[ad_1]

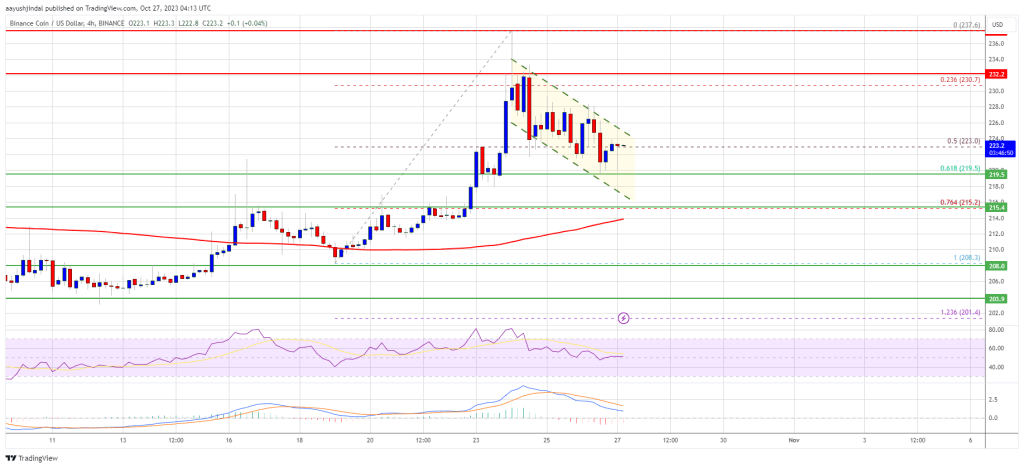

BNB worth struggled to climb above $240 and corrected positive factors towards america Buck. It’s now coming near a big reinforce zone at $220 and $215.

- BNB worth is slowly shifting decrease towards the $220 reinforce towards america Buck.

- The cost is now buying and selling above $215 and the 100 easy shifting moderate (4 hours).

- There’s a key bullish flag trend forming with resistance close to $225 at the 4-hour chart of the BNB/USD pair (knowledge supply from Binance).

- The pair would possibly acquire bullish momentum if there’s a transparent transfer above $228.

BNB Value Eyes Contemporary Build up

Those previous few days, BNB worth noticed a tight restoration wave above the key $220 resistance zone. Bitcoin rallied over 20% to $35,000 and helped BNB keep away from a big problem smash.

The cost climbed above the $225 and $230 resistance ranges. On the other hand, it struggled close to the $238-$240 zone. A prime was once shaped close to $237.6 and the associated fee just lately began a problem correction. There was once a transfer underneath the $235 degree.

BNB dipped underneath the 50% Fib retracement degree of the upward transfer from the $208.3 swing low to the $237.6 prime. It’s now buying and selling above $215 and the 100 easy shifting moderate (4 hours). There could also be a key bullish flag trend forming with resistance close to $225 at the 4-hour chart of the BNB/USD pair.

If there’s a contemporary build up, the associated fee may face resistance close to the $225 degree. The following resistance sits close to the $228 degree. A transparent transfer above the $228 zone may ship the associated fee additional upper. Within the mentioned case, BNB worth may take a look at $238. A detailed above the $238 resistance would possibly set the tempo for a bigger build up towards the $250 resistance.

Extra Losses?

If BNB fails to transparent the $228 resistance, it might get started any other decline. Preliminary reinforce at the problem is close to the $220 degree and the 61.8% Fib retracement degree of the upward transfer from the $208.3 swing low to the $237.6 prime.

The following primary reinforce is close to the $215 degree or the 100 easy shifting moderate (4 hours). If there’s a problem smash underneath the $215 reinforce, the associated fee may drop towards the $207 reinforce. To any extent further losses may begin a bigger decline towards the $202 degree.

Technical Signs

4-Hours MACD – The MACD for BNB/USD is shedding tempo within the bullish zone.

4-Hours RSI (Relative Power Index) – The RSI for BNB/USD is recently above the 50 degree.

Main Beef up Ranges – $220, $215, and $207.

Main Resistance Ranges – $225, $228, and $238.

[ad_2]