[ad_1]

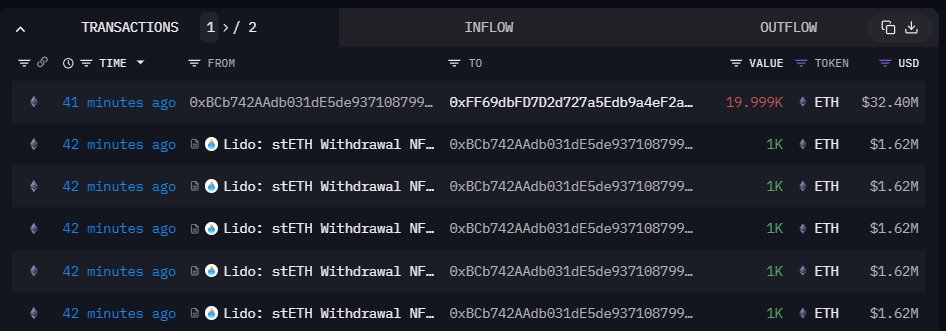

A crypto pockets related to Justin Solar, the co-founder of Tron, a wise contract platform, has moved 20,000 Ethereum (ETH) value more or less $32.4 million from Lido Finance, a liquidity staking platform. Budget had been transferred to Binance, the sector’s greatest crypto alternate, buying and selling quantity and shopper depend.

The transaction, achieved in one batch, was once captured by means of The Information Nerd, an research platform, and shared on X on October 5. As it’s, Ethereum (ETH) is below force, taking a look on the efficiency within the day by day chart.

Ethereum Drops 4%, Are Bears Flowing Again?

Trackers display that the coin is down more or less 4% in 3 days, confirming dealers of October 2. Significantly, the day by day chart has a double bar formation with the undergo candlestick of October 2, totally reversing consumers of October 1.

This association means that bears may well be in regulate, particularly taking into account the draw-down of the previous few buying and selling days and the extent of participation on October 2 when the coin slipped.

In technical research, losses in the back of expanding volumes continuously level to top participation. If costs are emerging, then the coin in query may just rally. Conversely, a sell-off may just aggravate if the bar had top buying and selling volumes.

It’s also unclear whether or not Justin Solar plans to promote ETH after shifting cash to exchanges. Crypto transfers to centralized exchanges, which give a boost to many stablecoins like USDT and others, are continuously related to sell-offs.

Marketplace individuals would possibly interpret such actions as bearish, fueling the sell-off, therefore heaping extra force on costs. ETH is now at a one-week low.

Justin Solar Shuffling ETH In 2023

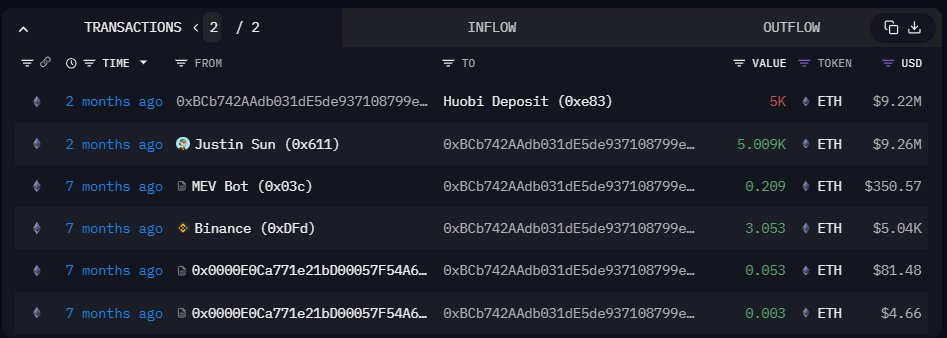

The Information Nerd observes that costs fell the final time the pockets moved ETH to Huobi, which has since rebranded to HTX. In August, the pockets moved 5,000 ETH to HTX. The deposit got here per week prior to ETH costs crashed 12%.

Bitcoin and Ethereum costs fell sharply in mid-August, inflicting a “cascade liquidation” that spooked buyers. ETH bulls have since did not opposite the ones losses. Making an allowance for the moderately low buying and selling volumes within the final two months, costs are nonetheless boxed throughout the August 17 industry vary, a bearish sign.

In overdue February 2023, Justin Solar staked 150,000 ETH, value more or less $240 million, to Lido Finance. The switch stays the biggest single-stay transaction, forcing the liquidity staking supplier to turn on the Staking Price Restrict characteristic, capping the volume of cash one can stake at 150,000 ETH.

Lido Finance stated the characteristic is extra of a “protection valve” that “addresses imaginable side-effects reminiscent of rewards dilution, while not having to pause stake deposits explicitly.”

Function symbol from Canva, chart from TradingView

[ad_2]