[ad_1]

Bitcoin has proven some spectacular power above the $34,000 mark in spite of a top quantity of profit-taking from temporary holders.

Bitcoin Quick-Time period Holders Are Promoting, Whilst Lengthy-Time period Holders Are Nonetheless Quiet

As defined via analyst James V. Straten in a brand new put up on X, the temporary holders are these days collaborating in one of the most most powerful profit-taking occasions of the previous couple of years.

The “temporary holders” (STHs) right here seek advice from all the ones Bitcoin buyers who’ve been protecting onto their cash since not up to 155 days in the past. This workforce accommodates one of the most two major divisions of the BTC marketplace, with the opposite being known as the “long-term holders” (LTHs).

Statistically, the longer an investor helps to keep their cash dormant, the fewer most probably they grow to be to promote them at any level. On account of this explanation why, the STHs are typically the weak-minded fingers of the field, whilst the LTHs are the sturdy, power holders.

Each time the field is going via any important FUD or FOMO, the STHs budge and take part in no less than some quantity of marketing. The LTHs, alternatively, in most cases display little response.

For the reason that Bitcoin value has loved a sharp rally lately that has taken its value above the $34,000 degree, the STHs would naturally be promoting now. One strategy to observe whether or not this Bitcoin workforce is promoting their cash can also be via monitoring the quantity that they’re shifting to exchanges.

Within the context of the present dialogue, Straten has determined to make a choice the model of this indicator that in particular tracks the transactions from buyers who’re in cash in, as profit-taking is typically the habits of focal point right through rallies. By contrast, loss transactions play a better function in value slumps.

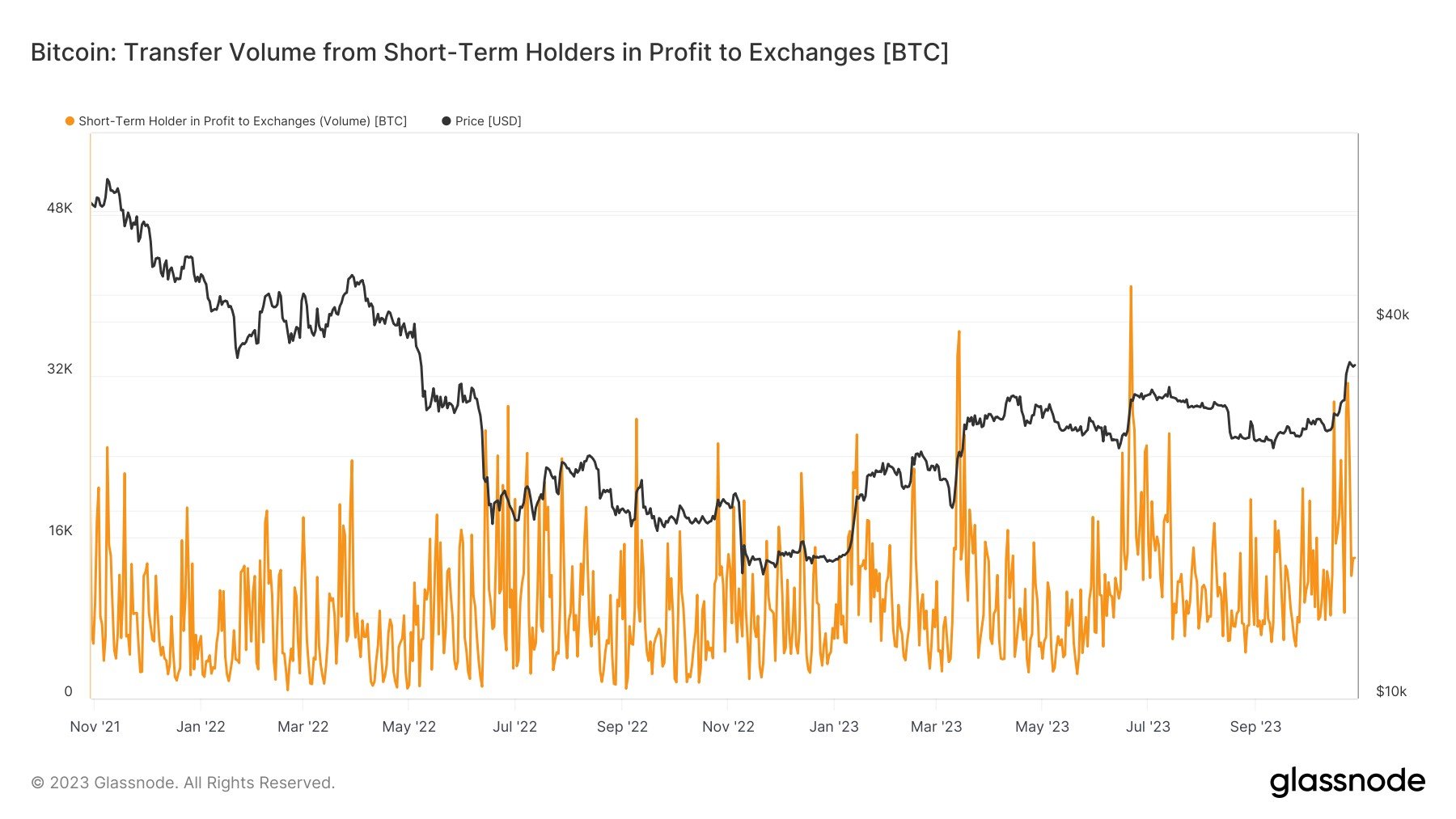

Now, here’s a chart that displays the fashion within the metric for the Bitcoin STHs during the last two years:

Seems like the price of the metric has been reasonably top in fresh days | Supply: @jimmyvs24 on X

As proven within the above graph, the Bitcoin STHs in cash in have despatched massive quantities to those centralized platforms since the most recent rally within the asset.

This confirms that those susceptible fingers had been promoting lately. As discussed ahead of, it’s now not ordinary for any such factor to occur, however the scale of the profit-taking this time round is especially important.

From the chart, it’s visual that there have simplest been a couple of instances prior to now couple of years the place the STHs in cash in have transferred related or upper volumes to exchanges. Given this selloff, it’s spectacular that Bitcoin has been in a position to carry on above the $34,000 degree right through the previous few days.

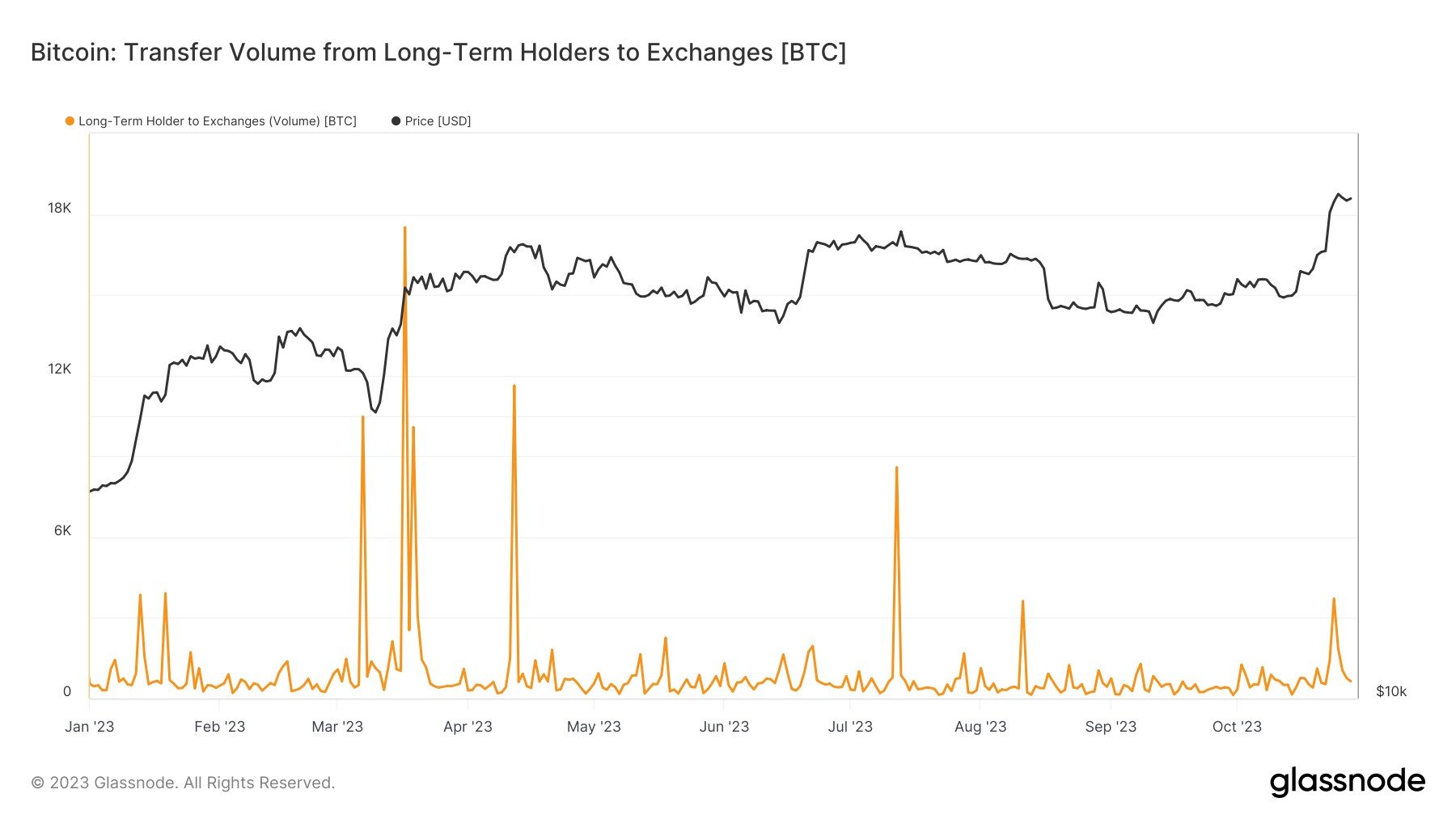

As anticipated from the LTHs, they haven’t bought a lot in spite of the rally.

The metric has observed a small spike lately | Supply: @jimmyvs24 on X

The metric is these days at its sixth-largest price for this yr, however as is apparent from the above graph, the dimensions of this selloff remains to be now not that a lot in natural phrases.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $34,700, up 13% prior to now week.

BTC has bogged down just a little since its sharp rally | Supply: BTCUSD on TradingView

Featured symbol from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]