[ad_1]

The underneath is an excerpt from a up to date version of Bitcoin Mag Professional, Bitcoin Mag’s top class markets e-newsletter. To be a few of the first to obtain those insights and different on-chain bitcoin marketplace research directly for your inbox, subscribe now.

Subjects this week:

- Paul Tudor Jones 3 Trades

- Bitcoin, Ethereum and BNB

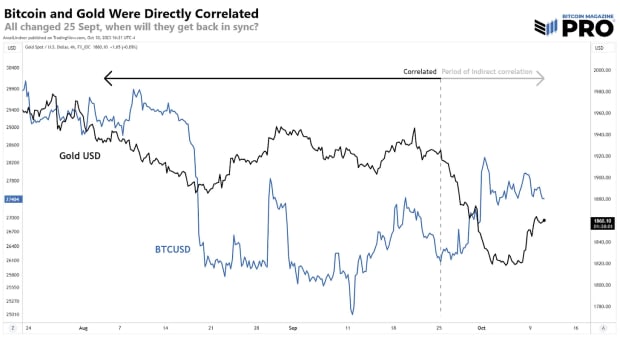

Closing week, I wrote about The Bitcoin-Gold-China Connection. I pointed to the hot bitcoin and gold oblique correlation, but in addition to a number of attention-grabbing correlations between the 3 belongings. I need to revisit that matter in advance, as a result of a pioneer of the fashionable hedge fund business, Paul Tudor Jones, stated in an interview that he’s bullish at the “barbarous relics,” lumping bitcoin in with gold.

“ much more likely than now not, we’re going to enter recession, and there are some beautiful transparent lower recession trades.”

Paul Tudor Jones’ 3 Recession Trades

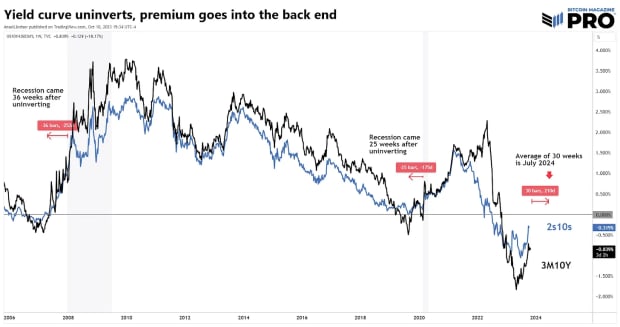

1) “The yield curve will get truly steep, and the term-premium is going into the again finish.”

Translation: The fast finish of the yield curve falls relative to the lengthy finish. We already see this within the yield curve steepening, particularly the 10Y-2Y (2s10s) and the 10Y-3M (3M10Y). Yields generally tend to un-invert previous to recessions. In 2008, it took 36 weeks between un-inverting and recession. In 2020, it took 25 weeks, however simply will have taken longer.

Projecting ahead, the curve continues to be inverted, and if we estimate an un-inversion through November this 12 months, a extend of 30 weeks takes us to July 2024. Now not strangely, this fits the Fed Finances futures pricing within the Fed cuts we mentioned in a prior letter. It additionally offers bitcoin numerous time to rally in the course of the halving.

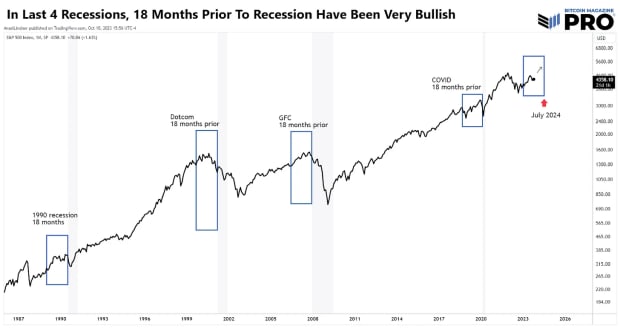

2) “The inventory marketplace normally, proper ahead of a recession, declines about 12%.”

We’ve written about this matter just lately as smartly. Whilst Jones is proper that “proper ahead of” the recession shares normally fall, it’s the 18 months main as much as recession that we’re in presently which can be very certain. He recognizes this along with his clarifying remark, “that’s almost certainly going to occur in the future, from some degree.” The emphasis right here being that that is his remark, that means it will climb so much ahead of that impending recession drop.

3) “You take a look at the massive shorts in gold. Much more likely than now not, in a recession the marketplace is truly lengthy belongings like bitcoin and gold. So, there’s almost certainly about $40 billion in purchasing that has to come back into gold in the future. So, yeah, I love bitcoin and I love gold proper right here.”

Jones says that bitcoin and gold will probably be correlated and emerging in a pre-recessionary surroundings. We agree, and that being the case, recession is most probably additional out than many be expecting as we stay up for the hot disconnect between gold and bitcoin to sync again up.

Checking in on bitcoin and gold, we see the oblique dating continues. It’s most probably the gold facet of this correlation that’s the one out of sync. It stays a top chance that China used to be dumping gold to give protection to the yuan as a substitute of dumping bucks. Gold and bitcoin will most probably get again into sync quickly, as Jones predicts. We also are gazing the yuan intently on this recognize, hoping it has bottomed in the interim.

Ethereum and BNB Dragging Bitcoin Down

Let me make a case for uncoordinated value suppression in bitcoin with a couple of charts. I don’t suppose this can be a grand conspiracy towards bitcoin, however a herbal results of the marketplace construction because it exists these days.

Ethereum is bleeding out. Charge burning couldn’t reserve it, Evidence-of-stake couldn’t reserve it, and now the futures ETFs can’t reserve it. It’s taking place as opposed to the greenback and a lot more as opposed to bitcoin itself. The hot BitVM on Bitcoin isn’t an Ethereum killer, however it does rob Ethereum of lots of pleasure and hype. There’s merely no momentum to talk of left in altcoins.

I’ve a idea why bitcoin is having somewhat bother right here in comparison to our different calls. Bitcoin is being held again through algorithmic buying and selling bots constructed to arbitrage bitcoin/ether discrepancies in value motion. I don’t have direct proof as of but, however this might provide an explanation for the disconnect between bitcoin’s value motion and all different markets presently.

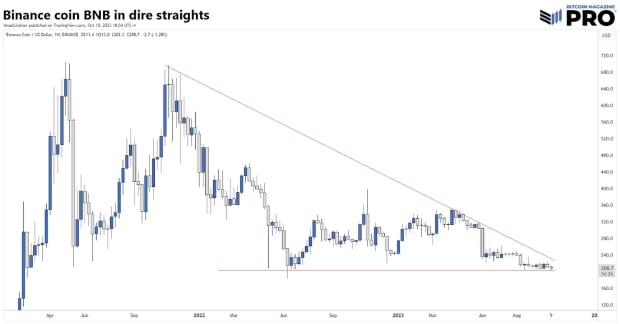

Some other supply of bitcoin value suppression is Binance. Rumors are flying that the BNB token could also be extremely leveraged like FTX’s FTT token used to be. The allegation is that Binance is buying and selling bitcoin for BNB to prop up the cost.

Right here we’ve two brief resources of bitcoin promoting: Ethereum arbitrage and Binance looking to prop BNB up. Even supposing there’s partial reality about both one, it might be a just right reason why for bitcoin’s moderately surprising weak point.

This weak point is most probably brief for the reason that inventory marketplace is emerging, bonds yields are falling, and the greenback is falling. This provides extra weight to the Bitcoin business cause of the slight value dip.

We will be able to see above that the 200-day (grey) fought off repeated and extended makes an attempt to proceed upper. In our estimation, that is proof of heavy marks on that degree from buying and selling bots with a easy rule: If bitcoin is on the 200-day and ether is underneath, quick bitcoin and lengthy ether. One thing like that.

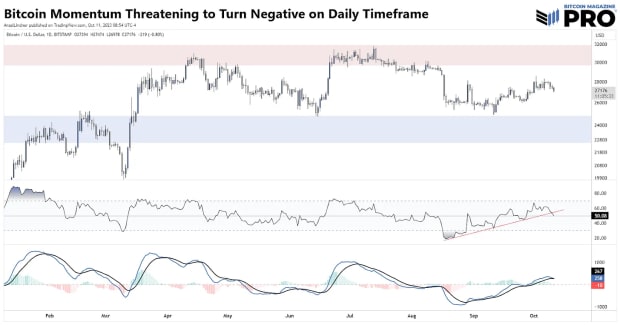

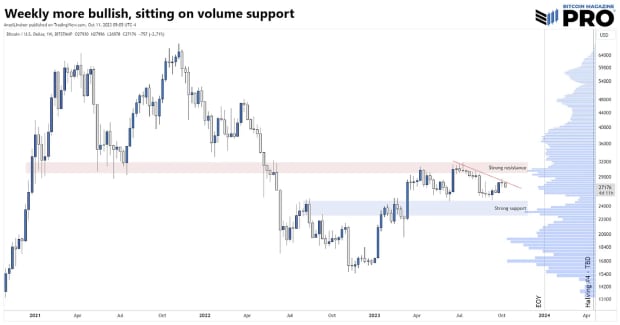

Day by day momentum signs are threatening a bearish shift. RSI has damaged pattern and MACD may just pass bearish. At the weekly time frame on the other hand, those identical signs are markedly extra bullish.

Bitcoin is sitting proper on cast quantity give a boost to at $27,000, with numerous room above the most powerful give a boost to house if there used to be a dip. As soon as bitcoin breaks this downward pattern, it’s going to abruptly check the resistance band at $31,000.

There’s every other risk we need to point out: Bitcoin is the main indicator on this marketplace. If that’s the case, we’d be expecting shares to rollover and yields to proceed upper, sending us again to the planning stage on our type. After all, I don’t suppose that’s the case, however we can must pass that bridge once we get there. For now, the type has been a hit on many macro and micro calls and the normal markets believe us.

Abstract

Legend Paul Tudor Jones defined 3 recession trades we took a take a look at above. They’re a steepening business that we already see taking form, a brief inventory marketplace business that we don’t somewhat see creating but, and bitcoin and gold. A deep dive of the Ethereum, BNB and bitcoin charts finds some insights about correlation and the state of this marketplace.

The underneath is an excerpt from a up to date version of Bitcoin Mag Professional, Bitcoin Mag’s top class markets e-newsletter. To be a few of the first to obtain those insights and different on-chain bitcoin marketplace research directly for your inbox, subscribe now.

[ad_2]