[ad_1]

Ethereum community charges are recently at their lowest level in 2023.

The Ethereum (ETH) blockchain witnessed a vital aid in community charges, with customers paying an insignificant $1.15 in step with transaction, Santiment knowledge presentations. The present decline in Ethereum’s transaction charges carries with it a ancient trend that bodes neatly for the community’s software.

As transaction charges drop, Ethereum turns into a less expensive selection for customers to have interaction with its flexible platform. This construction holds the promise of boosting Ethereum’s total marketplace price.

In recent times, there was a notable upward push within the stage of on-chain transactions throughout the Ethereum community. The determine, totaling 1,089,893 person energetic wallets (UAW), marks the second-highest job stage in Ethereum’s historical past. Blockchain analysts at Santiment famous that such spikes in on-chain job generally is a sign for attainable worth rebounds.

This higher job suggests rising hobby and software within the Ethereum community, which might undoubtedly affect its marketplace capitalization within the coming months.

Whilst the broader cryptocurrency panorama sees important worth dips, Ethereum has remained above the $1,500 mark.

In June, analysts expressed optimism on this planet’s second-largest crypto, with some predicting Ethereum’s ascent to a historical prime of $3,000. What fuels this bullish sentiment is the outstanding dwindling of ETH reserves on exchanges, plunging to an exceptional low of 12.6%.

This shortage of Ethereum in change wallets underscores the platform’s tough call for, providing a compelling narrative amidst turbulent crypto seas. This shortage of tokens to be had on the market on centralized exchanges is thought of as a bullish signal of Ethereum’s long term efficiency.

Grayscale floats Ethereum Futures ETF software

In a vital transfer, Grayscale lately filed an software for an Ethereum futures-based exchange-traded fund (ETF). This software follows a prior submitting below the Securities Act of 1933, the similar regulatory framework governing commodities and see Bitcoin (BTC) ETFs.

Particularly, Grayscale‘s submitting for an Ethereum futures ETF marks the most important difference, because the SEC has up to now authorized Bitcoin futures ETFs below each the Securities Act of 1933 and the Funding Corporate Act of 1940, which regulates maximum security-based ETFs. This transfer via Grayscale displays the rising institutional hobby in Ethereum.

In the middle of Ethereum’s adventure, co-founder Vitalik Buterin’s voice resonates with a transparent imaginative and prescient. Buterin puts a robust emphasis on two pivotal pillars: privateness and decentralization. Those rules, he asserts, don’t seem to be mere aspirations however core priorities guiding Ethereum’s trail ahead.

In a crypto panorama marked via trade, Buterin’s dedication to those beliefs illuminates Ethereum’s enduring quest for a extra non-public, decentralized, and inclusive virtual long term

He expressed considerations in regards to the vulnerability of centralized entities like custodial exchanges, which can also be simply corrupted. Buterin advocates for direct transactions at the Ethereum blockchain to empower customers and beef up safety.

Ethereum worth research

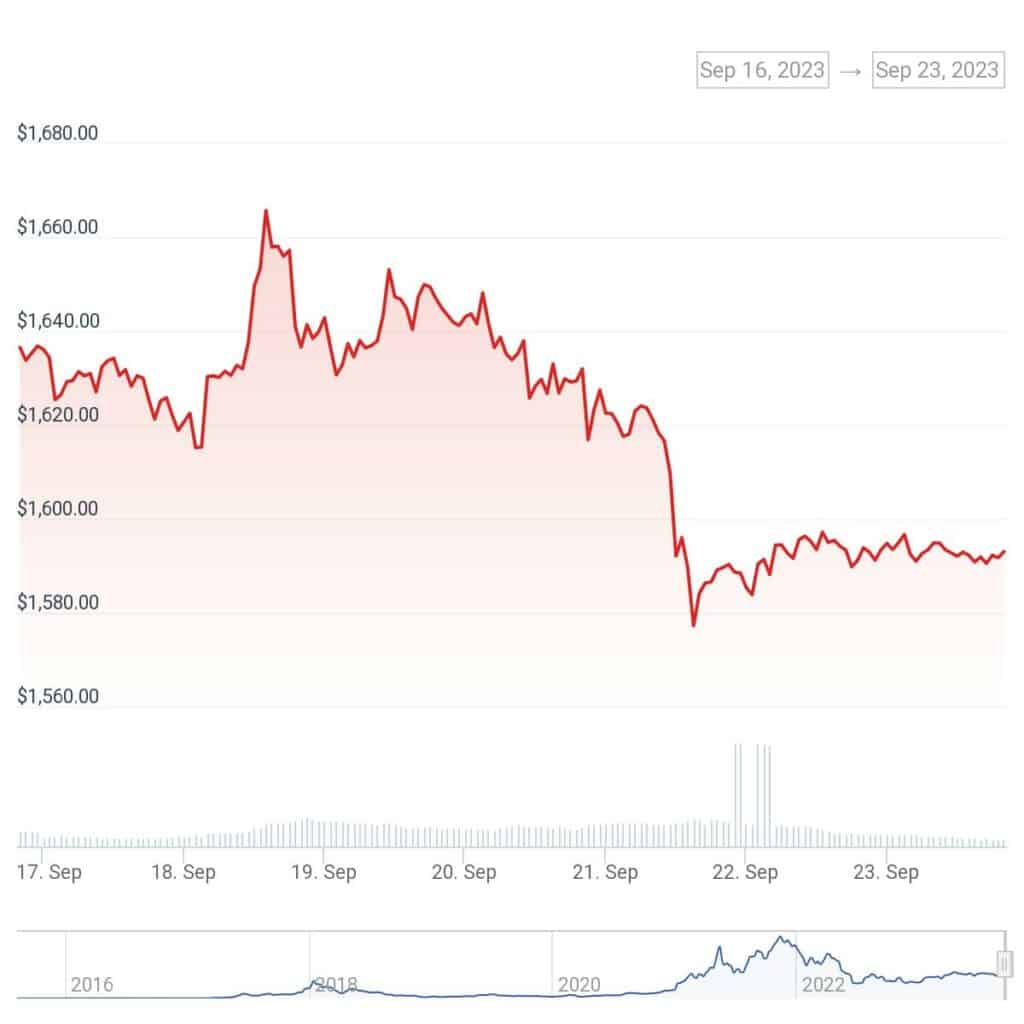

After dealing with resistance on July 14, Ethereum’s (ETH) worth has been on a downward pattern. These days, ETH is buying and selling at $1,593, reflecting a 2.7% worth decline in a single week. Ethereum’s marketplace capitalization stands above $191 billion, consistent with CoinGecko.

The Relative Power Index (RSI) of Ether at the weekly time-frame recently stands at 21.8, indicating a possible oversold situation. Ethereum has a important make stronger stage of $1,500.

Whilst Ethereum’s fresh worth decline might concern buyers, its basic trends and rising institutional hobby counsel a promising long term.

[ad_2]