[ad_1]

Bitget emerges resilient in Q3 2023, recording an important 9.43% marketplace percentage and outstanding efficiency for its local token BGB, in spite of difficult marketplace prerequisites.

Crypto derivatives and duplicate buying and selling platform Bitget has weathered a difficult Q3 marketplace with noteworthy resilience, in step with its newest transparency file. Whilst the full business noticed a decline in spot and spinoff buying and selling volumes, Bitget’s marketplace percentage climbed to an excellent 9.43% in September.

Remarkable token efficiency

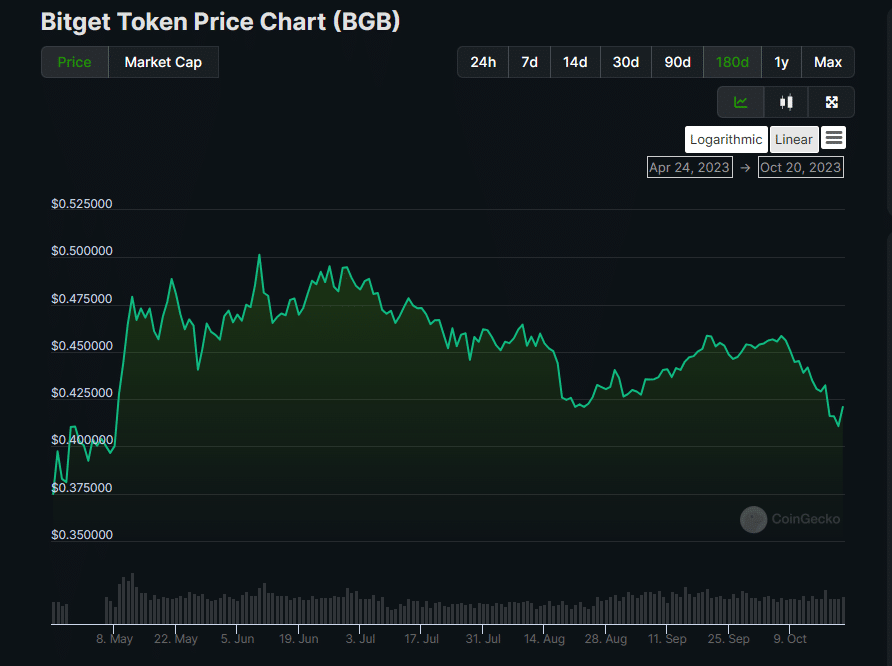

Bitget’s local token, BGB, emerged as one of the most most sensible 5 platform tokens by way of marketplace cap, registering a quarterly top of $0.4927 in September. The choice of BGB holders additionally surged to 354,472 in Q3, whilst buying and selling quantity for the token exceeded $1.3 billion previously 3 months.

The platform has additionally strengthened its international enlargement efforts. The file highlighted a number of strategic partnerships throughout tax reporting, portfolio control, and buying and selling automation sectors, together with alliances with Cointracking, Coinstats, CCData, Koinly, 3commas and Cobo Superloop, amongst others.

Having a look globally, the platform has disclosed bold enlargement plans concentrated on the Heart East, in particular international locations like Bahrain and the UAE. This comes along Bitget’s $100 million EmpowerX Fund, introduced in September to gasoline construction inside its Web3 ecosystem.

In spite of marketplace uncertainties, Bitget’s Coverage Fund remained tough, exceeding $300 million right through Q3. The fund peaked at $368 million in July, expanding the platform’s over 200% Evidence-of-Reserves ratio and including an additional layer of safety for customers.

[ad_2]