[ad_1]

Have you ever ever questioned what the historical past and the portions of a bank card are? How did they get began, and what constitutes a bank card?

This text will talk about the historical past and anatomy of a bank card: what are all of the numbers and magnetic bits, and why are they there?

We’ll additionally talk about how bank card issuers handle safety features, be offering advantages and perks to their participants, the way forward for bank cards, and extra.

Stay studying to be told the whole lot you want about bank card portions and the way they paintings.

Portions of A Credit score Card

First, let’s have a look at the anatomy of the bank card:

Entrance of the Credit score Card

The entrance of the bank card will normally have the next.

- Bank card quantity: The numbers at the entrance of your bank card make up the bank card quantity, or your account quantity. This identifies your credit score line whilst you attempt to use the cardboard. It’s vital to stay this quantity non-public as a result of along with your bank card quantity, expiration date, and 3-digit quantity at the again, somebody may just use your card.

- Financial institution Id Quantity: The BIN is very similar to your financial institution’s routing quantity to your private checking account. The primary six to 8 numbers direction the fee directions to the right kind fee community and issuing financial institution.

- Main Business Identifier (MII): The primary digit of your card is the MII and signifies the kind of establishment that issued your card. A few of the maximum not unusual MIIs, Amex playing cards get started with a three, Visa playing cards get started with a 4, Credit cards get started with a 5, and Uncover playing cards get started with a 6.

- Take a look at digit: The closing digit of your bank card quantity is a test digit. That is used to ensure the authenticity of your card quantity and is in response to an set of rules that considers the opposite digits to your card. If the test digit doesn’t fit a undeniable price, the bank card is invalid, and the financial institution will decline the transaction. The test digit is one function of many used to forestall fraud.

- Cardholder identify: The identify at the card identifies the individual eligible to make use of it. This may occasionally or is probably not the one who implemented for and opened the cardboard. Card homeowners can get playing cards for approved customers, comparable to a partner or kid.

- Expiration date: All bank cards expire if for not anything else than protection. Getting a brand new card with a brand new expiration date and safety code reduces the danger of any individual figuring out your data and the usage of your card. Playing cards additionally expire to permit all cardholders to have playing cards with the newest era.

- EMV Chip: Steel chips in bank cards lead them to extra protected than conventional magnetic strips. The chip encrypts your bank card data because it’s processed, lowering the danger of fraud.

- Identify of the bank card issuer: The bank card issuer is a financial institution. You’ll see the financial institution’s identify at the bank card. That is who you’re making bills to and phone when you have a subject along with your card.

- Cost community emblem: Each and every bank card is from a bank card corporate, comparable to Visa, Mastercard, Uncover, or American Specific. Whilst you pay on-line or over the telephone, you normally have to spot your card sort.

Please Word: No longer all bank cards have this knowledge at the entrance, and it is dependent upon the kind of card. Some playing cards are transferring a large number of this knowledge to the again of the cardboard.

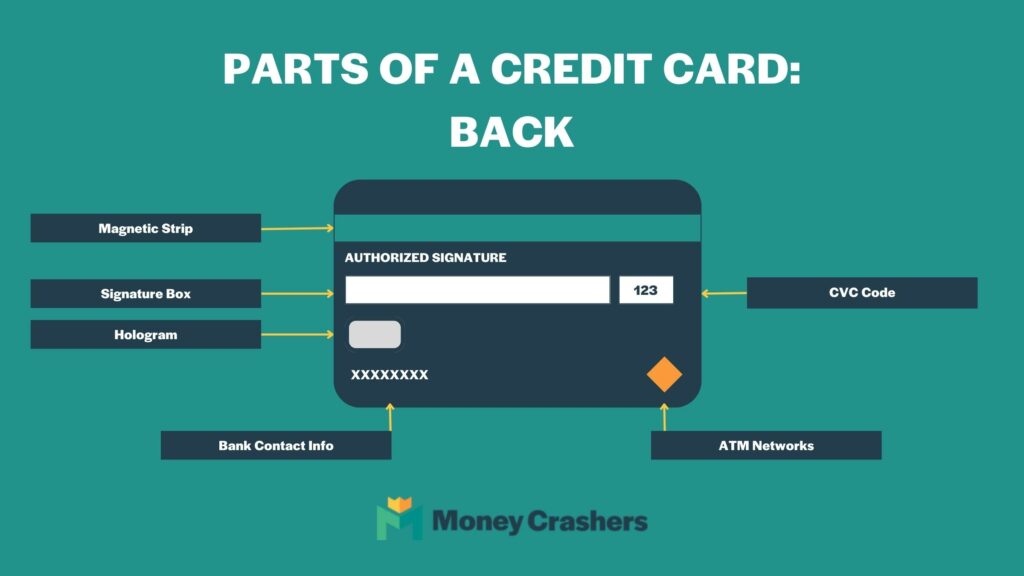

Again of the Credit score Card

The again of a bank card normally has a number of figuring out markers.

- Magnetic stripe or magstripe: The black strip at the again of the cardboard is magnetic and, when swiped, supplies all of the essential data to procedure a fee, together with your identify, the account quantity, and card expiration. It’s vital to stay it secure as a result of thieves can scouse borrow this knowledge and create a faux strip to make use of as your bank card.

- Card Verification Code (CVC): The Card Verification Worth (CVV) is the 3-digit safety code for additonal security features. It can be after an extended code, however they ask for the three-digit code when creating a fee. It is helping restrict fraudulent job, particularly with on-line or telephone purchases. Distributors will ask for the code to ensure you’ve the cardboard. Whilst it doesn’t ensure the cardholder is the usage of the cardboard, it decreases the possibility of fraud.

- Signature field: The white field at the again of the cardboard is a signature field that shops use to ensure your signature whilst you signal for transactions. This will assist save you fraudulent job; on the other hand, it’s now not as useful since maximum transactions are digital or no-contact as of late.

- Hologram: Maximum playing cards have a hologram emblem at the again. As a result of holograms aren’t simply replicated, recognizing a faux bank card is more uncomplicated with holograms.

- ATM networks: You might realize different trademarks of ATM networks at the again of your card. This means the place you’ll be able to use your bank card to generate income withdrawals.

- Issuing financial institution’s touch data: The ideas to touch the issuing financial institution is at the again of the cardboard, together with the telephone quantity, bodily mailing deal with, and/or site.

How Do Credit score Playing cards Paintings?

A financial institution or monetary establishment problems bank cards and permits cardholders to pay for items or services and products at shops that settle for fee through bank card.

In the US, Visa, Mastercard, Uncover, and American Specific dominate the bank card community. Capital One, Chase Financial institution, and Wells Fargo are 3 not unusual issuing banks.

The financial institution or monetary establishment can pay the store to your acquire — in response to an settlement you’ve with the creditor to pay the ones fees, which is your accumulated debt. Via your bank card, your financial institution will give you a line of revolving, unsecured credit score.

The volume of unsecured credit score they prolong to you is in response to quite a lot of elements, together with creditworthiness (credit score ranking), fee historical past, source of revenue, general debt load, and period of your courting with the financial institution. Credit score limits can also be diminished, greater, and even canceled in response to the phrases defined to your settlement.

Many bank cards be offering rewards, like money again, airline miles, or issues you’ll be able to redeem for perks.

Skilled Tip: In case your chip isn’t operating, some shops is not going to take your card, even supposing it does have a magnetic strip. However don’t fear! In case your chip isn’t operating, it might simply be from a build-up of dust, and a excellent wiping may just mend your chip as excellent as new.

What Can You Do With A Credit score Card?

Bank cards are a handy technique to make purchases, however there are alternative ways to make use of them too.

- In-person purchases: Making a purchase order in a shop with a bank card is its maximum not unusual use. You swipe, insert, or faucet the cardboard at the bank card reader and if authorized, you utilize a portion of your credit score line to pay for the acquisition.

- On-line purchases: Making a purchase order on-line is handiest conceivable with a credit score (or debit ) card. When purchasing on-line, you should manually input your bank card data together with the bank card quantity, expiration date, and safety code. The similar is right for purchases revamped the telephone.

- Arrange autopay: To keep away from past due bills, you’ll be able to arrange many invoice bills, comparable to utilities, cellphones, and web expenses, on autopay. The invoice quantity comes out of your credit score line at the specified date, after which you’ve a bank card invoice to pay.

- Money advances: If you want money speedy, you could possibly get a money advance at a spouse ATM, as famous at the again of your card. Beware, despite the fact that, money advances normally have a far upper APR than purchases and would not have a grace length. Learn your bank card settlement carefully to resolve what to anticipate.

- Earn rewards: In the event you qualify for a rewards bank card, you’ll be able to earn issues or miles that you’ll be able to convert to observation credit, or redeem for different rewards, comparable to airline tickets, resort reservations, or reward playing cards.

Historical past of Credit score Playing cards

Kinds of bank cards have existed for no less than 5,000 years in historical Mesopotamia. They used clay drugs to turn a document of transactions amongst neighboring traders.

Bank cards was extra well known and firstly began as “Diners Membership” playing cards within the Nineteen Fifties. Founding father of the Diner Membership, Frank McNamara, by accident left his pockets whilst eating in New York Town. This incident precipitated the theory of a technique to pay for pieces with no need your pockets.

The eating place would ship the invoice to the Diners Membership, the place fee could be remitted immediately to the eating place’s financial institution. Then, the cardholders could be required to pay their invoice in complete every month to the Diner’s Membership, and they’d obtain a small fee.

American Specific advanced its first rate card in 1958. Since then, bank cards have revolutionized the banking, service provider, and client buying revel in. There is not any longer any want to raise money when making a purchase order normally.

Credit score Playing cards vs. Debit Playing cards vs. Pay as you go Playing cards

Whilst some would possibly assume bank cards, pay as you go playing cards, and debit playing cards can be utilized interchangeably, they range.

Pay as you go Credit score Card

Typically talking, a pay as you go bank card is a card you load cash onto and use till it’s long past. Some pay as you go bank cards permit reloading, and others don’t. A pay as you go card isn’t connected to a financial institution bank account. In the event you lose the pay as you go bank card, there could also be little coverage to recuperate your cash.

Credit score Card

A bank card most often manner you’re the usage of cash that isn’t yours. You’re making bills and pay an rate of interest on your bank card issuer for the finances that you simply borrowed whilst you made purchases.

Debit Card

A debit card is connected on your checking account and is as on the subject of money as playing cards get. A debit card is immediately tied on your bank account, so no matter cash you’ve is pulled immediately from your account whilst you use your debit card.

This normally occurs instantaneously, while bank cards have a grace length of a couple of days prior to the cash clears. There are fewer protections with debit card use as opposed to bank cards.

Regularly Requested Questions

What’s the anatomy of a bank card quantity?

A bank card quantity is normally 16 digits. The primary six are the cardboard issuer’s quantity (Visa, Mastercard, and so on.), the following 5 numbers point out the issuing financial institution, and the closing numbers are your own account quantity.

How do bank card statements paintings?

You obtain bank card statements per 30 days. Each and every month, it presentations your transactions from the closing billing date to the present one. It additionally presentations any accumulated pastime fees from unpaid balances and every other fees. The observation presentations the minimal required fee that you simply should pay, however you’re unfastened to pay all the steadiness to keep away from pastime fees or any increment you’ll be able to manage to pay for.

Why do I’ve to signal the again of my bank card?

Sooner than the latest era, a signed bank card was once one of the best ways to forestall fraud. Outlets would examine the signature at the card to the signature you whole in entrance of them. With as of late’s era, despite the fact that, the general public use playing cards with out touch or appearing them to the cashier, so the signature panel isn’t as useful.

Are bank card signature packing containers a factor of the previous?

It’s conceivable that we would possibly see signature traces pass away altogether as microchips and different era grow to be extra complex. Mastercard introduced in 2018 that cardholder signatures could be non-compulsory on playing cards and receipts.

Why is the magnetic stripe essential if we use the chip?

Magstripe could also be needless — or changing into needless. Since many debit and bank card issuers are transferring to EMV (Europay, Mastercard, and Visa) chip playing cards, magnetic stripes are changing into out of date.

Consistent with Mastercard, they’ll segment out magnetic stripes in 2024, relying at the area. Banks in the US will now not be required to factor chip playing cards with magnetic stripes beginning in 2027.

How do I alter the expiration date of my bank card?

You’ll’t alternate the expiration date of your bank card; it is very important get a brand new one.As soon as your bank card expires, it doesn’t imply your bank card issuer will shut or cancel your account; it simply manner you want a brand new bodily card.

Bank card firms do that for a number of causes, together with bodily card use, safety, and inspiring customers to reevaluate and replace their bank card plans if essential.

Maximum card issuers will mail you a brand new card prior to expiration, however different firms require you to name. In case your card is nearing its expiration, it can be a good suggestion to touch your issuer and ensure a substitute is coming.

What’s the variation between a CVC and a CVV?

The CVC and CVV are the similar regardless of having other names. CVC stands for Card Verification Code, and CVV stands for Card Verification Worth. They each reference the 3 digit safety code at the again of your bank card to forestall fraud.

Backside Line

Understanding the portions of a bank card is vital as they’re an crucial a part of making purchases on the earth. Understanding the anatomy of a bank card assist you to perceive your card’s safety features and community achieve and make a selection the appropriate bank card.

Since many of those options are being phased out over the following couple of years, you might wish to get started converting now the way you get admission to and use your bank card for each in-store and on-line purchases.

[ad_2]