[ad_1]

Transactions at the UPI (Unified Bills Interface) community surged over 8 in step with cent in October at the again of competition season-led spending, crossing the milestone of one,100 crore transactions right through the month.

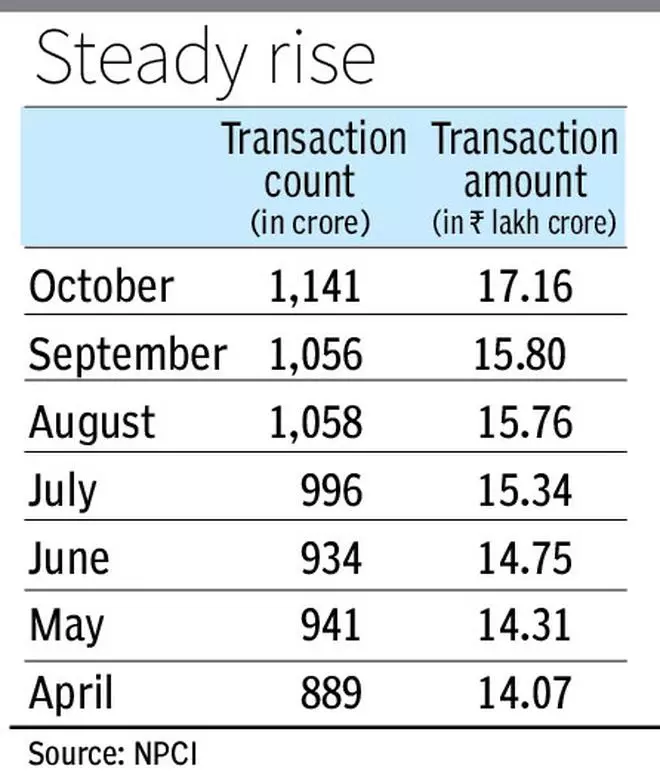

The choice of transactions stood at 1,141 crore, upper than 1,056 crore in September and the sooner report of one,058 transactions in August. The transactions had been 8.05 in step with cent upper on month and 56 in step with cent on yr, consistent with information through the Nationwide Bills Company of India (NPCI).

Document transactions

“There was a notable build up in transactions right through October, specifically because of the festive season. This surge is attributed to heightened shopper engagement, particularly within the e-commerce sector,” stated Mandar Agashe, Founder and MD, Sarvatra Applied sciences, including that volumes have additionally been supported because of the opportunity of micro-transactions.

In the case of the worth of transactions too, UPI noticed an 8.61 in step with cent soar and processed report transactions price ₹17.16 lakh crore in comparison with ₹15.80 lakh crore within the earlier month. The transaction quantity was once up 42 in step with cent from a yr in the past.

On-year expansion in UPI transactions has persistently remained over 40 in step with cent for the worth of transactions and above 50 in step with cent for the quantity of UPI trades in FY24 up to now. In FY23, the UPI platform processed 8,376 crore transactions aggregating Rs ₹139 lakh crore, in comparison with 4,597 crore transactions price ₹84 lakh crore in FY22.

Professionals’ View

“The choice of transactions in January 2018 was once 151 million (15.1 crore); this reached 11 billion (1,100 crore) in October 2023. It’s going to be no marvel if UPI transactions hit 20 billion (2,000 crore) a month within the subsequent 18-24 months. What has made this expansion sustainable and would be the driving force going ahead is the expansion in Particular person-to-Service provider (P2M) transactions,” stated Sunil Rongala, Senior Vice President, Head – Technique, Innovation & Analytics, Worldline India.

Sachin Castelino, Leader Technique and Transformation Officer, In-Answers World too stated that UPI transactions are at a prime because of greater virtual adoption each on the buyer and service provider degree, and the continual buyer onboarding through third-party fee programs, together with via incentive gives and techniques.

The proportion of person-to-merchant (P2M) trades in total UPI transactions rose to 57.5 in step with cent in June 2023 from 40.3 in step with cent in January 2022, and is anticipated to continue to grow, consistent with Worldline India. Right through Jan-Jun, P2M transactions quantity grew 119 in step with cent yoy to ₹2,915 crore and the worth rose 72 in step with cent to ₹19 lakh crore. Alternatively, P2P transaction quantity grew 22 in step with cent to two,275 crore with the worth of transactions emerging 41 in step with cent to ₹64 lakh crore.

“Because the festive season approaches and we growth during the 0.33 quarter, the predicted surge in buying groceries and commute transactions is poised to force a considerable uptick in UPI transaction volumes,” stated Harish Prasad, Head of Banking- India, FIS.

UPI transactions are anticipated to breach 100 crore transactions in step with day through FY27, as in step with a document through PwC India, which tasks UPI to dominate the retail virtual bills panorama, accounting for 90 in step with cent of general transaction volumes over the following 5 years.

[ad_2]