[ad_1]

Percentage this text

S&P International Scores, a number one monetary knowledge research company, not too long ago offered a stablecoin balance review. This review charges cryptocurrencies in response to their talent to deal with a strong worth in opposition to fiat currencies, with ratings starting from 1 (indicating robust balance) to five (appearing weak point).

Gemini Greenback and Circle’s USDC gained the absolute best scores from S&P, scoring a 2, classified as “necessary.”

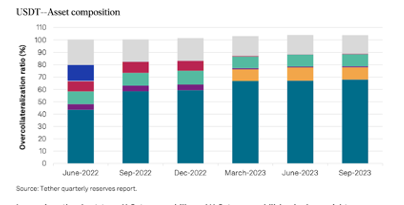

Against this, Tether’s USDT and different stablecoins like Frax and Dai gained a ranking of four, regarded as “constrained.”’ S&P attributed those decrease ratings to dangerous reserve belongings and a loss of transparency in control procedures.

This rating means that USDT might face demanding situations persistently keeping up its peg to the USA greenback.

S&P recognized a number of weaknesses in Tether’s operations, together with restricted reserve control and menace urge for food transparency, a scarcity of a regulatory framework, no asset segregation to give protection to in opposition to the issuer’s insolvency, and obstacles to USDT’s number one redeemability.S&P explicitly said:

“In our view, the temporary US treasury expenses and the USA treasury-bill-backed in a single day opposite repos (78% of the collateralization ratio) constitute low-risk belongings. On the other hand, the Tether reserve document does no longer reveal the entities that act as custodians, counterparties, or checking account suppliers of the belongings in reserve.”

In spite of those issues, USDT has demonstrated notable worth balance not too long ago, even all through vital crypto marketplace volatility occasions.

Percentage this text

[ad_2]