[ad_1]

Whilst long-term traders seem unaffected through the surge, the rally units the basis for a ‘resumption of the 2023 uptrend,’ analysts say

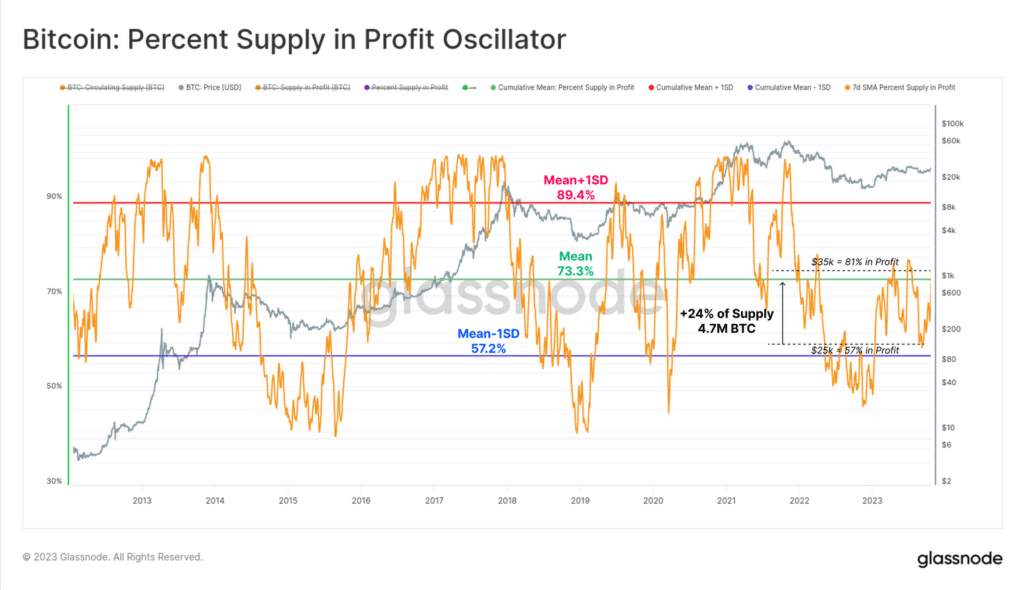

Bitcoin (BTC) volatility explosion on Oct. 24 has set the marketplace in a position for a brand new rally as a “significant share of provide and traders now in finding themselves above the common break-even worth,” Glassnode says.

In a analysis record on Oct. 24, analysts on the blockchain analytics agency famous that over 80% of Bitcoin provide is now in benefit because the marketplace is coming near year-to-date highs.

Alternatively, long-term holders (LTH) appear unaffected through this week’s rally as virtually 30% in their provide is “held at a loss,” analysts say.

The present situation for Bitcoin holders is very similar to overdue 2015 and early 2019 and the March 2020 backside, suggesting that the present cohort “might be a extra hardened and firm-handed” in comparison to prior cycles, Glassnode added.

“A significant share of provide and traders now in finding themselves above the common break-even worth, situated round $28k. This units the basis for a resumption of the 2023 uptrend.”

Glassnode

Within the interim, analysts at Bitfinex say that on-chain metrics, such because the Spent Output Age Bands (SOAB), point out additional make stronger for sustained volatility for Bitcoin within the coming months. As Bitcoin hastily surpassed the $34,000 mark, the crypto marketplace is now extra depending on main information narratives than ever prior to, analysts say.

Bitcoin has reached new annually highs in a while after stories surfaced that BlackRock’s iShares Bitcoin Believe has been indexed at the Depository Believe and Clearing Company (DTCC) amid staunch call for for an exchange-traded fund throughout the crypto trade and broader monetary markets.

[ad_2]