within the retail automobile trade. Rent bills

nowadays are as top as finance bills have been only some years in the past. So

as a substitute of leasing, customers are an increasing number of financing new

automobile purchases for longer phrases. Loans of 84 months have grown

from 5.4% of retail loans in 2021 to ten.4% in 2023, in keeping with

S&P World Mobility and TransUnion AutoCreditInsight

research.

Leasing additionally advantages OEMs by means of fostering a quicker go back to

marketplace. Just about two-thirds of rent families RTM inside 36 months,

in comparison to 51% of acquire families. It will support emblem

engagement, facilitate extra alternatives to upsell or cross-sell,

and fortify loyalty to the emblem.

“With leasing, OEMs will see a aggressive benefit for his or her

captive finance corporations in segments and markets the place the banks

and credit score unions would no longer be as aggressive or take part at

all,” Louden stated.

Rent returns shedding in overdue ’24

On the other hand, the stock constraints of the previous few years will

prolong the leasing birthday party from beginning up once more anytime quickly. In

truth, whilst anticipated rent terminations are anticipated to upward thrust to

about 800,000 gadgets by means of Q2 2024, they must regularly decline in Q3

and This fall, finishing 2024 at fewer than 500,000 gadgets, in keeping with the

TransUnion client credit score database.

Because of this, except induced by means of exterior components, fresh tendencies

point out that the recognition of leasing is a number of years away at

perfect, stated Satyan Service provider, senior vp for the

car line of industrial at TransUnion.

“Leasing shall be in fashion once more when producers need it to

be, as a result of leasing and lending incentives are decided by means of

inventories,” Service provider stated. “It is just like the iPhone: Other people desire a

new automobile each and every few years and they may be able to get that thru auto

leasing.”

CHECK OUT OUR RTM AND LEASE-ENDING

DATA

LEARN MORE FROM

AUTOCREDITINSIGHT

CONSUMER LOYALTY TO FINANCE

COMPANIES FELL SHARPLY DURING PANDEMIC

This text used to be printed by means of S&P World Mobility and no longer by means of S&P World Rankings, which is a one at a time controlled department of S&P World.

[ad_2]