[ad_1]

HTX (previously referred to as Huobi), one of the most main cryptocurrency exchanges, has been embroiled in a brand new controversy as Justin Solar, Tron’s founder and BitTorrent’s CEO, faces allegations of a staggering $2.4 billion shortfall in person finances.

Adam Cochran, Managing Spouse at Cinneamhain Ventures, has make clear the intricate main points of the alleged malpractice, revealing a internet of “monetary manipulations.”

Huobi Disaster Unveiled?

Cochran’s research raises considerations over Huobi’s monetary steadiness, wondering the integrity of the trade’s claims relating to its holdings of Ethereum (ETH) and USDT, a stablecoin pegged to the United States buck.

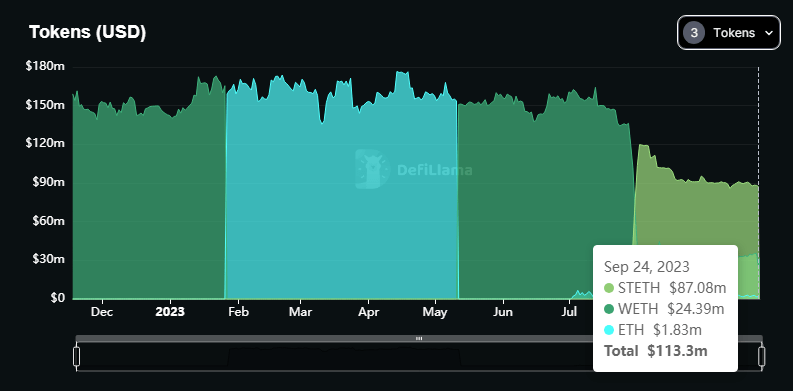

As noticed within the chart above, whilst Huobi asserts property price $200 million in ETH, Cochran’s investigation, corroborated by means of defillama knowledge, unearths a discrepancy, with the true price amounting to below $113 million, even if making an allowance for wrapped ETH (WETH) and staked ETH (stETH).

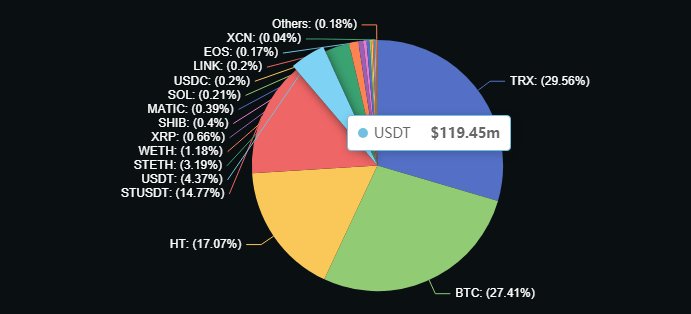

The placement additional unravels when inspecting Huobi’s purported $624 million USDT holdings. On the other hand, Cochran’s findings point out that simplest $119 million of USDT is living throughout the trade, whilst the remainder steadiness is in staked USDT (stUSDT).

What raises suspicion is that Justin Solar has enabled staked USDT (stUSDT) a staking function, which permits customers to stake both USDT or TUSD (TrueUSD) to earn stUSDT, as reported by means of NewsBTC.

Allegations Mount In opposition to Justin Solar

As a substitute of following the predicted protocol of burning staked property to say the money and take it offline, those finances are redirected to Justin Solar’s addresses or applied to fortify JustLend, a lending platform related to the Huobi ecosystem.

Opposite to Huobi’s declare that it burns the stUSDT with Tether, Cochran’s investigation unearths that the counterparties for USDT on Huobi are the trade’s deposit wallets or Binance.

This implies that Justin Solar might make the most of USDT from person balances on Huobi to generate stUSDT, therefore leveraging the underlying USDT to fortify JustLend or repurchase TUSD on Binance.

Cochran concludes that this complicated monetary association, together with TUSD deposits into stUSDT, successfully mints “pretend property” in opposition to an unknown fairness.

In consequence, Cochran estimates that Justin Solar’s alleged debt to customers around the Huobi and Tron ecosystems quantities to roughly $2.4 billion, all whilst customers stay blind to the location.

Featured symbol from Shutterstock, chart from TradingView.com

[ad_2]