[ad_1]

Deposits and advances of all scheduled banks soared by way of over ₹2-lakh crore each and every within the reporting fortnight ended December 1, 2023, in line with RBI’s Scheduled Banks’ Remark of Place in India.

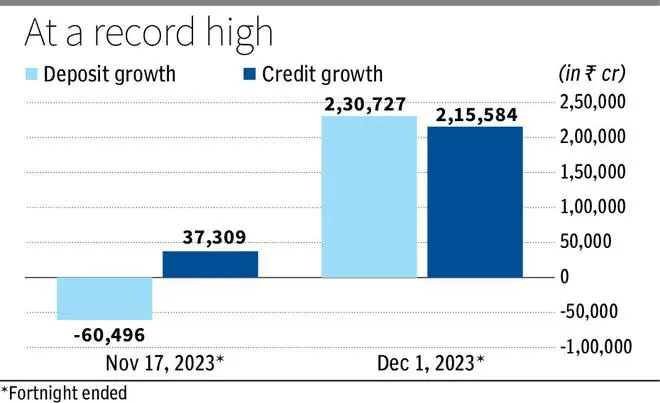

Deposits and advances jumped by way of ₹2,30,727 crore and ₹2,15,584 crore, respectively. Within the previous fortnight ended November 17, 2023, whilst deposits declined by way of ₹60,496 crore, advances rose by way of ₹37,309 crore.

“Competition call for is ebullient. In city spaces, shopper home equipment are in robust call for, particularly within the mid-and top rate segments. Shopper sentiment is upbeat. Just about 80 in line with cent of purchases of shopper durables are reported to be via shopper financing schemes spiced up with sexy equated per thirty days instalment (EMI) gives. Access-level phase call for is somewhat subdued as ‘premiumisation’ presentations transparent indicators of creating right into a constant pattern,” in line with a document in RBI’s November per thirty days bulletin.

Micro, small, and medium enterprises (MSMEs) supplying to in-demand segments also are experiencing a surge in orders, specifically from companies promoting via platforms and big structure retail outlets. In flip, financial institution loans to MSMEs is powerful.

“Within the inexpensive housing area, gross sales have declined, deterred by way of top rates of interest, however surging expansion is taking grasp for homes within the ₹1-2 crore and ₹50 lakh-1 crore segments.

“Competition spending and shopper exuberance also are riding file mortgage disbursements by way of non-banking monetary firms (NBFCs). Just about part of the credit score call for is originating from tier-3 towns,” in line with State of the Financial system document.

The document famous that rural call for accounts for a 3rd of the revenues of shopper items firms. Total rural quantity expansion is estimated to have risen by way of 6.4 in line with cent (as opposed to 10.2 in line with cent in city spaces), it added.

Additionally learn: House purchasing now observed as a solid funding proposition: Manoj Gaur, Chairman, CREDAI

“Non-food firms are monitoring higher on the subject of rural volumes than meals firms. That is partially attributed to competitive gross sales pitches by way of small and regional gamers, indicative of the agricultural shopper changing into more and more worth delicate and switching to inexpensive possible choices and smaller sized packs,” the document stated.

Credit score offtake for FY24

CARE Scores, in a document, stated the outlook for credit score offtake continues to stay sure for FY24, supported by way of elements similar to financial enlargement and a endured push for retail credit score which has been supported by way of bettering digitalisation.

The ranking company has estimated that credit score expansion could be within the vary of 13-13.5 in line with cent for FY24, except for the have an effect on of the merger of HDFC with HDFC Financial institution.

Additionally learn: Early-stage delinquencies emerging in inexpensive, low-ticket house loans

Moreover, because the credit score to deposit (CD) ratio stays increased, expansion within the legal responsibility franchise would play a vital function in maintaining mortgage expansion. On the other hand, inflation, increased rates of interest and international uncertainties may just probably impinge at the credit score expansion in India.

“Because the credit score to deposit ratio stays increased, expansion within the legal responsibility franchise would play a vital function in maintaining mortgage expansion. The contest for deposits is prone to accentuate even additional, leading to a upward push in investment prices within the coming sessions as charges stay increased and CASA percentage reduces,” CARE Scores stated.

[ad_2]