[ad_1]

New York, USA, October nineteenth, 2023, Chainwire

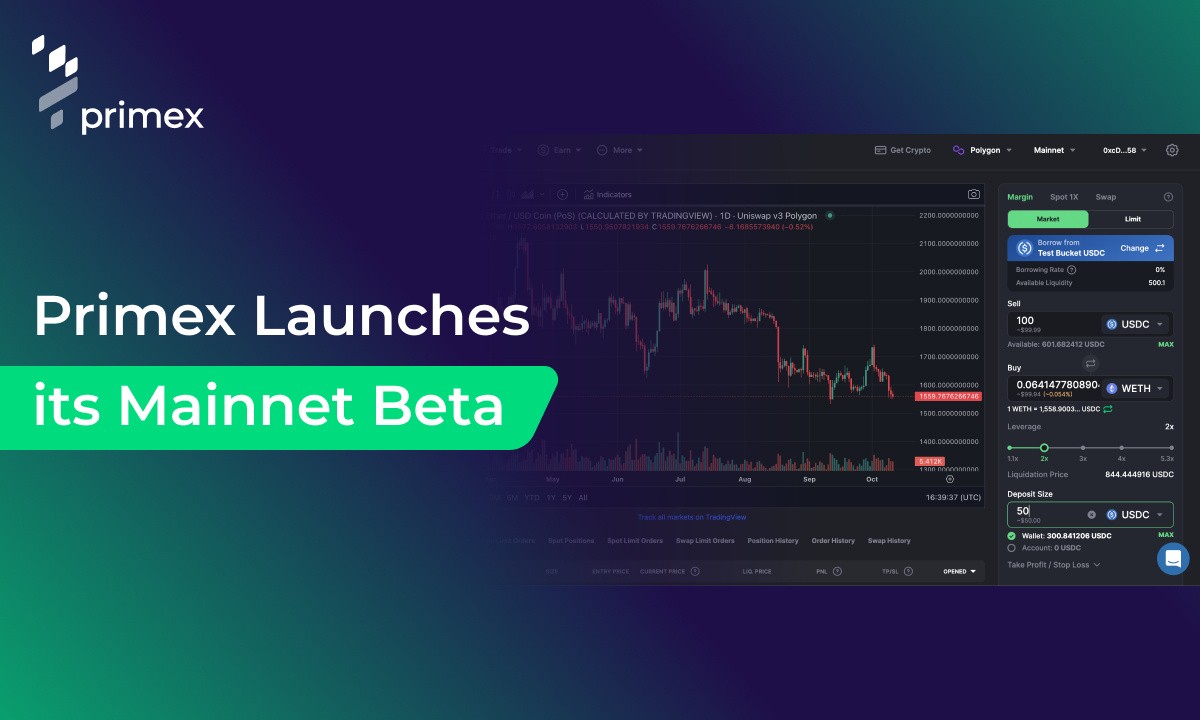

Non-custodial protocol for spot margin buying and selling Primex Finance pronounces the release of its long-awaited mainnet Beta. Representing a vital milestone for the protocol, the most recent model has been deployed on Polygon’s PoS chain. As a result, buyers can make the most of the Primex app and get entry to spot margin buying and selling at the Uniswap, Balancer, Curve, Sushiswap, Quickswap, and Meshswap DEXs.

Connecting Lenders with Buyers, Primex allows Buyers to make use of Lender liquidity for leveraged spot buying and selling on current DEXs whilst taking advantage of CEX-like tooling and interfaces. In change for supplying belongings to the protocol, Lenders earn pastime on deposited virtual belongings. With Primex, Lenders profit from top lending APYs and the power to diversify their portfolio in accordance with their chance urge for food by way of Credit score Buckets, specialised liquidity swimming pools that attach lenders with margin buyers.

The protocol achieves decentralized business execution thru a community of community-hosted Keepers. As a substitute of the usage of centralized order books (CLOB), Keepers are chargeable for executing all automatic trades and liquidating Buyers’ dangerous positions to offer protection to Lender budget. But even so non-custodial spot margin buying and selling, Primex will permit different leveraged operations throughout quite a lot of DeFi protocols in long term variations.

Together with the mainnet Beta, Primex Finance may be launching its Liquidity Mining Program. This program is very important for amassing early Lender liquidity and buying and selling quantity, and it is composed of rewards for bucket release participation and Early Lenders and Buyers rewards. Individuals within the Liquidity Mining Program can be eligible for Early Primex Tokens (ePMX) in accordance with their roles and actions. One day, holders will be able to change the ePMX they’ve earned for totally useful Primex Tokens (PMX).

Along with the Liquidity Mining Program, Primex additionally launches an on-chain Referral Program that performs the most important position within the mainnet Beta’s release. The referrers are eligible for a fee paid from the protocol earnings for actions generated by way of the referees, whilst referees will get pleasure from unique NFTs that can be used to cut back protocol charges and build up lender pastime. The relationship between referrers and their referees is saved in a wise contract, making sure each side are rewarded for his or her job.

“Devoted months of arduous paintings have ended in the release of the mainnet Beta, turning a far off purpose right into a truth. Primex’s first mainnet in any case allows undercollateralized, totally decentralized lending for buying and selling functions. Now, with the release of the mainnet Beta, buyers can make the most of a wealthy characteristic set and interfaces for buying and selling on their favourite DEXs with leverage,” said Dmitry Tolok, Co-founder of Primex.

About Primex Finance

Based in 2021, Primex Finance is a decentralized protocol for spot margin buying and selling on DEXs. It connects lenders with buyers, enabling buyers to make use of lender liquidity for leveraged buying and selling on well-liked DEXs. Primex provides buyers acquainted CEX-like buying and selling interfaces and gear to support flexibility for his or her buying and selling methods.

For more info seek advice from Primex Finance’s: Respectable Web page | Twitter | Discord

Touch

CMO

Anton Demenko

Primex Finance

[email protected]

[ad_2]