[ad_1]

Three hundred and sixty five days after ChatGPT’s public release, generative AI is almost certainly nonetheless the freshest matter on the planet of industrial—and with excellent reason why. Analysis suggests gen AI may upload virtually $7 trillion to world GDP.

So what, precisely, will gen AI imply for banks?

A lot of the dialog nowadays across the era generates extra warmth than mild. Our “Meet the Mavens” consultation at Sibos 2023—“How Gen AI Will Rewire the Banking Business”—integrated a presentation of our new analysis and research, which objectives to convey some information to the dialogue and transfer previous the hype and hypothesis.

Those are key takeaways from our communicate.

Gen AI won’t trade banking, however will trade how banking will get accomplished

The headline of our research is that gen AI will trade banking—however banking itself won’t trade. The era will turn into now not the paintings of banking itself however moderately how that paintings will get accomplished.

Banking will all the time encompass the basics: taking in deposits, lending cash and managing bills. However gen AI goes to basically rewire how that paintings will get accomplished.

Whilst there may be basic acceptance of the significance of gen AI throughout banking, there may be trepidation about how and the place it must be used. However any financial institution that sits at the sidelines for lengthy will possibility being left at the back of.

In truth, early adopters are already the usage of it to power dramatic potency positive factors. One world financial institution, for instance, has carried out an electronic mail routing device that makes use of AI and gadget finding out; it eradicated 40% of electronic mail visitors in its first 12 months. GitHub’s generative AI Copilot coding software, in the meantime, can assist a financial institution’s programmers write code as much as 55% sooner (and create 46% of the desired code itself). And Morgan Stanley has deployed a gen AI software that provides its monetary advisors advanced get admission to to the financial institution’s “highbrow capital” of round 100,000 reviews and paperwork right through Jstomer conversations.

However use circumstances like those are most effective the start.

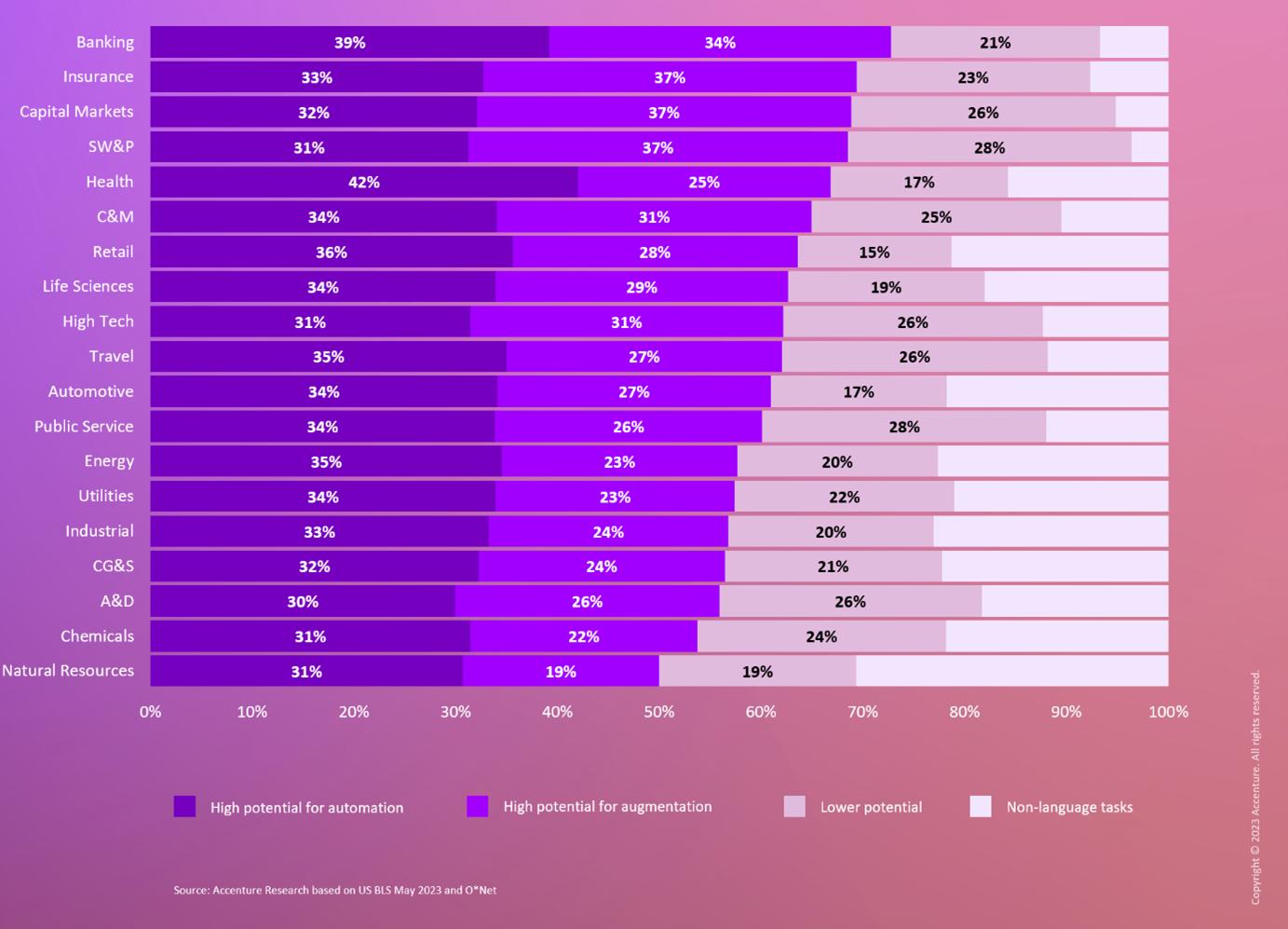

Our analysis at the attainable have an effect on of generative AI on other industries, in line with information from the United States Bureau of Hard work Statistics and the Occupational Data Community, discovered that 61% of running time throughout 19 other industries might be reworked by means of new applied sciences together with huge language fashions (LLMs) like ChatGPT. In banking that portion jumps to 73%, which is the biggest of all industries in our research. We discovered that 39% of all of the paintings accomplished at banks had a prime attainable to be automatic (accomplished with out interpersonal or cognitive talents) and 34% may readily be augmented (requiring interpersonal conversation, proactive reasoning, or skilled validation).

Determine 1. The possibility of US staff’ time that would doubtlessly be automatic or augmented by means of era equivalent to LLMs.

As early adopters leverage those positive factors for potency and to ship awesome buyer reports at scale, the have an effect on of the era will ripple out to turn into the business.

That have an effect on will heighten the will for banks and different customers of gen AI to construct the appropriate guardrails round those new equipment. Maximizing the have an effect on of gen AI on banking can most effective occur if the equipment are utilized in a accountable, safe approach that complies with legislation.

We hint this wave of generative AI trade throughout 3 main spaces of have an effect on. Gen AI will permit banks to:

1. Innovate and differentiate

Generative AI creates many new tactics for banks to spice up income with insight-driven selections and higher buyer reports. The Morgan Stanley instance we discussed above is one early use case right here.

Every other comes from a big North American financial institution, which is the usage of gen AI to scrutinize buyer information and monetary historical past to evaluate credit score publicity. This is helping its analysts make higher lending selections and scale back the danger of mortgage defaults.

2. Grow to be mid- and back-office operations

Generative AI goes to noticeably give a contribution to how banks arrange their mid- and back-office operations. This may occasionally each decrease operational prices, as within the electronic mail routing instance discussed previous, and liberate highbrow capital for innovation by means of automating repetitive duties like reporting, information access and transaction processing. This may occasionally permit financial institution body of workers to spend extra time on ingenious duties and customized buyer care.

We have already got an concept of what this seems like, because of early adopters just like the Ecu financial institution this is nowadays the usage of an LLM to fortify customer support reps on buyer calls. The fashion mechanically takes notes for the rep and brings up related data, permitting the human to pay attention extra on serving to the client.

The level of this have an effect on will, after all, range by means of function around the group. Our analysis discovered that 37% of shopper carrier rep time in banking at the moment might be automatic by means of generative AI (call to mind the notetaking within the above instance), whilst 28% might be augmented (surfacing related data right through the decision).

3. Embed gen AI into operations and equipment to supercharge productiveness

The ecosystem of tool companions that energy banking nowadays are incorporating gen AI into each and every facet of what they do. This may occasionally radically spice up productiveness for staff around the financial institution.

For instance, Microsoft started integrating LLMs into its Microsoft 365 suite of apps again in March 2023 with the release of Copilot. Adobe’s Firefly software can generate pictures from easy textual content activates. Salesforce, likewise, gives a gen AI-powered CRM assistant referred to as Einstein at the moment, and Workday lately introduced plans to combine gen AI into its equipment.

Those choices are all early efforts within the box. Distributors will iterate, support and compete on them in time. The one choice for banks here’s which gen AI options are price the extra price.

Generative AI as a expansion multiplier

Our research additionally discovered that inside of 3 years, generative AI may enlarge a financial institution’s running source of revenue by means of two to 3 occasions in comparison with present consensus forecasts by means of using income expansion and lowering prices.

At the income aspect, we see lots of the positive factors coming from generative AI’s have an effect on on client-facing actions. We wait for that it would create a 17% build up in time allotted to Jstomer interactions and recommendation, that are liable for round 80% of banking income. This overtime may translate right into a 9% surge in income.

For the associated fee aspect, we think a 9 – 12% relief in mid- and back-office prices accomplished by means of a productiveness build up of seven – 10% in company purposes.

Generative AI may lead to a 17% build up in time allotted to Jstomer interactions and recommendation, that are accountable for round 80% of banking income.

Compounding the have an effect on of the era throughout each spaces, we discover that generative AI’s attainable uplift on a financial institution’s running source of revenue stands at 25 – 40%. That is greater than double or triple the prevailing expansion forecasts for banks as much as 2026.

No financial institution can manage to pay for to forget about expansion like that.

In the event you’re now not positive the place your financial institution’s generative AI adventure must start, our most sensible piece of recommendation is to shape a generative AI SWAT workforce nowadays. This must come with leaders from each the trade and tech facets of the financial institution, and its mandate must contact on technique, coverage, skill, era and knowledge.

For extra detailed insights in your financial institution’s trail ahead, we would like to listen to from you. You’ll in finding Mike right here and Keri right here.

Disclaimer: This content material is equipped for basic data functions and isn’t supposed for use instead of session with our skilled advisors. This record might confer with marks owned by means of 1/3 events. All such third-party marks are the valuables in their respective homeowners. No sponsorship, endorsement or approval of this content material by means of the homeowners of such marks is meant, expressed or implied. Copyright© 2023 Accenture. All rights reserved. Accenture and its emblem are registered emblems of Accenture.

[ad_2]