[ad_1]

Hanover Financial institution is a standard brick-and-mortar financial institution based totally in New York. It provides on-line banking to shoppers in New York, New Jersey, Connecticut, and Pennsylvania. Accounts are to be had to shoppers and companies, with quite a lot of banking and lending merchandise supported.

Hanover Financial institution generally is a good selection in case you’re on the lookout for a brand new financial institution and reside within the Northeast. Stay studying for an in-depth have a look at how Hanover Financial institution works in our detailed Hanover Financial institution assessment.

- Provides on-line and in-person banking in New York and different states within the Northeast United States.

- Shopper banking merchandise come with checking, financial savings, and loan loans.

- Distinctive systems come with mortgages for funding houses and overseas nationals.

|

|

|

|

|

Opening Deposit Requirement |

|

|

Minimal Steadiness Requirement |

|

What Is Hanover Financial institution?

Hanover Financial institution is a private and trade financial institution within the Northeast U.S. It operates bodily branches in New York Town, Lengthy Island, and New Jersey and gives on-line banking to shoppers in Connecticut and Pennsylvania.

Hanover Financial institution options a number of client checking and financial savings account choices, together with accounts and not using a routine per thirty days charges and aggressive financial savings account rates of interest.

The financial institution used to be based in 2009 and operates 9 department places. Hanover Financial institution is a member of the FDIC and gives greater than 40,000 unfastened ATMs throughout the Allpoint community.

It’s a publicly traded corporate, so financials are public for any individual to view. You’ll be able to to find it at the NASDAQ with the ticker image HNVR. As of the tip of the second one quarter of 2023, the financial institution held $1.59 billion in buyer deposits with greater than $2 billion in general property.

What Does It Be offering?

Whilst companies can to find maximum banking wishes met by means of Hanover Financial institution, we’re desirous about client banking for people. Right here’s a have a look at what Hanover Financial institution provides.

Checking

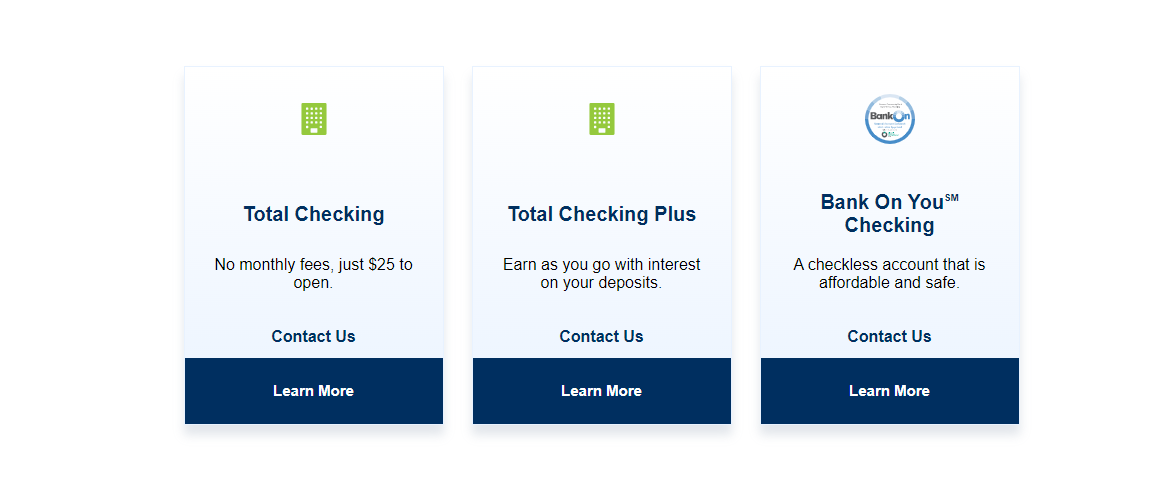

Hanover Financial institution has 3 non-public checking accounts with various minimal steadiness necessities and lines.

- Overall Checking: The fundamental bank account has no per thirty days charges or minimal steadiness necessities. It has a $25 minimal opening steadiness requirement.

- Overall Checking Plus: Overall Checking Plus options the power to earn passion out of your bank account steadiness. It has a $300 minimal opening steadiness and a $300 minimal day-to-day steadiness requirement to steer clear of the $5 per thirty days carrier rate.

- Financial institution On You Checking: Financial institution On You Checking has a $25 minimal to open a brand new account and not using a per thirty days charges or minimal steadiness necessities thereafter. This account is digital solely, and not using a check-writing privileges.

Financial savings

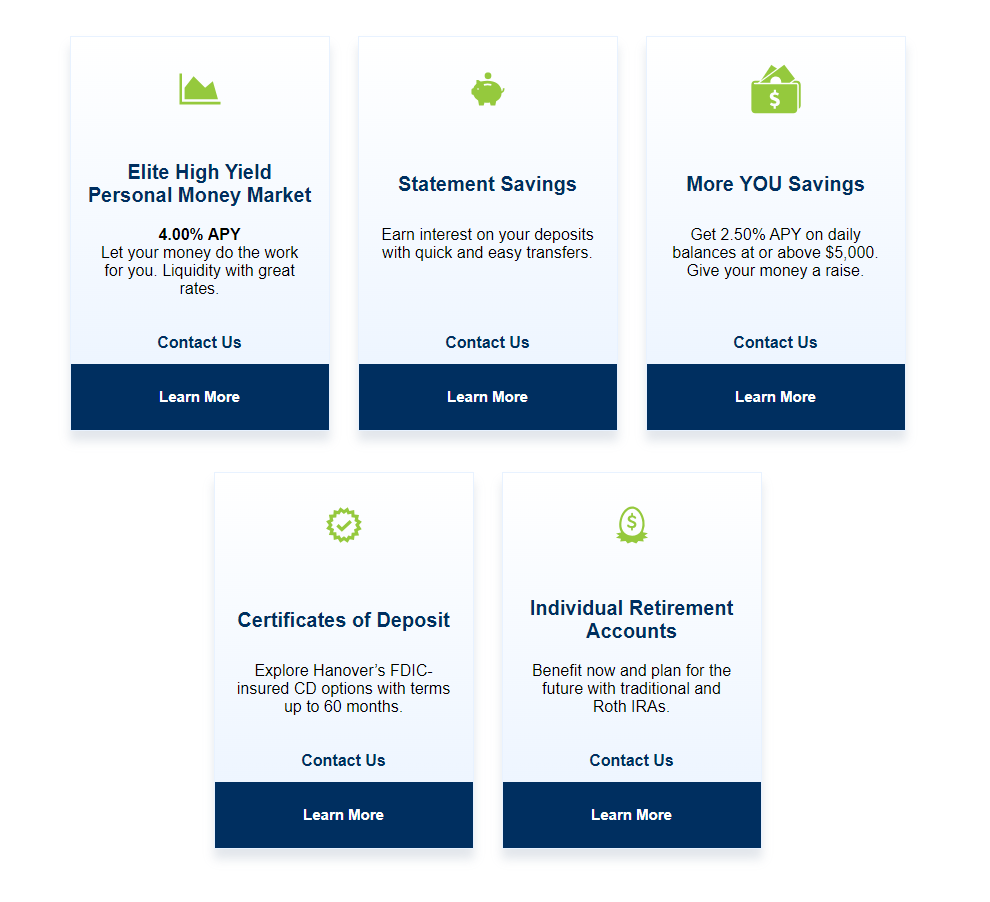

As with checking accounts, Hanover Financial institution options a number of financial savings choices, together with conventional financial savings, CD, and cash marketplace financial savings accounts.

- Elite Prime Yield Non-public Cash Marketplace: Arguably the most efficient financial savings account from Hanover Financial institution, this cash marketplace financial savings account options an APY of four.00%, which is definitely above the nationwide reasonable. On the other hand, a $5,000 day-to-day steadiness is needed to earn passion and steer clear of a $10 per thirty days carrier rate. It comes with a debit card and check-writing privileges.

- Remark Financial savings: The Remark Financial savings account has a far decrease $100 day-to-day steadiness requirement to steer clear of a $5 per thirty days carrier rate. It does earn passion however the price isn’t disclosed on-line.

- Extra YOU Financial savings: This financial savings account earns an APY of two.50% on balances over $5,000. Balances underneath $100 do not earn any passion and balances between $100 and $5,000 earn 0.01%. It calls for a $100 minimal day-to-day steadiness to steer clear of a $5 per thirty days carrier rate.

- Certificate of Deposit (CDs): Hanover Financial institution CDs include phrases of 3 months to 60 months. Rates of interest range by means of time period, however some are very aggressive, ranging between 3.00% and 5.35% APY. You’ll want no less than $500 to open a brand new CD.

- Particular person Retirement Accounts (IRAs): You’ll be able to open a financial savings account as an IRA, despite the fact that you’re most likely with an IRA with complete brokerage options.

House Loans

Lending systems come with conventional mortgages, residential funding loan loans, overseas nationwide funding mortgages, and residential fairness strains of credit score (HELOCs). Charges and phrases range in response to your credit score historical past and different components.

Are There Any Charges?

Hanover Financial institution provides accounts and not using a per thirty days charges and accounts the place per thirty days charges observe in case you don’t meet minimal day-to-day steadiness necessities. Per thirty days charges are most often less than many different banks, with $5 to $10 carrier fees relying at the account.

Stay an eye fixed out for transactional fees for much less not unusual banking actions outdoor per thirty days charges.

How Does Hanover Financial institution Examine?

For online-only banking, which matches smartly for any individual who doesn’t receives a commission in money, believe banks akin to Best friend or SoFi. Either one of those banks have checking and financial savings accounts with aggressive rates of interest, no per thirty days charges, and no minimal steadiness necessities.

If you want department banking, believe Chase Financial institution, with branches in just about all corners of the U.S. Whilst rates of interest don’t seem to be nice and you will stumble upon charges in case you dip beneath the minimal steadiness requirement, Chase customer support is most often superb and branches are simple to seek out.

|

Header |

|

|

|

|---|---|---|---|

|

No – branches within the Northeast |

|||

|

2.50% on balances over $5,000 within the Extra YOU account |

|||

|

Mobile |

How Do I Open An Account?

One of the simplest ways to open an account with Hanover Financial institution is to consult with a department and open your account in consumer. Branches are positioned in Ny, Brooklyn, Queens, Lengthy Island, and New Jersey.

If that’s inconvenient otherwise you reside in Connecticut or Pennsylvania, you’ll open choose accounts on-line. Overall Checking, Elite Prime Yield Non-public Cash Marketplace, and 13-month CDs are to be had to open on-line. Different accounts are solely presented in department places.

Is It Secure And Safe?

Hanover Financial institution is an FDIC-insured establishment, so the nationwide govt protects your price range. Although Hanover Financial institution is going into chapter 11, which is not likely, you’re assured by means of the FDIC to get your a refund, as much as $250,000 in step with account sort, in step with depositor.

As with all monetary account, the use of a singular password and following cybersecurity perfect practices, akin to updating your laptop and make contact with, is significant. By no means click on hyperlinks or open attachments in suspicious emails. Additionally, set up high quality antivirus tool (even on Mac computer systems and smartphones) and activate auto-updates.

How Do I Touch Hanover Financial institution?

You’ll be able to succeed in Hanover Financial institution for customer support by means of telephone, electronic mail, or in consumer at any department. The telephone quantity for Hanover Financial institution is 516-548-8500. There could also be a touch shape on their site.

Is It Value It?

Hanover Financial institution is a rather excellent regional financial institution, with accounts providing aggressive charges and rates of interest. If you happen to reside close to a department or in probably the most 4 states served by means of Hanover Financial institution, it’s value taking into consideration to your checking and financial savings wishes.

There’s stiff festival, then again, from online-only banks providing options like ATM rate rebates and national protection. Take a look at our record of the most efficient banks to check and come to a decision which makes probably the most sense to your distinctive banking wishes.

Hanover Financial institution Options

|

|

|

|

|

Minimal Steadiness Necessities |

|

|

|

|

Sure, within the Northeast solely |

|

|

Monday via Friday 9 AM to five PM EST |

|

|

Internet/Desktop Account Get right of entry to |

|

[ad_2]