[ad_1]

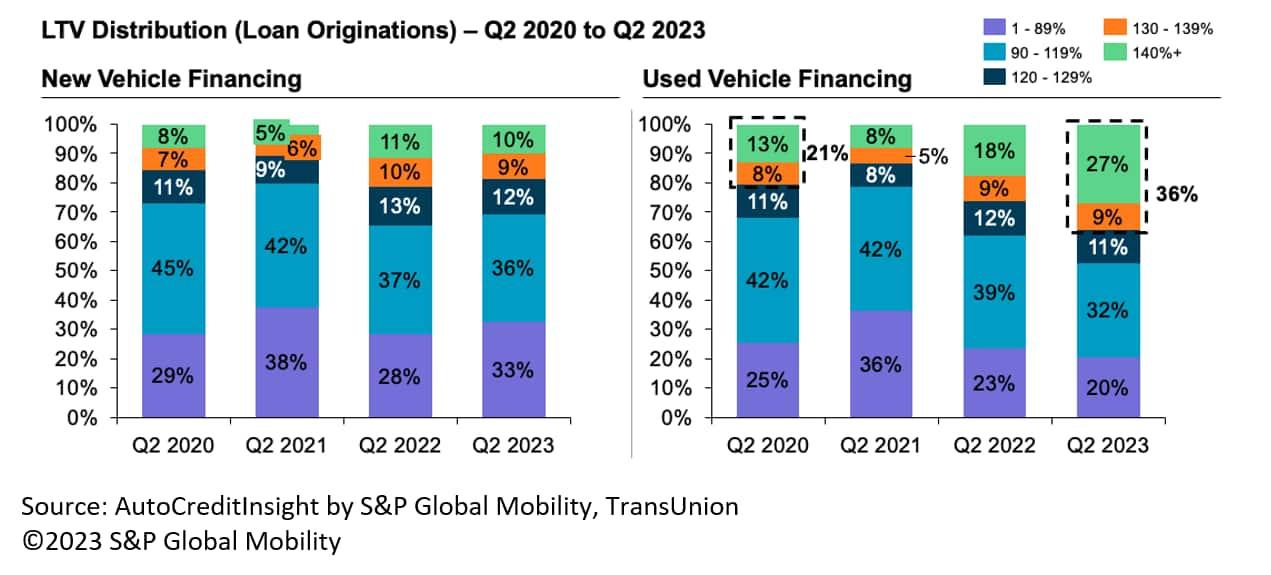

With greater than one-third of used car loans in 2023

sporting loan-to-value ratios above 130%, used car LTVs are at

historical highs. Have lenders (and customers) taken on an excessive amount of

possibility?

Because the transaction costs of used automobiles often rose thru

the pandemic, the corresponding investment wishes of customers who

acquire the ones automobiles even have higher. However so has the danger

that lenders will have to imagine when deciding to finance their

shoppers’ car purchases, in step with research of information from

AutoCreditInsight by way of TransUnion and S&P World Mobility.

The important thing metric in new- and used-car financing is the

loan-to-value (LTV) ratio. LTV weighs the worth of the car as

collateral for the mortgage and the quantity of possibility the lender is

prepared to take to originate the automobile mortgage. And whilst used car

costs soared and most commonly held company, their underlying values as

property have now not essentially stored tempo. What continues to be observed is

how used car values will decline or hang stable with new

car stock, incentives, and insist.

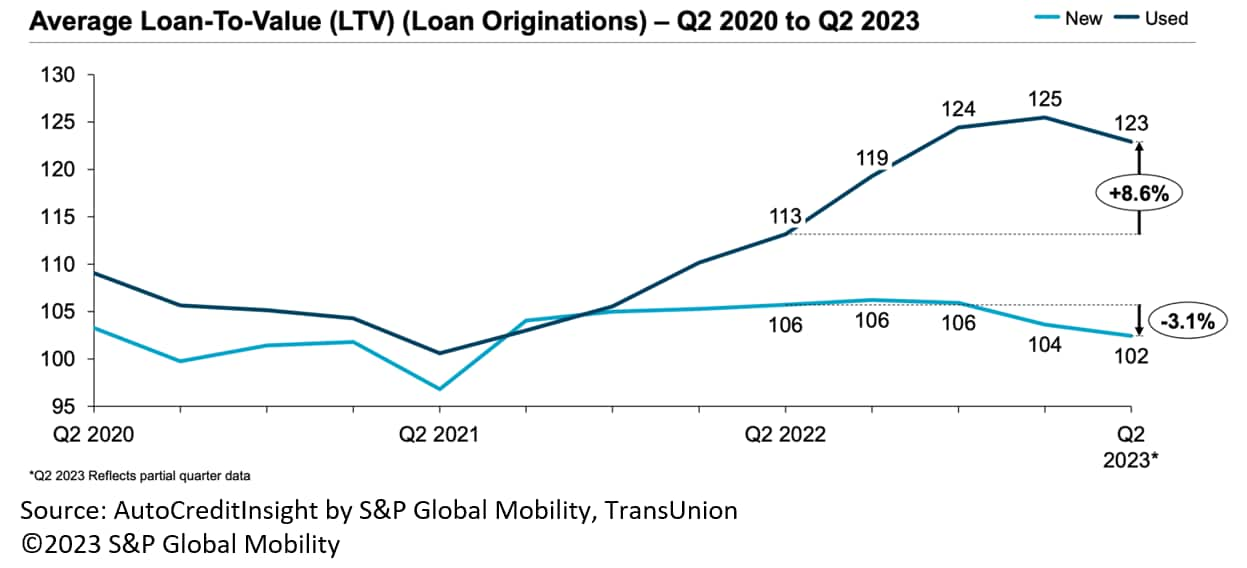

From the beginning of 2022 thru Q1 2023, the typical LTV on used

automobiles climbed sharply to 125 p.c, an build up of 15

share issues, in step with TransUnion and S&P World

Mobility AutoCreditInsight. In the second one quarter of 2023, that

share eased quite, to 123%.

What is extra, 40% of used car loans in Q1 2023 originated

with a beginning LTV of 130% or upper, in comparison to most effective 22% hitting

that stage in Q1 2019. In Q2 2023, that share additionally eased

quite, to 36%, however the ones are nonetheless close to historical highs.

In different phrases, lenders are loaning quantities of cash a ways upper

than the financed used automobiles are if truth be told value – at pastime

charges a ways upper than they had been two years in the past. May just this weigh

down the entire portfolio, or is it only a blip?

Why is that this quantity value looking at?

“Whilst customers are widely nonetheless doing smartly because of low

unemployment, fresh developments of upper originating LTV’s mixed

with upper car costs and the chance for sooner

depreciation as car values stabilize creates a pocket of

increased possibility in some auto portfolios,” mentioned Satyan Service provider,

senior vp and automobile industry chief for

TransUnion.

“That mentioned, excluding this fresh pocket of upper

LTV originations, the whole portfolio is definitely collateralized,”

Service provider added.

In contrast, new car LTVs jumped quite in 2021 after which

held stable in 2022, prior to declining for the 2 newest quarters,

virtually again to pre-pandemic ranges, in step with AutoCreditInsight

by way of TransUnion and S&P World Mobility.

“Used automobiles’ price skyrocketed all over the pandemic because of the

stock constraints of recent automobiles from provide chain and

manufacturing problems,” mentioned Jill Louden, affiliate director for

AutoCreditInsight at S&P World Mobility. “On the other hand, public sale

indices we have observed are beginning to stage out following massive spikes

of year-over-year expansion in used car pricing.”

Auctions and sellers need used automobiles as a result of they know they

can promote them for an increased value in accordance with call for and shortage

for those merchandise, Louden added. A brand new twist: Fresh-model used

automobiles are going to be challenged once more, as leasing cratered with

the preliminary degree of the pandemic 3 years in the past and in consequence,

fewer automobiles are coming off hire and to be had within the

marketplace.”

“When customers can not purchase new, because of loss of availability or

pricing, then they’re compelled to shop for used,” Louden mentioned. “But if

there’s a loss of availability of near-new used automobiles, the

pricing drive works its method thru all the resale

chain.”

Even supposing there was a loss of new-vehicle incentives from

OEMs who’ve now not had to bargain decal costs, this is

beginning to flip, as new-vehicle inventories had been emerging on

many automobiles.

However successfully canceling any money incentives – in step with

TransUnion – has been the Fed’s try to tame inflation with a

sequence of eleven charge hikes from March 2022 thru August 2023.

For the reason that Fed started elevating charges, moderate auto mortgage APRs have

higher from This fall 2021 ranges for brand spanking new automobiles at 3.86% and used

automobiles at 8.28%, as much as Q2 2023 ranges of 6.85% for brand spanking new, and

11.87% for used, Service provider mentioned.

Those mixed elements have driven up car bills, whilst

sporting a LTV just about 15 share issues upper, and for an extended

time period. All of this provides possibility – for lenders and customers alike.

The per thirty days fee build up is not as huge for used automobiles

all over this era as a result of used costs began to retreat from

their peaks,” Service provider mentioned. “However in spite of the used value declines,

per thirty days fee nonetheless went up because of charge will increase. New automobiles

had each value and APR will increase to deal with.”

Here is the mathematics

Consistent with S&P World Mobility and TransUnion knowledge, the

moderate per thirty days mortgage fee for a used car in Q1 2019 was once

roughly $390 with an LTV of 110% and a median per thirty days mortgage

time period of 63.6 months.

On the other hand, March 2020 marked the pandemic’s get started and resulting

havoc on regional and international economies.

Through 1Q 2021, hovering used car values supposed the typical

per thirty days fee for a used car surged to just about $414; however the

LTV dropped to 104% — because of shoppers having upper down

bills because of COVID-19 reduction cash and better trade-in values

because of used car shortage. Additionally, the typical time period jumped to 65.1

months.

In 1Q 2022, on the other hand, the entire impact of the pandemic started to

take form with appreciate to the car-buying public. Used car

values persevered to climb. Because of this, used automobiles noticed the

moderate per thirty days fee soar by way of just about $100 to $508, the LTV

build up to 110% and the typical time period appearing a modest build up to

67.2 months.

Then stipulations become dramatic. Via 2Q 2023, TransUnion

knowledge display that the typical per thirty days fee for a used vehicle jumped to

$533 whilst the LTV was once 123%. Those ranges are stratospherically

prime, even supposing the LTV has retreated quite from 125% in 1Q

2023.

“A median per thirty days car fee of greater than $530 for used

automobiles is a large chew out of the family per thirty days source of revenue, and we

see those demanding situations on per thirty days bills proceeding for now,”

Louden famous.

“At the plus aspect, new car inventories have returned on many

automobiles, which is able to assist sellers get again extra conventional retail

gross sales fashions and build up pageant amongst OEMs – inflicting

incentives to go back to the brand new car marketplace and lowering

drive at the used car aspect,” Louden added.

“Issues at this time are leveling out at the new aspect, and used

costs are slowly coming down,” Louden mentioned. “However in comparison to

pre-pandemic, it is nonetheless now not a consumer-friendly marketplace.”

CONSUMER LOYALTY TO FINANCE COMPANIES FELL SHARPLY DURING

PANDEMIC

AUTO-FINANCE DELINQUENCIES RISE PAST GREAT RECESSION PEAK,

BUT…

SUBSCRIBE TO AUTOCREDITINSIGHT

LOWER-CREDIT BUYERS PUSHED OUT OF NEW

VEHICLES

THE AUTO INDUSTRY SHARE WARS WILL RESUME IN

’23

SEPTEMBER AUTO INDUSTRY TRENDS

SUBSCRIBE TO OUR TOP 10 INDUSTRY TRENDS

NEWSLETTER

This text was once printed by way of S&P World Mobility and now not by way of S&P World Rankings, which is a one at a time controlled department of S&P World.

[ad_2]